by Don Vialoux, timingthemarket.ca

Economic News This Week

July Producer Prices to be released on Tuesday at 8:30 AM EDT is expected to increase 0.2% versus a gain of 0.1% in June. Core PPI is expected to increase 0.2% versus a gain of 0.2% in June.

July Retail Sales to be released on Tuesday at 8:30 AM EDT are expected to increase 0.3% versus a drop of 0.5% in June. Ex autos, July Retail Sales are expected to improve 0.4% versus a decline of 0.4% in June.

The August Empire State Manufacturing Index to be released on Wednesday at 8:30 AM EDT is expected to slip to 7.2 from 7.4 in July.

July Consumer Prices to be released on Wednesday at 8:30 AM EDT are expected to increase 0.2% versus no change in June.

July Industrial Production to be released on Wednesday at 9:15 AM EDT is expected to increase 0.5% versus a gain of 0.4% in June. July Capacity Utilization is expected to increase to 79.2 from 78.9 in June.

July Housing Starts to be released on Thursday at 8:30 AM EDT are expected to slip to 752,000 from 760,000 in June.

August Philadelphia Fed to be released on Thursday at 10:00 AM EDT is expected to improve to -4.0 from -12.9 in July.

August Michigan Consumer Sentiment to be released on Friday at 9:55 AM EDT is expected to slip to 72.2 from 72.3 in July.

July Leading Indicators to be released on Friday at 10:00 AM EDT are expected to increase 0.2% versus a 0.3% decline in June.

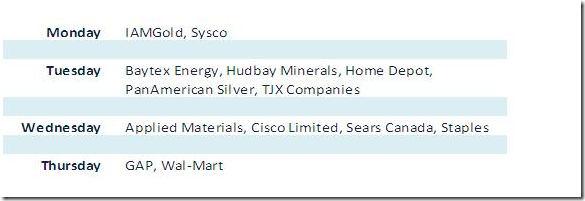

Earnings Reports This Week

Equity Trends

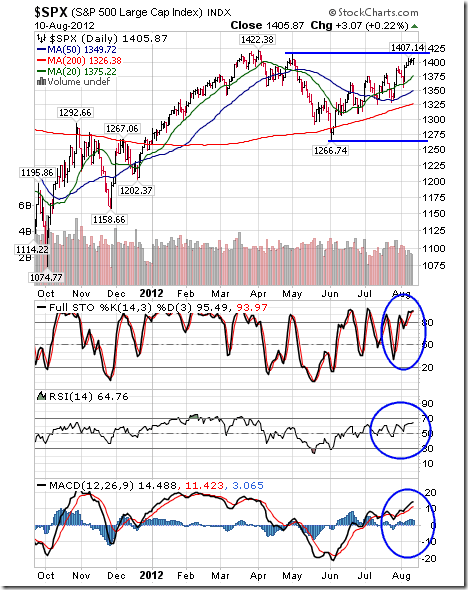

The S&P 500 Index added 14.88 points (1.07%) last week. Intermediate trend is down. Support is at 1,266.74 and resistance is at 1,415.22. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking.

Percent of S&P 500 stocks trading above their 50 day moving average increased last week to 80.20% from 74.80%. Percent is intermediate overbought, but has yet to show signs of peaking. Percent has reached a level where an intermediate peak above the 80% level normally leads to at least a short term correction.

Percent of S&P 500 stocks trading above their 200 day moving average increased last week to 70.60% from 63.60%. Percent is intermediate overbought, but has yet to show signs of peaking.

The ratio of S&P 500 stocks in an uptrend to a downtrend (i.e. the Up/Down ratio) increased last week to (273/142=) 1.92 from 1.40. The ratio is intermediate overbought, but has yet to show signs of peaking.

Bullish Percent Index for S&P 500 stocks increased last week to 67.80% from 63.00% and remained above its 15 day moving average. The Index remains intermediate overbought, but has yet to show signs of peaking.

