by William Smead, Smead Capital Management

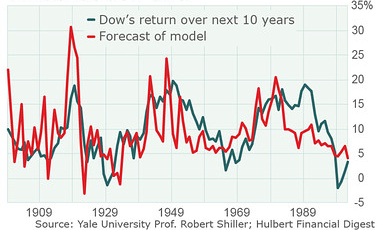

In an article published by Marketwatch.com on September 21, 2012, Mark Hulbert asks the question, “Where do you think the stock market will be ten years from now?” It was as a lead into the results of a predictive model from Rob Arnott, founder of Research Affiliates. His model argues that current dividend yields go a long way to predicting ten-year forward returns. Other than a big glitch in the 1990′s, it appears to have some value. The chart below represents the predictive model in comparison to the actual returns:

Hulbert explains the model this way: “The model, at least the variant I will focus on for this column, is breathtakingly simple. It says that the market’s long-term return will be a function of just two things: the current dividend yield and real growth in earnings and dividends.”

Rob Arnott concludes that the return from the S&P 500 Index will be 5.6 percent over the next ten years, based on those two factors. We at Smead Capital Management (SCM) are very respectful of long-term and mathematically sound analyses of equity returns. Hulbert and Arnott urge caution based on this view of the US stock market. He was even kind enough to bring out “all the usual suspects” to remind us of the coming profit margin mean reversion (GMO) and that academic studies show that low dividend levels don’t precede faster earnings growth.

For the purposes of a passive investor in the US stock market, it’s our opinion the only way to set expectations higher than the 5.6 percent return that Arnott’s model predicts would be to get higher growth in earnings and dividends. Arnott believes that only higher inflation would drive higher earnings and dividends. History shows that higher inflation causes PE ratio contraction, offsetting dividend increase benefits.

By now we hope you are dying to find out our take on all of this. First, we’d like to see how stocks do during ten-year stretches when dividend growth is the highest. We shared one year ago the information provided by Howard Silverblatt, the market historian from Standard & Poor’s (S&P). He pointed out that the payout ratio of S&P 500 companies was the lowest since 1936 during the last era when scared companies hoarded cash. He pointed out that over the last 50 years the payout ratio averaged 52.3 percent and over the tech-heavy last 20 years, it was 46 percent. We hypothesized that as the US economy heals and improves over the next 10 years and baby-boomer investors clamor for more income, that companies would respond by returning the payout ratio to more normal levels. We also believe that since our companies have above-average balance sheets, above-average free cash flow and wide moats that they would produce above-average dividend growth.

Second, we like to say that every day 3 million really smart people like Rob Arnott get up in the morning and try to predict the stock market based on mathematic and/or macroeconomic analysis. Rob and his firm are probably among the best, but the field is way too crowded for our taste. This kind of research has led institutional investors to drop from 36.7 percent of their portfolios in US stocks in 2002 to 15 percent one year ago. It has driven individuals into bond investments and bond funds which we feel has almost no mathematical possibility of beating Arnott’s 5.6 percent return. We also believe it has also led some of the most respected money managers to perform poorly the last three years, because they are overly defensive and much more market-timing sensitive because of these long-term forecasts. Stocks have a history of performing well when the vast majority of participants are highly under-invested.

Lastly, we have discussed the “profit margin mean reversion” argument in a prior missive. We believe that capital intensive businesses, those associated with commodity production and those which have built their future on uninterrupted economic growth from China and emerging markets, will see their profits margins plummet. On the other hand, those who buy commodities and sell brands could see significant margin improvement, in our opinion.

Therefore, here is our conclusion. Accept Arnott’s model if you are a passive US common stock investor, it beats the heck out of bond-market forward return potential. As stock pickers, avoid all capital intensive S&P 500 sectors and focus on companies with attributes which lead to superior dividend growth. Or you could just treat us as your equity “Greyhound” and leave the driving to us.

Best Wishes,

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

Copyright © Smead Capital Management