by Don Vialoux, Timingthemarket.ca

Broader Markets Reveal Peak - Use the Weakness to Accumulate or continue to hold Seasonally Strong Gold, Gold Equities, Canadian Energy Sector, and Software

August 24, 2012

(Editor’s Note: Don Vialoux is scheduled to appear on Berman’s Call on Monday at 11:30 AM EDT)

Interesting Charts

More short term technical evidence that U.S. equity markets have passed a short term peak! Short term momentum indicators for the S&P 500 Index have rolled over from overbought levels. The Index is about to break below its 20 day moving average at 1,399.12

Ditto for the Dow Jones Industrial Average! It already has broken below its 20 day moving average.

Weakness in equity market sparked an increase in the VIX Index.

One of the weakest sectors yesterday was the steel sector following a downgrade by Dahlman Rose.

The gold and gold equity sectors were the exception.

Updates on Seasonal Trades Recommended Since The Beginning of June

(Based on reports published by www.globeandmail.com )

June 11: Accumulate the Leisure and Entertainment sector

ETF: PEJ at $20.73 Current price: $21.51

Comment: Units are about to break below its 20 and 50 day moving averages and short term support at $21.34. Strength relative to the S&P 500 Index has turned negative. Take profits.

June 22: Accumulate the Fertilizer sector

ETF: SOIL at $12.20. Current price: $13.74.

Comment: Technical profile has started to turn negative. Units closed below their 20 day moving average yesterday. Strength relative to the S&P 500 Index turned negative two weeks ago. Take profits.

July 2: Accumulate the Software sector

ETF: IGV at $62.18. Current price: $63.30

Comment: Technicals remain positive. Intermediate trend is up. Units trade above their 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive. Continue to hold.

July 6: Accumulate gold bullion

Gold price: $1,578.90. Current price: $1,672.80

Comment: Technicals remain positive. Nice breakout above resistance at $1,642.40 earlier this week. Strength relative to the S&P 500 Index has turned from neutral to positive. Continue to hold.

July 13: Accumulate Canadian gold equities

ETF: XGD at $18.01. Current price: $19.65

Comment: Technicals remain positive. Nice break above its 50 day moving average last week. Strength relative to the TSX Composite Index remains positive. Continue to hold.

July 20: Accumulate the Canadian energy sector

ETF: XEG at $15.12. Current price: $16.11

Comment: Technicals remain positive. Units continue to move higher above a reverse head and shoulders pattern. Strength relative to the TSX Composite Index remains positive. Continue to hold.

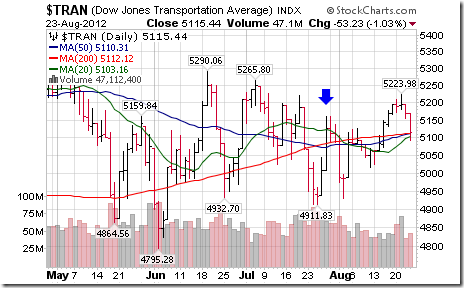

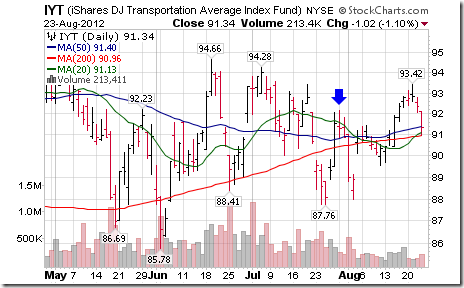

Sell the Transportation Sector

Dow Jones Transportation Average at 5,126.65. Current price: 5,115.64

ETF: IYT at $91.56. Current price: $91.34

Comment: Technicals once again are turning negative. Units briefly fell below their 20, 50 and 200 day moving averages yesterday. Strength relative to the S&P 500 Index remains negative. Continue to sell/avoid/short.

August 6: Sell the Airline sector

ETF: FAA at $28.66. Current price:$28.90

Comment: Technicals remain negative. Units closed below their 200 day moving average yesterday and are testing their 20 day moving average. Strength relative to the S&P 500 Index remains negative. Continue to sell/avoid/short.

