by Daniel J. Loewy, AllianceBernstein

Over the past three decades, bonds have provided balanced investors with the best of both worlds. As 10-year Treasury yields fell from a high of 13.7% in 1980 to less than 2% today, bonds provided both strong returns and a great cushion in times when equities were weak. Bonds are still important, but investors shouldn’t expect more of the same.

Future bond returns are likely to be much lower, since Treasury yields are at their lowest levels ever. Low yields also reduce the likely diversification benefit from bonds.

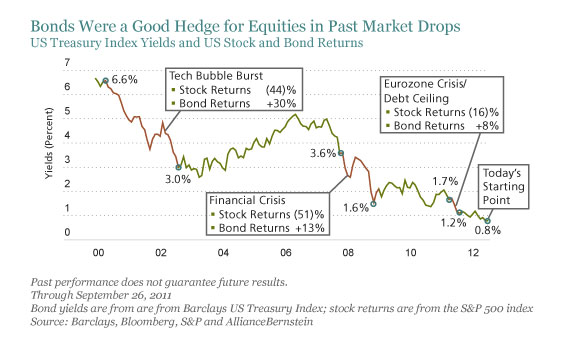

Bond yields have fallen most sharply during equity-market drops. In these periods, concerns about economic growth and deflation drove markets, so investors fled assets with uncertain cash flows (think stocks) and flocked to more reliable assets (think bonds). Demand for bonds’ steady income drove up bond prices and pushed yields lower. For balanced investors, bond gains helped offset stock losses, stabilizing overall portfolio values in turbulent times.

The display below shows that this hedging benefit has been quite substantial at times. For example, after the technology bubble burst in March 2000, the S&P 500 Index’s 44% cumulative loss through September 2002 was largely offset by the Barclays US Treasury Index’s 30% return as its yield fell from 6.6% to 3.0%. But with Treasury yields so low today, bond yields simply can’t fall enough to provide much of a hedge to equities.

What’s an investor to do? There are other strategies available for managing overall portfolio risk in a low-interest-rate world:

- Managing equity exposure dynamically has the potential to limit downside risk in periods of equity market declines.

- Option strategies that provide protection against spikes in equity volatility can be used on an opportunistic basis, when the cost of that insurance looks cheap.

- An allocation to real assets, such as real estate and commodities, could provide an equity market hedge if inflationary pressures build as a result of massive expansion of balance sheets by central banks around the world.

- Some alternative investments may provide a weakly correlated source of returns that complements equities.

Make no mistake: bonds are still likely to be a critical source of income for most investors. But in an uncertain world with the lowest interest rates on record, investors should consider additional ways to hedge their equity risk.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Daniel J. Loewy is Co-Chief Investment Officer and Director of Research for Dynamic Asset Allocation Strategies at AllianceBernstein.