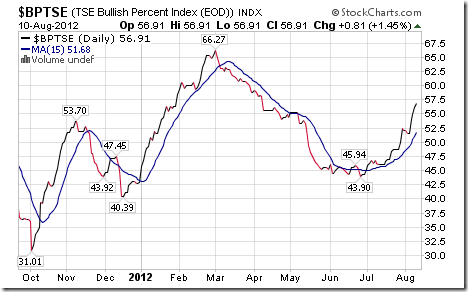

The Up/Down ratio for TSX Composite stocks increased last week to (131/90=) 1.46 from 1.02. The ratio is intermediate overbought but has yet to show signs of peaking.

Bullish Percent Index for TSX Composite stocks increased last week to 55.91% from 51.63% and remained above its 15 day moving average. The Index is intermediate overbought, but has yet to shows signs of peaking.

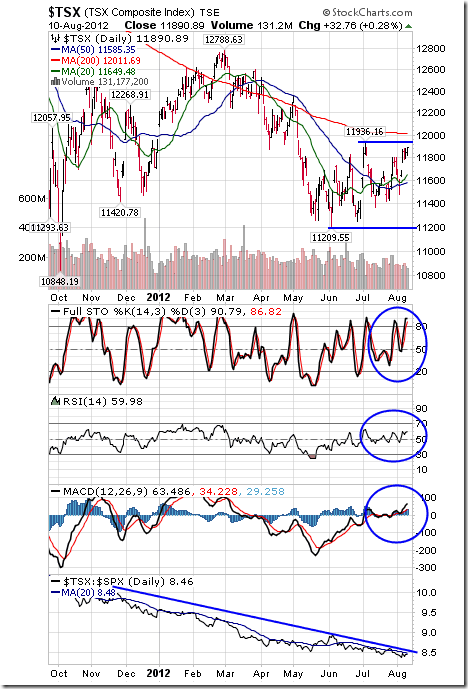

The TSX Composite Index gained 228.30 points (1.96%) last week. Intermediate trend is down. Support is at 11,209.55 and resistance is at 11,936.16. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains negative.

Percent of TSX stocks trading above their 50 day moving average increased last week to 66.26% from 52.44%. Percent is intermediate overbought, but has yet to show signs of peaking. Peaks near the 70% level normally lead to at least a short term correction by the Index.

Percent of TSX stocks trading above their 200 day moving average increased last week to 40.65% from 35.37%.

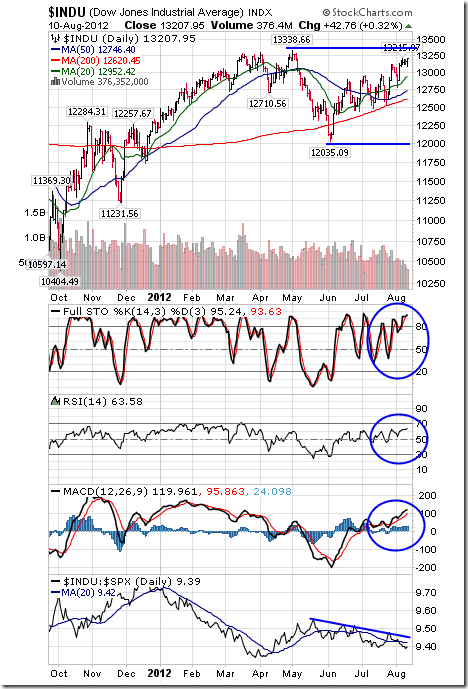

The Dow Jones Industrial Average added another 111.78 points (0.85%) last week. Intermediate trend is up. Resistance is at 13,338.66. The Average remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains negative.

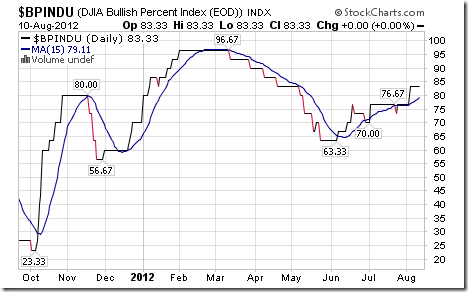

Bullish Percent Index for Dow Jones Industrial Average stocks was unchanged last week at 83.33% and remained above its 15 day moving average. The Index remains intermediate overbought.