************

Adrienne Toghraie’s “Trader’s Coach” Column

"Choices"

By Adrienne Toghraie, Trader’s Success Coach

How many opportunities do we let slip by because of the comfort of knowing that we can start tomorrow? I talk to some of the same people year after year at shows who tell me of their plans to become a trader only to repeat themselves the next year. Here are some of the promises I have heard traders make that keep them from becoming the person they want to become. I will:

How many opportunities do we let slip by because of the comfort of knowing that we can start tomorrow? I talk to some of the same people year after year at shows who tell me of their plans to become a trader only to repeat themselves the next year. Here are some of the promises I have heard traders make that keep them from becoming the person they want to become. I will:

· Start reading that book tomorrow

· Make arrangements for that seminar

· Quit my job

· Spend more time with my family

· Plan that trip

· Take on that hobby

· Volunteer for that cause

· Give up the drugs I am currently taking

· Go to see the doctor

· Hire that coach

· Lose that weight

· Do the things that it takes to become a better trader

The fact is that yesterdays are what brought you to this moment of now and today is what will decide tomorrow. If you put off your life until tomorrow, you will not enjoy the life you want to have.

Bad choices

We lost three celebrities whose lives we have followed for many years. Ed McMann, who was the comedian who was Johnny Carson’s sidekick for over thirty years. The choices he made about his financial situation after a lucrative career brought him to a place of needing rescue from foreclosure of his home from Donald Trump the billionaire.

Farrah Fawcett, the actress and pin up girl, we lost to cancer. She created many stressful situations in her life by some of her choices that weakened her body.

Michael Jackson, an icon of rock music, abused his body with prescription drugs and his body by extreme dance rehearsals. And now his children will be without their father and the rest of us will mourn his early passing.

Good choices

Clark was a participant in my Master Class in Australia a few years ago. He is a land developer from New Zealand who decided that he wanted to enhance his income by trading. He asked many questions during the class, which revealed a lot about him. I have learned over the years that by the questions people ask I can usually tell if they will succeed in trading. At lunch I was able to learn more about him, which made me feel certain about the belief I was developing that he would be successful as a trader.

Clark told me about how he worked with his father in construction from the time he could lift a hammer and he loved every moment. He said that his father’s story telling made it not seem like work. It was from this experience that work became a pleasure for him. His mom encouraged him to save two thirds of the money he earned, so he worked extra hard because the third that he could spend would be for the games and entertainment he enjoyed. Clark’s mother also encouraged him to take care of his health by eating well and having balance in his life. Clark purchased a small property at the age of sixteen and built a small house with his father’s licenses. With the profit he earned from selling this property, he purchased and even larger property. This pattern continued to where he is today as a highly successful developer.

I recommended a trading mentor to Clark specific to his personality, and I also recommended that he take my Top Performance Seminar after he traded for at least a month. Clark completed my Trading On Target Course by the time I saw him again. He made two trips to the United States to complete both of my suggestions. After six months since I originally met Clark, he is now earning a substantial living from trading and only putting in two to three hours a day while still maintaining his business. I asked Clark how he finds trading. His response was that the whole process was a blast and he is having a lot of fun. His wife and children were also happy because they got to vacation in the states when he came to study here.

What is time for you?

Is life full of fun time in work and play? Is each area of your life developing into how you want your future to be? If not, make a plan and act today so that your trading and everything that supports it will bring you to a better tomorrow.

New Free Monthly Newsletter

More Articles by Adrienne Toghraie, Trader’s Success Coach

Sign Up at – www.TradingOnTarget.com

************

Eric Wheatley’s Weekly Listed Options Column

Good morning,

Since I’ve started this job, I’ve pretty much been a professional reader and writer. I go through dozens of articles per day and I’ve realised one has to be wary of some of the dumb things that are written in the business press.

Last week, after a string of lessons on options basics, we dove into covered calls. On Friday, as I devoured my daily ration of articles, I stumbled upon this. It was published in a national paper of some repute and wonderfully frames what I meant in this little paragraph:

“George got $2.50 for a three-month call option. In selling the option, he promised Bob that he would sell his 100 shares to Bob for $50 per share if the stock’s price were to rise. Of course, the first knee-jerk reaction to this is that putting a ceiling on one’s potential gains for a measly $2.50 is stupid; particularly if you are holding the shares, so if their price drops through the floor, you’re on the hook. (Put another way, the MOST George could gain is $2.50, yet he could lose his shirt if XYZ were to drop to zero. This concept is hard to defend if your interlocutor has little understanding of finance and just wants to get rich in the stock market)”.

