Disrespected Rally…Can It Continue?

September 28, 2012

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.,

and Brad Sorensen, CFA, Director of Market and Sector Analysis, Schwab Center for Financial Research,

and Michelle Gibley, CFA, Director of International Research, Schwab Center for Financial Research

Key Points

- US equities are trading near five-year highs but numerous measures show investors remain skeptical. Economic data remain mushy but we believe the positive trend will continue, with some blips along the way.

- The enthusiasm following the Fed's announcement of more quantitative easing was short-lived, although the summer rally in stocks could be at least partially attributed to anticipation of more stimulus. Now, however, the Fed likely steps to the side and the election and fiscal situation take center stage.

- Spanish feet-dragging is raising concerns in Europe over the ultimate impact of the latest ECB plan. Economic growth continues to be almost nonexistent and differences between countries remain. China's economy is becoming more of a concern, as growth continues to slow and the infamous shadow-lending market may be cracking.

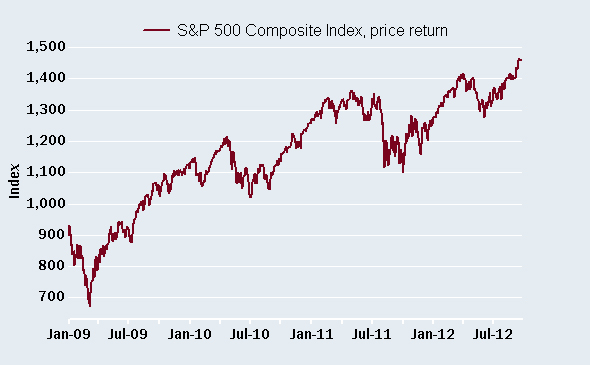

Despite substantial headwinds and bumps in the road, stock indices in the US are now at or near their highest level in roughly five years. Since the height of the financial crisis in 2009, the S&P 500 has more than doubled, while posting an approximately 14% gain to this point in 2012, despite the recent pullback. And, this has occurred in the face of, among many other things, a European debt crisis, the downgrading of the credit rating of the US, fiscal debates in Congress, numerous natural disasters around the world and an apparent slowing of global economic activity.

Impressive move by stocks

Source: FactSet, Standard & Poor's. As of Sept. 21, 2012.

Can it continue? We believe so. Nothing goes up in a straight line, of course, and you can see in the chart above that within the upward trend there were several relatively substantial pullbacks. With earnings season, European events, a US election, and the potential "fiscal cliff" approaching, we believe we'll see an increase in volatility, which continues to be at low levels. As a result, it seems likely that there will be some pullbacks in equities, a dose of which we've seen recently, that will allow investors who would like to increase their stock allocation an opportunity to do so. A warning: Don't try to time the bottom on a pullback. No one can consistently pinpoint when that will be, and as visible in the chart above, waiting can result in missing the next potential move higher. That's why, for many investors, dollar-cost averaging is a way to add to exposure to equities without trying to time the market.

Our optimism regarding equities comes from various sources. The current rally seems to us to be one of the most disrespected in recent memory. Volume remains low and fund- flow information indicates that money continues to move into bonds and out of equities. So although near-term sentiment may get overly optimistic at times, it currently appears as if the underlying market sentiment toward stocks remains relatively negative. But this skepticism contributes to our optimism. We believe investors will slowly begin to recognize that stocks could continue to move higher, while the meager returns on cash investments and the historically low yields on many fixed income products become more unattractive. With the massive amount of cash on the sidelines, we believe even a gradual change in sentiment could contribute to another strong run in stocks over the intermediate term.

Still sluggish

Also helping contribute to our optimism is the "Wall of Worry" that appears to remain firmly in place. First, the US economy continues to muddle through, raising concerns that a return to solid growth may be only a hope and a dream. The latest round of data from the summer did little to dispel that notion as industrial production fell 1.2% in August, the Empire Manufacturing Index hit its lowest level since April 2009 at -10.41, and the Philadelphia Fed Index posted its fifth-straight month of negative readings, at a level of -1.9, although that was up from -7.1 the previous month. Unemployment remains elevated and energy prices have risen again, meanwhile, pinching already tight consumer pocketbooks. There is hope on that front, however, as oil prices have retreated lately, and Saudi Arabia seems intent on keeping the price of crude below $100 per barrel.

On the other side, however, small-business optimism ticked up in the most recent month, which could help to spur job creation. Also, retail sales were positive and jobless claims remain well below the key 400,000 mark.

