July 27, 2012

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.

and Brad Sorensen, CFA, Director of Market and Sector Analysis, Schwab Center for Financial Research,

and Michelle Gibley, CFA, Director of International Research, Schwab Center for Financial Research

Key Points

- Volume has been low and stocks have managed to drift higher, despite some volatile days; but conviction appears to be lacking. We seem to be biding time until the action heats back up as summer winds down, but market-moving events can happen at any time.

- The US economy continues to slow and Fed Chairman Bernanke had a relatively dour outlook before Congress. But it appears things would have to get worse before another round of easing is initiated; the effectiveness of which we continue to question.

- Yields in Spain and Italy indicate action may be needed sooner rather than later, but we did get positive remarks by the ECB, which led to market rallies and a big drop in yields, providing a measure of hope. Meanwhile, Chinese growth has been hit by the global economic slowdown but their lack of transparency means getting a good read is difficult.

In contrast to the athletes in the Olympics that are laser-focused on moving forward and achieving their objectives, markets seem to be caught in a sort of summer malaise. Volume has been depressed and sentiment surveys show retail investor skepticism at high levels-despite stock market performance being relatively decent this year, with the S&P 500's 8.5% gain through July 20 the best showing to this point in the year since 2000 (thanks to Wolfe Trahan & Co. Portfolio Strategy). But with policymakers lacking the discipline and focus of Olympic athletes (the understatement of the year), and continuing publicity hits to the financial sector, we can't blame investors for their doubts; and determining what direction the next major move will likely be more difficult than usual. Whenever you get politicians and the courts involved in the financial picture, predictions become even more difficult than usual, and that's saying something!

In this frustrating, unpredictable environment, we find it helpful to take a step back. Asset allocation continues to be important and investors need to pay attention to their distribution of money relative to their time horizon and risk tolerance. In this environment, investors ignore their portfolios at their peril as things can and likely will change quickly. We are unlikely to see any resolution to the fiscal cliff before the election and the eurozone crisis remains on tenuous footing; notwithstanding Mario Draghi's encouraging comments (discussed below). But if you look out the five years that we suggest is an appropriate time horizon for equities, it's difficult to imagine that we'll still be dealing with these same issues. And US equities remain quite cheap based on historical measures and recently hit a cyclical high in terms of relative performance to most other global equity markets. Our view that the US market will be the best relative performer through at least the balance of 2012 has not changed.

Economy keeping its head above water—barely

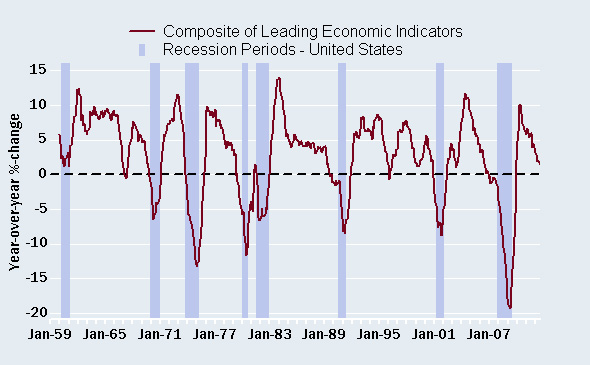

The US economic picture continues pointing toward still (barely) positive but slowing growth. Somewhat concerning, however, was the third-consecutive negative reading on retail sales, the Philly Fed Index remaining in negative territory, and the Index of Leading Economic Indicators declining by 0.3% last month.

LEI paints a disappointing portrait

Source: FactSet, U.S. Conference Board. As of July 24, 2012.

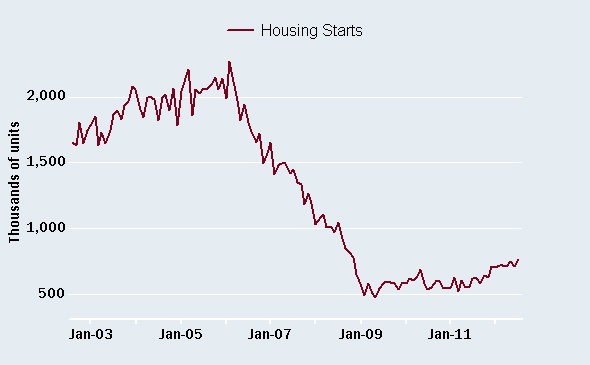

However, there continue to be positive offsets that did not exist in either of the past two years when we also dealt with growth scares—dominant among them is the recovery in housing. We've seen steady improvement over the course of the year; but housing is now less than 3% of US gross domestic product (GDP) after hitting a high of over 6% at the peak in the bubble. The National Association of Home Builders (NAHB) Index rose 6 points to 35, still below the 50 mark that would denote a growing housing market, but the best reading since March 2007. Additionally, housing starts rose 6.9% to the highest level since October 2008.

Housing now contributing positively?

Source: FactSet, U.S. Census Bureau. As of July 24, 2012.

