by Seth Masters, Chief Investment Officer, AllianceBernstein

Some experts today argue that the world has entered a “New Normal” condition in which stocks have permanently lost their return edge. We’ve heard this before. It was wrong then, and we think it’s wrong now, too.

In 1979, BusinessWeek published a cover story famously called “The Death of Equities.” Then, like now, stock market returns had lagged 10-year Treasury returns for a decade, although for somewhat different reasons.

Stock returns had been dragged down by the bursting of a bubble (the Nifty Fifty) and bleak economic conditions. OPEC had unleashed its second oil-price shock in five years. The so-called misery index—the sum of the unemployment and inflation rates—was 20% in the US, double its level today (because inflation is now very low). And corporate profits were very weak (today, they are very strong).

BusinessWeek was capturing widespread sentiment about the economic and market outlook. Nonetheless, stocks handily beat bonds over the 10 years starting in 1979.

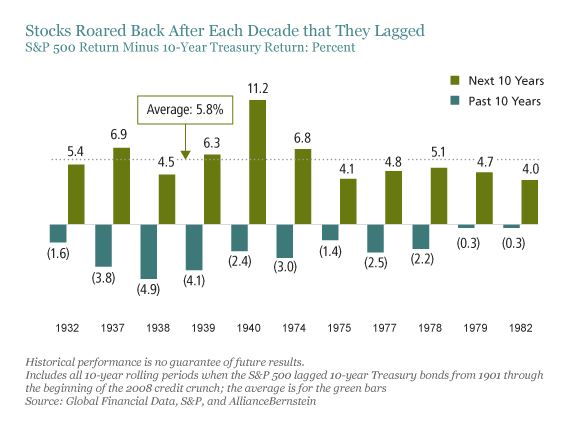

As the ubiquitous legal disclosure says, past performance does not guarantee future returns. Indeed, performance often reverses sharply.

Between 1901 and the onset of the recent credit crisis, there have been 11 10-year rolling periods in which bonds beat stocks, all of them coinciding with the Great Depression or the stagflation of the 1970s. And after each and every one of them, stocks beat bonds for 10 years—on average, by 5.8%, as the Display below shows.

Because we are human, we all tend to expect the future to resemble the recent past—to become “anchored” in our recent experience. It takes guts to buck the trend. But at a September 1983 client conference, we cited good fundamental reasons in making “The Case for the 2,000 Dow.” The Dow Jones Industrial Average was then slightly below 1,300. It reached 2,000 in January 1987, about three-and-a-half years later.

Today, our median annual return projections for global and US stocks are about 8% over the next 10 years, far ahead of our projected 2% median return for 10-year Treasuries. At that rate, the Dow could hit 20,000 in five to 10 years. In the same time frame, the S&P 500, a more representative index, could hit 2,000. (It’s now around 1,300.)

Our projected stock returns may sound optimistic. They’re not. They are well below the long-term average for US and global equities, and are based on conservative assumptions about economic and market conditions.

Still, many pundits argue that stocks today are overpriced. My next blog post will assess stock valuations.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Seth J. Masters is Chief Investment Officer for Asset Allocation at AllianceBernstein and Chief Investment Officer of Bernstein Global Wealth Management, a unit of AllianceBernstein.