Long-only stock pickers are a fun group of people. They usually have little time nor tolerance for charts or derivatives. The best of them will plough through financial statements and attend conference calls with company directors and otherwise do everything they can to outwit the markets and beat the benchmark (which they pretty much never do because of their fees). They have one and only one goal to which they are wholly dedicated: to find stocks that will go up faster than the index.

When a stock picker is asked about passive investments, short selling, complex portfolio management techniques and, especially, covered calls – things that are completely foreign to their daily lives and, let’s face it, which don’t generate fees for their firms – he or she will become hostile and start spewing out things which, for all intents and purposes, run against decades of academic study and common sense. Upon reading the aforementioned article, here are some statements which caught my eye:

· “90% of options expire worthless”. We’ve covered this at least twice in this space. It’s a non-starter because the statement itself is nonsensical. Options are asymmetrical instruments, like insurance policies, Russian roulette or lottery tickets. People who live in the fully symmetrical world of stock picking (things go up, things go down) have trouble with this concept.

· “If the price of the underlying stock collapses before the call expires, the call-buyer won’t exercise the option because the stock can be purchased more cheaply on the open market compared to the contract strike price. In this case, you continue to own the stock – with all of its downside – but you also keep the premium income”. Note the term “collapses”. The same statement could have been made by writing “…the price of the underlying stock is below the call’s strike price at the call’s expiry”. But no, if you carefully evaluate and buy a stock for your long-term portfolio, it will “collapse”, not move within a predictable range as 95% of stocks do over the short term. It’s also odd for a stock picker to mention “all of a stock’s downside”, given that stock pickers hold even greater downside risk than covered call writers.

· “If the stock soars, the call-buyer will exercise to buy the stock at the (below-market) strike price, forcing you to sell the shares below the market price. So, you get virtually all of the downside risk exposure while cutting off most of the upside potential. And given the history (and expected future) of generally rising long-term prices, this strategy’s long-term potential is not attractive”. In this case, of course, the stock “soars”. Yes, the long-term tendency for stock prices is to rise. Also, we have already gone into the fact that stock options are unique in the options trading world in that they have a skew built into their prices. In-the-money calls are more expensive than in-the-money puts BECAUSE stocks are asset-based securities and have a long-term tendency to gain value.

· “In other words, this strategy negatively skews the risk-return profile. Covered call writing strategies are promoted as a source of income with less risk than owning stocks outright. But adherents to this approach are giving away too much future upside in exchange for current income. The amount of forgone upside may well dwarf the extra income over time”. Here we go.

· Study after study (those are just two I got from a quick Googling) going over the subject over various time periods in all market conditions have shown that covered calls skew the risk-reward ratio in the investor’s favour. Why does the argument against covered calls get any traction? Because stock pickers and options neophytes assume that the premium received when selling an option is a pittance or a rounding error which can be brushed aside in one’s calculations. “Oh yeah, you get that tiny little premium, but what if the stock COLLAPSES? What if it SOARS??”. The fact is, anyone who has spent any time in the markets knows that stocks don’t collapse nor soar all that often. The POTENTIAL for collapses and… soareses is already priced into the options’ premiums. When you sell an option, you are receiving the market’s evaluation of the probability AND AMOUNT of collapse or soar. Sure, over any given period a stock could be more volatile than what the market evaluated. But over an investment horizon of years or decades, the options market has proven itself to be rather accurate in its valuation of volatility. As we have already seen, if anything, the path-dependant nature of options market-making adds a little juice to options prices, which goes into options writers’ pockets.

Also, as a portfolio manager, here’s a hint to the gentleman: I was an options trader and draw upon that experience to my clients’ benefit. I’ll grant him that in a secular bull market, covered calls may underperform the straight holding of stocks. You know what I’d do in a strong bull market (e.g. 1994-1999)? I wouldn’t be putting on covered calls. If he’s intimating that covered calls are bad RIGHT NOW, then we have a distinctly different definition of a secular bull market.