And although existing home sales posted a decline of 5.4%, the National Association of Realtors noted that the fall was attributable to inventory tightness, something that we haven't heard in a while. In fact, there is now just a 6.6 month supply of existing homes for sale, versus 9.1 months a year ago. We're not trumpeting the all-clear signal yet, but it appears to us that housing is now a help and not a hindrance to economic growth.

Additional support for our "muddle through" view comes from various other areas such as the Empire Manufacturing Index getting a modest bump to 7.4, industrial production expanding by 0.4%, and jobless claims remaining comfortably below 400,000. We are also through the bulk of earnings season and bottom-line results, while not spectacular, were largely better than reduced expectations. However, top-line growth was somewhat disappointing but consistent with the low level of nominal GDP growth.

Policy frustration grows

Unfortunately, much of the frustration expressed during earnings season was directed toward Washington. Politics has thrust itself into the middle of both the markets and the economy and cannot be ignored. Corporate executives are increasingly pointing toward the uncertainty surrounding regulation and tax policy as reasons that they were unwilling to take the risk of expanding their business or hiring new workers. And while companies often take shots at Washington, the difference this time around is the unanimity in the desires of executives. While each would likely have their own view on what the ultimate outcome would look like, the bottom line for the vast majority of them is that they need a bottom line. Businesses can adjust to a variety of circumstances—that's one thing that has made America what it is—but they need to know the rules of the game. Unfortunately, Washington's dysfunction and the typical antics in an election year suggest limited resolutions to what presently ails confidence and hiring.

Last week's outrage was to hear a sitting Senator tell the Chairman of the Federal Reserve—after hearing again that the best thing for economic growth would be responsibly addressing the fiscal cliff—that the Fed better "get to work" because Congress was hopelessly deadlocked. And while Bernanke said the Fed is prepared to act again if necessary, our belief is that there is little they can do at this point to have a real impact on the economy.

Europe's cliff draws nearer

Europe has leaned more toward collectivist fiscal policies than the US, which has helped to contribute to the ongoing debt crisis as governments have spent and promised beyond their means. At some point, bills have to be paid, and without strong incentives to take risks and expand business, payers start to dwindle while payees increase.

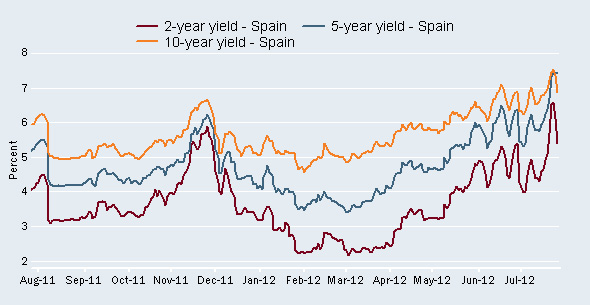

Currently, policymakers are again treading water but summer doldrums are noticeable in the peripheral sovereign bond auctions in Europe, where the few buyers that are showing up are demanding higher rates, particularly for Spanish and Italian government debt.

The risks for Spain remain high, with regional government debt and deficits the new concern du jour. Despite the 17 regional governments being major contributors to the 2011 deficit slip, the Spanish central government has been unable to control their spending due to strong cultural and historical adherence to regional autonomy. Regional government spending is significant, as they control education, health and social services, accounting for 50% of total government spending. The buyers' strike for Spanish debt is intensified for regional governments, where the 10-year debt yield for the region of Catalonia exceeded 14% in June and the region of Valencia had to pay a punitive 6.8% six-month yield to roll over 500 million euros of debt in May.

As a result, yet another bailout fund has been created; this time for Spain's regional governments, which Spain insists will not increase its borrowing burden. When adding to bank capital needs that were revised higher and deficit targets which were adjusted larger, investors are skeptical. This lack of confidence has resulted in Spanish government short-term yields spiking nearly as high as long-term rates, a sign of market stress, although we did see a marked pullback following the Draghi comments.

Spain's stress gauge volatile

Source: FactSet, Tullett Prebon. As of July 26, 2012.

With Spain's average maturity of 6.4 years resulting in a 4.1% average interest rate, rates may need to stay elevated longer before a bailout is necessary, but more forceful action is needed to contain the situation. The reason is that the size of Spain's economy and government bond market is around double the combined size of those of Greece, Portugal and Ireland, and Spain's problems have increasingly ensnared Italy.

Meanwhile, eurozone bailout funds are still impotent, with the temporary European Financial Stability Facility (EFSF) lacking sufficient funds, the permanent European Stability Mechanism (ESM) on hold for a ruling by the German Constitutional Court in September, and the European Central Bank (ECB) is not yet using monetary measures to solve what they view a fiscal problem. Despite recent comments by ECB President Mario Draghi indicating they would do "whatever it takes to preserve the euro," actions are still lacking and their ability to implement substantial plans is likely severely constrained by their mandate and the continuing disagreements among member nations. While the market rallied on the comments and reminds us that sharp rallies are possible on potential positive movement, words have become less meaningful and more decisive action is needed.

