David Rosenberg, Gluskin Sheff: BernanQE Plays With A New Deck

It would be glib to ask "well, wasn't QE3 priced in?"

What the Fed did was actually much more than QE3. Call it QE3-plus... a gift that will now keep on giving. No maximum. No time limit. The Fed also lowered the bar on what it will take, going forward, for even more intervention.

The Fed announced that it will buy $40 billion per month in MBS (together with the on-going Operation Twist program, this brings total asset purchases to around $85 billion monthly through year-end), but the press statement contained an open-ended commitment to QE until labour market conditions not only improve, but do so 'substantially". This is a radical shift.

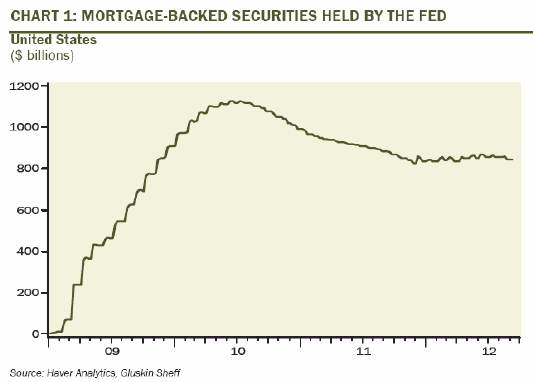

Before, the QEs had an explicit maximum limit in magnitude duration. That is no longer the case — $40 billion in MBS buying month in, month out, perhaps until such time that the Fed owns the entire market (the Fed already has $843 billion of Agency MBS on its balance sheet as it is — if this is truly Japan and it takes another ten years for the economy to improve "substantially", the Fed will end up owning the entire market).

Prior QEs seemed predicated on relapses in economic growth (or at least no follow-through). This was the case with QE1 in March 2009, QE2 in November 2010 and Operation Twist just over a year ago. Now the economy has to strengthen dramatically and if it doesn't - the Fed is clearly targeting the jobs market and specifically on the unemployment rate here - then the spectre of even more balance sheet expansion will remain fully intact. We could soon be attaching Roman numerals to future QE actions (January 31st 2014 is Bernanke's last day as Fed Chairman and that is a loooong way away).

The payroll data always move the market but now more than ever and the Fed's explicit goal of generating "substantial" improvement in the jobs market will ensure that this 'bad news is good news' psychology will remain fully intact (why the stock market so easily managed to shrug off last week's data - this new normal of bad news being good news is now going to be more fully entrenched for the market). And with the Fed targeting mortgages, it is clear that it views housing as the transmission mechanism for its objective of strengthening the jobs market. So each housing indicator going forward is also going to very likely elicit a stronger market reaction than normal - remember, because the stock market is addicted to QE, weak data can still be expected to be supportive. A notable improvement in the data will be even more supportive because the Fed will still keep the hope alive of more QE even if economic conditions get better.

I have to stress this but anything less than "substantial" is just not going to cut it for the Fed - I don't know how that is defined numerically, but if the economy and specifically the jobs market does not go gangbusters, more QE can be expected. And it won't always be in MBS - the Fed came right out and said that it will also "undertake additional asset purchases and employ other tools as appropriate until such improvement is achieved in the context of price stability".

That reference to "price stability" is a bit comical because in the prior rounds of unconventional stimulus: market-based inflation expectations (from the TIPS market) were sub-2% and falling. Going into today's meeting, they were 2.6% and rising. This, for a central bank that spent an inordinate amount of time talking about how important it was to prevent inflation expectations from becoming unhinged when it was busy tightening policy in the 2004-2006 rate-hiking cycle. The times, they are a changin' (in other words, the price stability objective has a big fat R.I.P. on its tombstone). This is why gold swung from a moderate decline to a huge gain yesterday afternoon, and the DXY is breaking. It is clear that out of its dual mandate, a lower unemployment rate right now clearly trumps any concern over higher inflation expectations (whether justified or not).