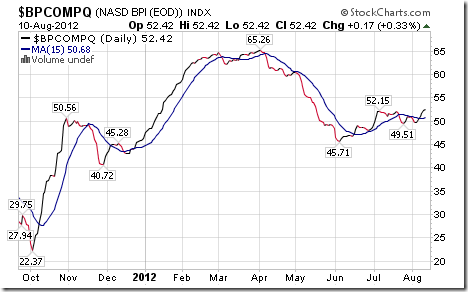

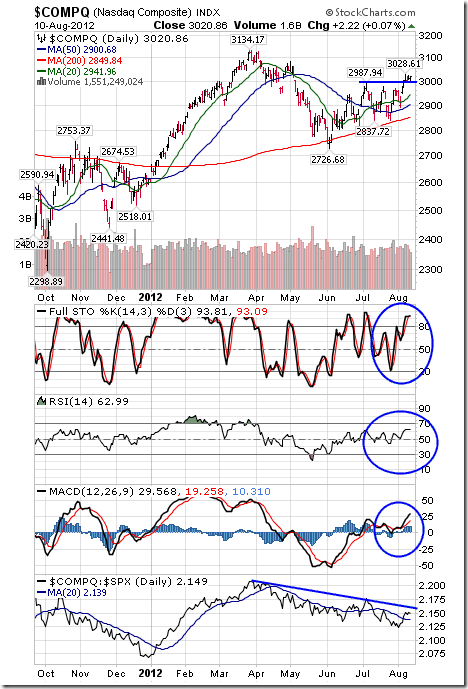

Bullish Percent Index for NASDAQ Composite stocks increased last week to 52.42% from 49.75% and moved above its 15 day moving average.

The NASDAQ Composite Index gained 52.95 points (1.78%) last week. Intermediate trend changed from down to up on a break above resistance at 2,987.94. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains negative.

The Russell 2000 Index added 13.07 points (1.66%) last week. Intermediate trend is down. Support is at 729.75 and resistance is at 820.44. The Index remains above its 50 and 200 day moving averages and moved last week above its 20 day moving average. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains negative.

The Dow Jones Transportation Average fell 22.76 points (0.45%) last week. ‘Tis the season! Intermediate trend is down. The Average fell below its 20, 50 and 200 day moving averages last week. Short term momentum indicators are neutral. Strength relative to the S&P 500 Index remains negative.

The Australia All Ordinaries Composite Index added 59.80 points (1.41%) last week. Intermediate trend is down. Support is at 4,033.40 and resistance is at 4,515.00. The Index remains above its 20 and 50 day moving averages and moved above its 200 day moving average last week. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains neutral.

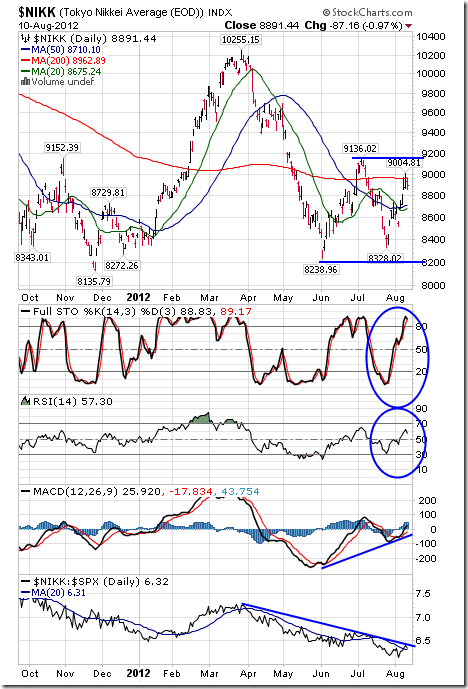

The Nikkei Average jumped 336.33 points (3.93%) last week. Intermediate trend is down. Support is at 8,238.96 and resistance is at 9,136.02. The Average moved above its 20 and 50 day moving averages last week, but remains below its 200 day moving average. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index is negative, but showing early signs of change.

The Shanghai Composite Index added 36.01 points (1.69%) last week. Intermediate trend is down. Support is forming at 2.100.25 and resistance is at 2,478.38. The Index remains below its 50 and 200 day moving averages, but moved above its 20 day moving average last week. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index is negative, but showing early signs of change.

