by Don Vialoux, Timingthemarket.ca

Upcoming US Events for Today:

- Existing Home Sales for July will be released at 10:00am. The market expects 4.5M versus 4.37M previous.

- Weekly Crude Inventories will be released at 10:30am.

- Minutes from the latest FOMC meeting will be released at 2:00pm.

Upcoming International Events for Today:

- Canadian Retail Sales for June will be released at 8:30am. The market expects a month-over-month increase of 0.1% versus an increase of 0.3% previous.

- China Flash Manufacturing PMI for August will be released at 10:30pm EST.

The Market

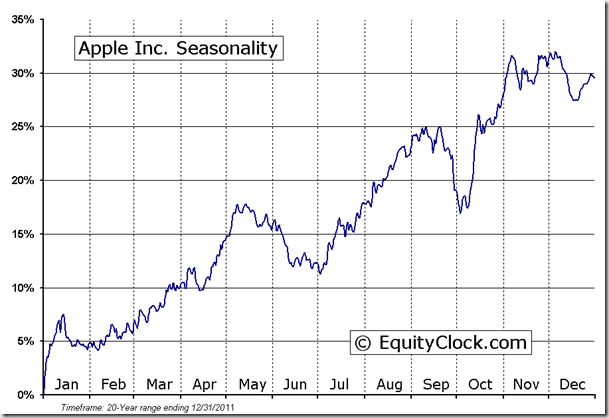

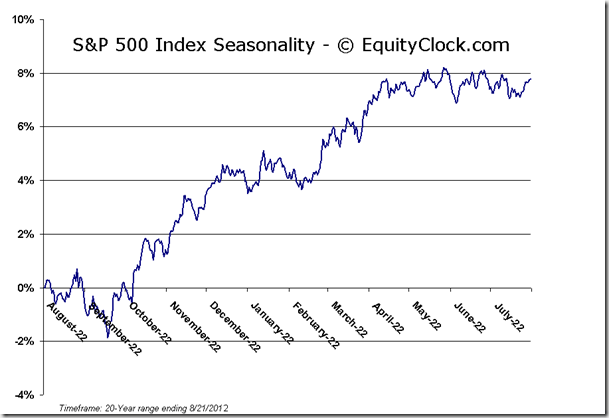

Markets traded lower on Tuesday after briefly touching multi-year highs, as was the case for the S&P 500 Index. The large cap benchmark broke through April’s high of 1422 in early trade, helped by significant weakness in the US Dollar. However, as resistance was being battled with, investors began to take profits, pushing equity benchmarks lower, exceeding the trading range of the previous two sessions. Volume picked up marginally, suggesting heightened conviction to the bearish reversal. Part of the reason for the weakness in equities was attributed to the decline in shares of Apple, the heaviest weighted position in the S&P 500 index. Apple received a rare downgrade from buy to hold as analyst targets become met or exceeded. Seasonal tendencies indicate an intermediate peak for the stock between now and the beginning of September, followed by a period of weakness through to third quarter earnings season in October.

As mentioned above, equity benchmarks in the US charted a key reversal day on Tuesday, suggesting that the market may be in the process of correcting following the almost three month old market rally. Equity indices are at the most overbought levels since March of this year and are butting up against the upper limit of a rising trend channel that has remained intact since the beginning of June. A correction in the context of a bull trend would be a healthy event to refresh struggling equity momentum. Technicals have increasingly become bullish over recent sessions, including improving risk sentiment, as derived by the relative performance of cyclical sectors over defensives, suggesting that the bull trend has yet to be broken. The S&P 500 could see a pullback to as far as the lower limit of the rising 2+ month trend channel, presently at 1360. A negative catalyst would likely be required in order to push equity markets substantially further.

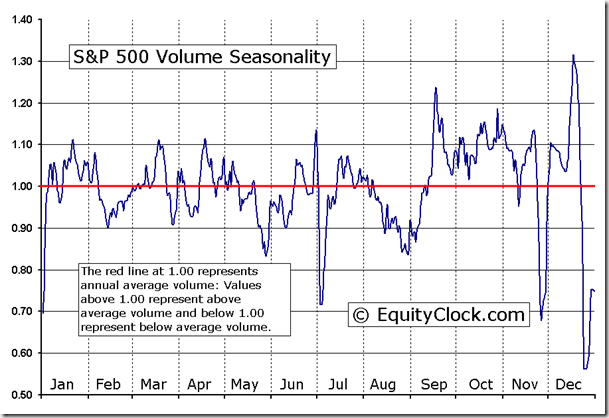

One of the factors to potentially pressure equities lower is the return of volume into the month of September. Volume hits a summer seasonal low around August 30th, on average, before spiking into Labour Day weekend and beyond as traders return from summer vacation. Along with volume comes investor scrutiny, often leading to volatility, a scenario that could offset the recent complacent price action that has benefited stocks for the past few weeks.

Sentiment on Tuesday, as gauged by the put-call ratio, ended bullish at 0.90. The ratio is currently trading above a declining wedge pattern, which has a positive technical bias, suggesting that the early stages of a change of trend may be evident, leading to increase market volatility and risk aversion. The VIX is also showing signs of rebounding from severely depressed levels at a point of long-term support, often a precursor to higher levels of volatility ahead. Volatility remains seasonally positive through to October.

Chart Courtesy of StockCharts.com

Chart Courtesy of StockCharts.com

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $12.37 (down 0.32%)

- Closing NAV/Unit: $12.39 (up 0.03%)

Performance*

| 2012 Year-to-Date | Since Inception (Nov 19, 2009) | |

| HAC.TO | 1.74% | 23.9% |

* performance calculated on Closing NAV/Unit as provided by custodian

Click Here to learn more about the proprietary, seasonal rotation investment strategy developed by research analysts Don Vialoux, Brooke Thackray, and Jon Vialoux.