Equities have ripped to the upside. Commodities are bid. Gold has broken out. The U.S. dollar is sliding. Yet the bond market refuses to buy in. The yield on the 10-year note has remained stable through this entire dramatic response to QE3 (and pledges for more). The Fed announced that it was buying mortgage-backed securities, not Treasuries, so it is curious as to why the bond market is not selling off dramatically. I can count numerous Fed meeting days when the stock market rallied sizably and bonds sold off alongside the reflationary view. I recall all too well the June 26, 2003 FOMC meeting when the Fed cut rates for the last time in that cycle and told the market it was on its own because the economic clouds had finally parted. The Dow ran up more than 100 points from the intra-day low that session and the 10-year note yield jumped 17 basis points, basically ratifying the view of the equity market at the time. But this time around, the Treasury market remains the odd man out on this new pro-growth view evident in the pricing of other asset classes. For any perma-bull out there, Mr. Bond is like having a mosquito in your ear on the putting green.

So from a markets standpoint, let's talk about what all this means.

- The Fed is setting us up for more risk-on/risk-off volatility. Long-short strategies or relative value strategies are perfectly appropriate.

- The Fed extended the period of ultra low policy rates through to mid-2015 (one FOMC member is at 20161) from the end of 2014, which will nurture a low yield environment even further. Not only that, but the Fed said that "a highly accommodative stance of monetary policy will remain appropriate fora considerable time after the economic recovery strengthens" which means that even if growth miraculously manages to accelerate earlier than expected, the Fed is not going to begin raising rates. The age of "pre-emptive" tightening is long gone. This nurturing of a low policy rate environment for years to come will continue to underpin the income (dividend) theme in the stock market.

- The fact that the Fed is embarking on an even more aggressive course with inflation expectations on the rise should be viewed constructively for gold and other precious metals (and gold mining stocks).

- The Treasury market is like the brake lights on a car - we need to acknowledge that it is not signalling better growth ahead. Screen for earnings visibility and less cyclicality. Bonds usually have the economy right.

- Corporate bonds should be a beneficiary as the Fed continues to anchor a low interest cost environment and as such, correspondingly keep debt- servicing charges and default risks at bay.

I don't think this latest Fed action does anything more for the economy than the previous rounds did. It's just an added reminder of how screwed up the economy really is and that the U.S. is much closer to resembling Japan of the past two decades than is generally recognized. Maybe in the central bank world of the "counterfactual" these QEs prevent a worse outcome but the most radical easing in monetary policy ever recorded has not stopped this post-bubble-bust American economy from posting its weakest recovery ever whether measured in real, nominal or per capita terms.

The economy is saddled with too much debt, a shortage of skills, bloated government, an uncertain tax rate outlook, the costs associated with Obamacare, banking sector re-regulation and a spreading European recession. Home prices may have revived of late, but there are still an amazing 22% of debt-ridden homeowners who are upside-down on their mortgage. Monetary policy is best equipped to deal with the vagaries of the business cycle but is a blunt way to deal with deep structural, fiscal and regulatory hurdles. QE has done squat for the economy and I don't expect that to change. Even the Fed cut its 2012 real GDP growth projection for this year to 1.85% from 2.15% - for a year when typically growth is closer to 4% - and so the bump-up in 2013 to 2.75% from 2.5% has to be viewed in that context (in fact, it would seem as though for all the bluster, the level of real GDP is actually lower now at the end of next year compared to the pre-QE3 forecast... maybe this is what the Treasury market has latched on to).

It would seem as though the Fed's macro models have a massive coefficient for the 'wealth effect' factor. The wealth effect may well stimulate economic activity at the bottom of an inventory or a normal business cycle. But this factor is really irrelevant at the trough of a balance sheet/delivering recession. The economy is suffering from a shortage of aggregate demand. Full stop. Perhaps most importantly, in order for the Fed's action to have a lasting impact on the direction of the equity market, it must foster at least some significant belief that the action will lead to self-sustaining economic expansion. The scars of real family median income declining for two years in a row - the Fed's action in a perverse way perpetuates this by forcing essential basic material prices higher - and an unprecedented five-year decline in household net worth are lingering, and exerting far more powerful dampening effect on spending and confidence than the Fed's repeated attempts to generate risk-taking behaviour.

To the extent that the Fed is at least temporarily successful in nurturing a risk-on trade for portfolio managers, the reality is that changing the relative prices of assets does not create demand.

It just perpetuates the inequality that is building up in the country, and while this is not a headline maker, it is a real long term risk for the health of the country, from a social stability perspective as well.