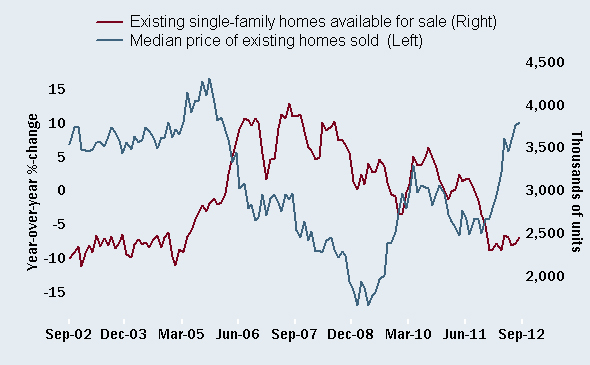

And, perhaps the most encouraging economic development to us, which also appears to be getting little respect, is the improvement in the housing market. The National Association of Homebuilders builders index rose to 40 in September, which, although still below the key level of 50, was the best reading since June of 2006. Additionally, housing starts rose 2.3%, indicating rising confidence among the insiders in the housing industry, while existing home sales rose 7.8%. And perhaps even more encouragingly, the number of sales attributable to distressed homes fell to 22%, down from 29% in March.

Housing prices up-inventories down

Source: FactSet, Nat'l Association of Realtors. As of Sept. 21, 2012.

There are likely to be bumps in the housing recovery road, but with the Federal Reserve now focusing its new round of easing on mortgage-backed securities, it appears that rates will stay near their historic lows, allowing more time for buyers who may have been delaying a purchase to finally act.

Fed focus may lessen as election season looms

With the Fed decision at its most recent meeting and its commitment to pour money into the economy until it sees "substantial improvement," investors may now be turning their attention to the election and potential action surrounding the impending fiscal cliff.

We have no desire to wade into the political waters beyond saying that the outcome of the November election could go a long way in determining how the fiscal cliff is ultimately addressed, in both the near and longer term. It seems as if both sides agree that something needs to be done in the near term to at least soften the blow of the scheduled cliff at year end, while also apparently singing the same tune about the need for a longer-term solution. That's where the agreements between the two parties appears to stop, thus leading to the need for us to see the outcome of the election before any real accurate prediction can be attempted with regard to the details of how these problems may be addressed.

Déjà vu all over again in Europe?

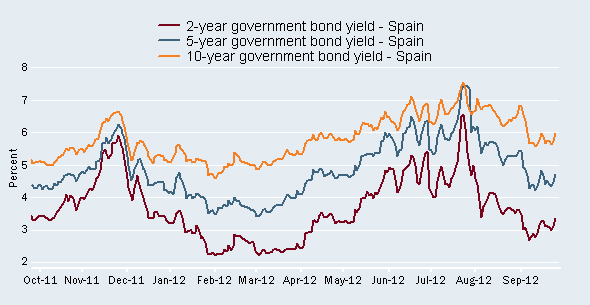

The situation is even more complicated across the pond. The implementation of monetary policy is hindered in the euro-zone due to concerns about the economic health of peripheral governments. As such, the European Central Bank (ECB) has offered to purchase bonds in its plan named Outright Monetary Transactions (OMTs), but the ECB cannot act alone—countries must ask for assistance and then commit to politically unpopular fiscal austerity and reforms.

Spanish yields: "ECB plan bought temporary relief"

Source: FactSet, Tullett Prebon. As of Sept. 26, 2012.

The ECB's plan bought time and short-term government debt yields have fallen, as discussed in our article. This means Spain does not yet have incentive to ask for assistance. With economic growth slipping, deficits rising and banks needing capital, however, it may only be a matter of time before concerns heat up again, resulting in a debt market riot that forces Spain to ask for help reactively. This is a disappointment for those who are hoping for a planned request, as it likely increases costs and reinforces uncertainty. We view late October as a crucial time for Spain, when auctions to refinance existing debt pick up.

Additionally, more uncertainty in Spain stems from calls for independence by the region of Catalonia, which accounts for roughly 20% of Spanish GDP, as well as finance ministers of a German-led group that is apparently trying to roll back an agreement reached in June. The group said the permanent bailout fund, the European Stability Mechanism (ESM), cannot provide bank recapitalization until eurozone-wide bank supervision is in place, which is unlikely until 2013, putting plans to inject money into Spanish banks in November into question.

Euro-zone economic growth, meanwhile, is likely to be subdued at best due to continuing fiscal austerity measures, debt deleveraging by banks and households, wage reductions, and a hobbled banking sector. Discouragingly, business sentiment continued to fall despite the ECB's plan, with the expectations component of the German Ifo Business Climate Index falling to 93.2 in September, the lowest level since May 2009. Additionally, the preliminary eurozone composite PMI for September fell to a 39-month low of 45.9, and PMI data provider Markit noted that headcounts were falling at the fastest rate since January 2010.

We outline our neutral stance on euro-zone stocks in our article, noting the challenges and continued volatility along with reasons for optimism and significant underperformance by euro-zone stocks over the past two years.