As to “Option trading is a quant game and big options traders – who often exclude traditional money managers – are in the best position to find pricing inefficiencies with their sophisticated computer models that can make decisions in a nanosecond”. Ummm… not even close dude (and this is the best proof that the writer in question has no clue). Nanosecond trading based upon models and/or electronic arbitrage exists in futures trading. It exists in stock trading. But if anyone thinks that you can actively trade options in-and-out on a “nanosecond” basis, that person has never actually seen an options quote, much less put their money in play. Options are a segmented market. Any given stock can have dozens or hundreds of different listed options across different strike prices and expirations. The liquidity on those options is therefore also segmented. Even on the biggest, most liquid options classes, if you try to buy and sell mechanically on an in-and-out basis, you’ll be paying the bid-ask spread on instruments which just aren’t made for that kind of trading. The “quants” and their models will try to take advantage of perceived opportunities, but the resulting position will inevitably be held for a while and probably be traded against in the underlying market. This has nothing to do with the program trading intimated in the text.

So, in closing (and you can tell that I could go on all day), don’t get options advice from a stock picker. Stock pickers are undoubtedly good at what they do, but they don’t use options and, if you don’t use them, you don’t understand them enough to comment on them. I’ll always affirm that options aren’t really all that complicated if you’re actively interested in learning about them. If you aren’t, please keep your commentary within the bounds of subjects on which you have some knowledge.

*****************

New development: I’ve gained a little experience in the world of Twitting over the past couple of weeks and have realised that the bilingual idea wasn’t going to work. I’ve therefore decided to start a new account on which I’ll be posting articles which, to my mind, offer some value-added commentary on the world of economics and finance along with my usual facetiousness. From now on, I’ll post two or three which I really liked in this space. If you want, you can follow me at @jchood_eric_en.

· An overview of the European crisis and its inevitable conclusion (or so says a geopolitical guy whom I really like, though I may not always completely agree with).

· An analysis stating that the Canadian housing market isn’t a bubble and will be fine as long as nothing, y’know, unpredictable happens (filed under “gotta love economists”).

· A contrarian view as to the reinstatement of Glass-Steagall and the wisdom of splitting up big banks.

In this week’s French-language blog: a buddy brings me to one of those shiny-pole-filled places which fascinate visitors to my hometown and which will not be described explicitly here.

Cheers!

Éric Wheatley, MBA, CIM

Associate Portfolio Manager, J.C. Hood Investment Counsel Inc.

eric@jchood.com

514.604.2829; 1.855.348.2829

Twitter: @jchood_eric_en

Blogue en français : gbsfinancier.blogspot.ca

*****************

Little known fact about John Charles Hood #40

John Charles Hood knows a few stock pickers. Apparently, they flick quite well too.

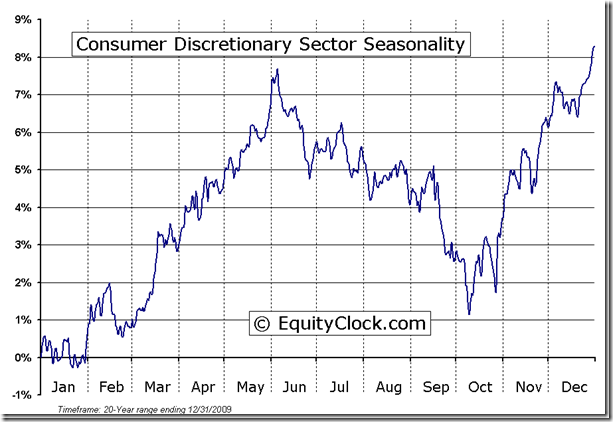

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Consumer Discretionary Sector Seasonal Chart

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

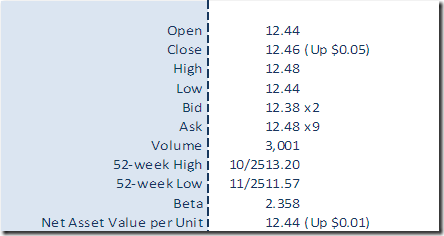

Horizons Seasonal Rotation ETF HAC August 23rd 2012