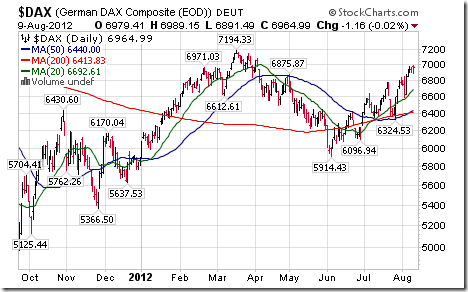

The London FT Index gained 64.23 points (1.11%), the Frankfurt DAX Index added 99.33 points (1.45%) and the Paris CAC Index improved 82.52 points (2.45%) last week.

The Athens Index gained 20.11 points (3.36%) last week. Intermediate trend is down. Support is at 471.35 and resistance is at 662.49. The Index remains below its 200 day moving average and above its 50 day moving average. Last week it moved above its 20 day moving average. Short term momentum indicators are trending higher. Strength relative to the S&P 500 Index remains slightly negative.

Currencies

The U.S. Dollar Index added 0.17 (0.21%) last week. Intermediate trend is up. Support is at 81.16 and resistance is at 84.10. The Dollar remains above its 200 day moving average and below its 20 and 50 day moving averages. Short term momentum indicators are trending down.

The Euro fell 0.87 (0.70%) last week. Intermediate trend is down. Support is at 120.42. The Euro remains below its 50 and 200 day moving averages and above is 20 day moving average. Short term momentum indicators are trending higher.

The Canadian Dollar added 1.03 cents U.S. (1.03%) last week. Intermediate trend is neutral. Support is at 95.76 and resistance is at 102.05. The Canuck Buck remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking.

The Japanese Yen added 0.45 (0.35%) last week. Intermediate trend is down. Support is at 124.12 and resistance is at 128.77. The Yen remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are trending down.

Commodities

The CRB Index added 1.12 points (0.37%) last week. Intermediate trend turned positive on a break above resistance at 305.04. The Index remains above its 20 and 50 day moving averages and briefly tested its 200 day moving average. Short term momentum indicators are trending higher. Strength relative to the S&P 500 Index is neutral/positive.

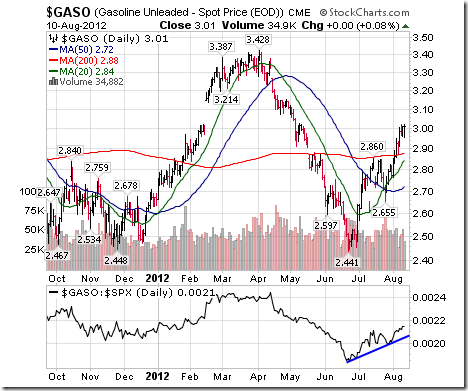

Gasoline gained another $0.08 per gallon (2.73%) last week following news of a fire at a California refinery. Gasoline remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive.

Crude oil added $1.97 per barrel (2.16%) last week on growing Middle East tensions and declining inventories. Intermediate trend changed from neutral to up on a break above resistance at $93.25. Crude remains above its 20 and 50 day moving averages and below its 200 day moving average. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains positive.

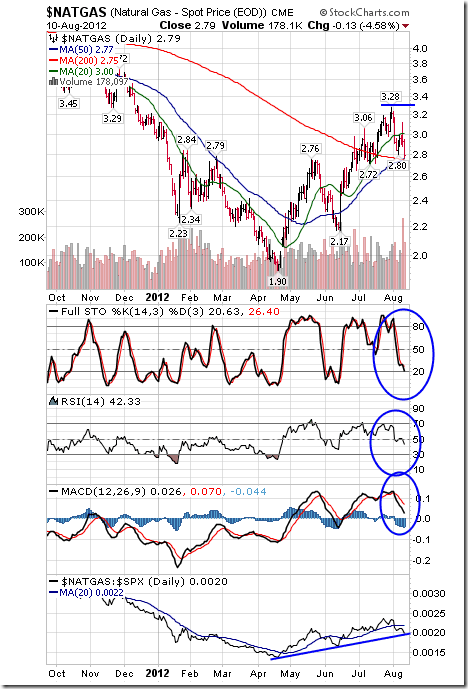

Natural Gas fell $0.09 per MBtu (3.12%) last week. Intermediate trend is up. Resistance may be forming at $3.28. Gas remains above its 50 and 200 day moving average and below its 20 day moving average. Short term momentum indicators are trending down. Strength relative to the S&P 500 Index remains positive, but showing early signs of a change.