Is China tightening?

We've been noting the problem of high growth expectations in China, both by investors as well as foreign and domestic businesses. Businesses seemed to believe growth would stay robust and any slowdown would be followed by a snap back, therefore necessitating continued production so that inventories would be available to meet future demand.

In the vacuum of large-scale stimulus and after several months of orders falling, some businesses have acquiesced, fulfilling orders from existing inventories and cutting production, making the slowdown "feel" worse than actual end demand. Additionally, the slowdown has resulted in a cash squeeze for businesses across a broad range of sectors, as falling sales, rising labor and electricity costs and lack of pricing power due to excess inventories have resulted in lower profits.

As such, borrowers are having difficulty making payments and the number of bad loans is rising, which may result in banks having to raise capital and/or reduce lending. In the opposite of credit expansion, which generates "multiples" of economic growth for each dollar lent, also called the money multiplier, credit constriction has a negative impact on economic activity.

The slowdown is also exposing a potential credit bubble in China. A shadow banking sector was born as an unintended consequence of China's immature and controlled economy, whereby lending restrictions and lack of access resulted in some small businesses "finding a way" to get capital. The size of the shadow banking problem is unquantifiable, as reported figures exclude lending transacted outside of the formal banking system.

In order to get capital, some businesses and individuals bought assets such as copper, steel and construction equipment on credit, then used these assets as collateral to obtain longer-term loans that were several times larger than the value of the underlying asset. Additionally, households with money to invest and unsatisfied with low-returning traditional investments were attracted to the double-digit rates earned by lending in the gray market. When these complex financing webs work in reverse, borrowers sell underlying assets, lenders lose their savings, lending slows down and confidence falls.

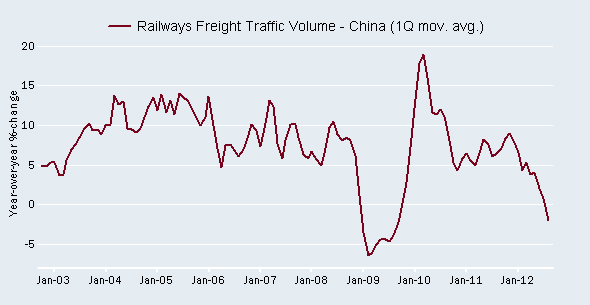

Freight volumes fall as economy slows

Source: FactSet, National Bureau of Statistics of China. As of Sept. 26, 2012.

Meanwhile, excluding some infrastructure projects restarting and residential property construction improving, many economic indicators continue to deteriorate. Combined with the tightening by default that is occurring, we believe a reacceleration in China's growth is further out than most expect, and there is a risk that the slowdown has been allowed to persist too long and growth could be entering a negatively reinforcing phase.

The government thus far has been either unable or unwilling to forcibly enact stimulus, and even a long-awaited 1 trillion yuan ($158 billion) infrastructure stimulus was disappointing because it will be implemented over four to eight years and may have included projects already contemplated or started. It is unclear whether the government leadership changeover that begins in mid-October will bring either stepped-up stimulus or continued restraint.

We believe continued caution is warranted for the Chinese stock market and our concern about China has now spilled over to the broader emerging-market stock asset class.

Geopolitical risks creep higher

There are signs of growing assertiveness by China, highlighted by territorial disputes in the East China Sea and South China Sea. Without a significant escalation, we believe the main consequence will be to temporarily restrict trade. Japan is likely to suffer the biggest negative impact, as China constitutes a large end market for Japan.

Read more international research at www.schwab.com/oninternational.

So what?

Risks remain elevated around the world but central banks are acting aggressively to put a floor under assets and stimulate economic growth. While there are risks with this approach as well, we believe risk-based assets will benefit from these actions. And with skepticism toward the bull market apparently remaining high, we believe there's further to run and suggest investors consider adding to their stock positions during market pullbacks. For investors who are seeking a stream of fixed payments, however, the bond market remains the place to be. While low yields can be frustrating, greatly increasing the risk profile of your portfolio in a search for higher income can be detrimental. For more information on fixed income investing, go to the Bonds Article Library.

Important Disclosures

The S&P 500 Composite Index® is a market capitalization-weighted index of 500 of the most widely-held U.S. companies in the industrial, transportation, utility, and financial sectors.

Indexes are unmanaged, do not incur fees or expenses and cannot be invested in directly.

Past performance is no guarantee of future results.

Investing in sectors may involve a greater degree of risk than investments with broader diversification.

International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Investing in emerging markets can accentuate these risks.

The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. This report is for informational purposes only and is not a solicitation or a recommendation that any particular investor should purchase or sell any particular security. Schwab does not assess the suitability or the potential value of any particular investment. All expressions of opinions are subject to change without notice.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.