The S&P Energy Index added 12.38 points (2.34%) last week. The Index is testing resistance at 544.25. The Index remains above its 20, 50 and 200 day moving averages. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains positive. ‘Tis the season!

The Philadelphia Oil Services Index gained 7.13 points (3.22%) last week. The move above a reverse head and shoulders pattern continues. The Index remains above its 20 and 50 day moving averages and moved above its 200 day moving average last week. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains positive. ‘Tis the season!

Gold added $15.30 per ounce (0.95%) last week. Intermediate trend is down. Support is at $1,526.70 and resistance is at $1,642.40. Gold remains below its 200 day moving average and above its 20 and 50 day moving averages. Short term momentum indicators are trending higher. Strength relative to the S&P 500 Index remains neutral/positive. ‘Tis the season!

The AMEX Gold Bug Index gained 22.62 points (5.55%) last week. Intermediate trend is down. Support is at 372.74 and resistance is at 464.76. The Index remains below its 200 day moving average and above its 20 day moving average and moved above its 50 day moving average. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to gold has turned positive. ‘Tis the season!

Silver gained $0.31 per ounce (1.12%) last week. Intermediate trend is down. Support is at $26.10 and resistance is at $28.44. Silver remains below its 200 day moving averages and above its 20 and 50 day moving averages. Short term momentum indicators are trending higher. Strength relative to gold remains neutral.

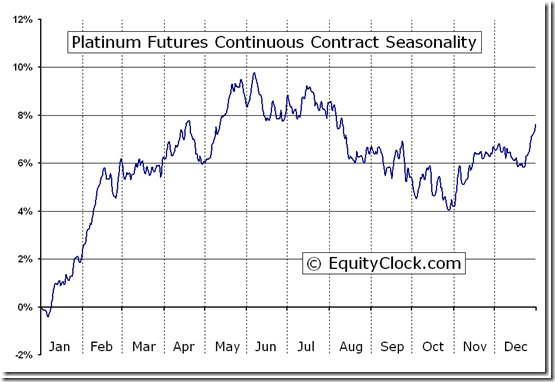

Platinum fell $2.90 per ounce (0.21%) last week. Intermediate trend is down. Platinum remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are trending higher. Strength relative to gold remains negative.

Copper added $0.04 cents per lb. (1.19%) last week. Intermediate trend is down. Support is at $3.24 and resistance is at $3.56. Copper remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are bottoming and trending higher. Strength relative to the S&P 500 Index remains negative.

The TSX Global Metals and Mining Index jumped 47.21 points (5.71%) last week. Intermediate trend is down. Support has formed at 781.13. The Index remains below its 200 day moving average and above its 20 day moving average and moved above its 50 day moving average last week. Short term momentum indicators are trending higher. Strength relative to the S&P 500 Index has been negative, but is showing signs of change.

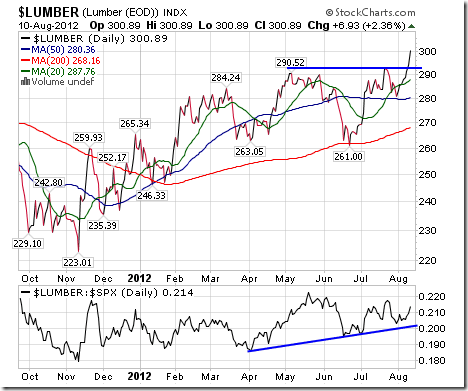

Lumber gained $15.29 (5.35%) last week. On Friday, it broke to a 17 month high. Lumber remains above its 20, 50 and 200 day moving averages. Strength relative to the S&P 500 Index remains positive.

The Grains ETN slipped $0.06 (0.10%) last week. Intermediate trend is up. Resistance has formed at $64.83. The ETN remains above its 20, 50 and 200 day moving averages.

The Agriculture ETF added $0.52 (1.04%) last week. Intermediate uptrend resumed on a break above resistance at $50.54. The ETF remains above its 20, 50 and 200 day moving average. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains neutral/slightly negative.

Interest Rates

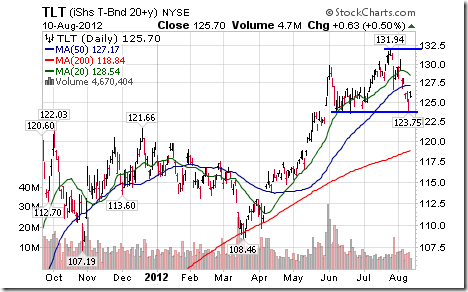

The yield on 10 year Treasuries increase 0.072 (4.57%) last week. Intermediate trend changed from down to neutral on a break above resistance at 1.686%. Short term momentum indicators are overbought, but have yet to show signs of peaking.

Conversely, price of the long term Treasury ETF fell another $1.72 (1.35%) last week. It briefly broke support at $123.56.

Other Issues

The VIX Index fell another 0.90 (5.75%) last week. It broke below support at 15.45 last week. The Index remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are oversold, but have yet to show signs of bottoming.

Second quarter earnings reports are winding down. The focus this week is on reports from the retail merchandisers.

Economic reports this week are expected to be neutral/positive for equity markets. The next major economic event to watch is the Jackson Hole Economic Conference hosted by the Fed from August 30th to September 1st. Bernanke previously announced Quantitative Easing at the Jackson Hole Conference. Will he announce QE III at this conference?

Macro news is relatively quiet this week. European economic data to be released on Tuesday could attract attention.

Short and intermediate technical indicators currently are overbought, but have yet to show signs of peaking.

North American equity markets have a history of moving flat to lower in mid-August

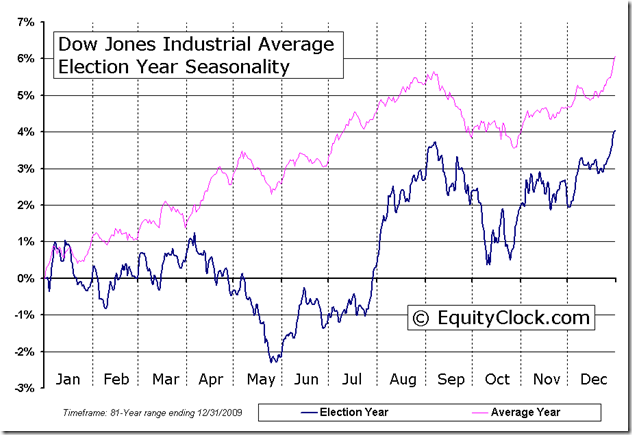

North American equity markets have a history of moving higher from July to August during a U.S. election year. However, equity markets also normally show at least a shallow correction in September and into early October.

Cash on the sidelines on both sides of the border is substantial and growing. However, political uncertainties (including the Fiscal Cliff) preclude major commitments by investors and corporations.

The Bottom Line

Equity markets on both sides of the border have had a good ride since their lows set on June 4th. The Dow Jones Industrial Average is up 9.7% and the S&P 500 Index has gained 11.0%. Investing in equity markets has become less attractive. Accumulation of seasonal trades on weakness continues to make sense as long as the seasonal trades are outperforming the market. Sectors in this category include agriculture, energy, leisure & entertainment, software and gold. A cautious bullish stance appears appropriate.

Tom Rogers’ Weekly Elliott Wave Blog

Following is a link:

http://www.tomrogers.net/signpost.htm

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices.

To login, simply go to http://www.equityclock.com/charts/

Following is an example:

Platinum Futures (PL) Seasonal Chart

ETF News

The latest weekly update on ETFs in Canada to August 10th is available at

Disclaimer: Comments and opinions offered in this report at www.timingthemarket.ca are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Don and Jon Vialoux are research analysts for Horizons Investment Management Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons Investment Management Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment Management Inc

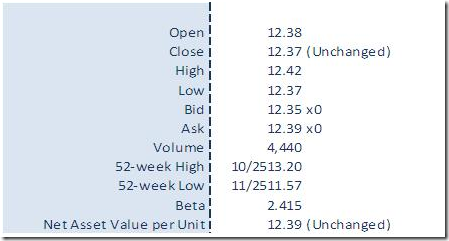

Horizons Seasonal Rotation ETF HAC August 10th 2012

Copyright © timingthemarket.ca