We've said in the past that the situation is rife for outbreaks of market volatility, as we continue to see. Moody's Investor Service apparently concurs, downgrading the outlooks for the AAA-rated nations of Germany, the Netherlands and Luxembourg. It was due in part to the rising risk of future liabilities, because policymaker's "continued reactive and gradualist" response will "very likely be associated with a series of shocks, which are likely to rise in magnitude the longer the crisis persists."

We've believed it would take severe market instability, nearing the edge of the precipice, before more forceful actions would be taken. The flattening of the Spanish yield curve indicates more forceful actions are drawing closer, with the ECB the institution able to respond most quickly. Granting the ESM a banking license could create large firepower, but Draghi said in July that this could risk the ECB's credibility by behaving outside its mandate—seemingly conflicting with the above statement of unconditional support. Other "non-standard" measures such as restarting the Securities Market Program (SMP) for sovereign bond purchases were not discussed at the ECB's July policy meeting, but traders are on the lookout for a change in the ECB's stance.

Germany remains resistant to endlessly fund peripheral country problems, as it is responsible for the largest share of potential future liabilities. With Greece's problems remaining, a Greek exit from the euro is not out of question. Conversely, there have been increasingly vocal suggestions that Germany leave the euro. While this is easier said than done and any action would have attendant costs, the ultimate decision is political, and therefore difficult to forecast.

All of the wrangling does have an outcome we can foresee—likely continued economic suppression in the eurozone; as uncertainty halts investment and spending, and a hobbled banking sector hampers lending. Additionally, the rollercoaster of investor sentiment is likely to remain, and we continue to believe European stocks will underperform most other global markets.

Chinese economic data manipulated?

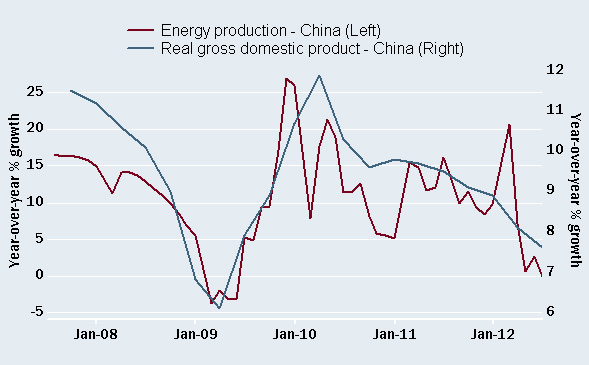

China's lack of transparency breeds speculation about where the economy is headed. Attention has focused on a significant slowdown in electricity production and consumption, which have fallen to single-digit rates in recent months, while gross domestic product (GDP) has slowed more modestly.

China's electricity deviation historically "normal"

Source: FactSet, National Bureau of Statistics of China. As of July 24, 2012.

Electricity production has deviated from GDP in the past, not only in China, but also in other major economies, including the United States. This statistic is volatile and it is important to note that one of China's major long-term initiatives has been to lower its energy usage per unit of GDP, and that energy-intensive industrial sectors have slowed more than the overall economy.

Positively, HBSC's initial manufacturing purchasing manager index (PMI) for July rose to a five-month high of 49.5, driven by gains in production and export order components. We are skeptical China's economy has yet to significantly accelerate, believing growth in China will slow further in the third quarter, but remain above a hard landing. Conversely, the Street is still grappling with the slowdown, forecasting a turn higher in third quarter growth 8.2% from 7.6% in the second quarter. A pick-up in fiscal and monetary stimulus is likely needed for China's economy to reaccelerate, and the government thus far has been disappointingly slow and measured on this front.

With the desire to keep social unrest at bay, employment trends are likely closely monitored by Chinese officials. While not yet at a crisis level, the faster rate of contraction in employment indicated in the HSBC report, and comments from consumer-goods maker Jarden about a "halt" in wage inflation momentum, may indicate stepped up stimulus measures could be on the immediate horizon.

Spiking corn prices have ignited concern about food prices, in particular for emerging markets where the food component in consumer price inflation (CPI) indexes is two-to-five times larger than in developed markets, which could limit growth and continued easing by emerging market central banks. We are monitoring the situation, but aren't yet ready to declare a lasting and broad increase in overall food prices, with prices of the important staple of rice still subdued. Read more international research at www.schwab.com/oninternational.

So what?

With such a conglomeration of concerns, investors can be tempted to throw up their hands in frustration and seek the perceived safety of a nice, comfortable mattress. However, as we saw with the Draghi comments, sharp equity rallies are possible and we believe at some time in the not-too-distant future resolutions to the two major issues—the eurozone crisis and the fiscal cliff—will emerge, setting the stage for a renewed sustainable move. Waiting until it occurs carries risks just as staying invested does, so we urge investors to maintain a diversified portfolio with a bit more exposure to the US side of the ledger at the expense of some European exposure. Valuations are attractive and sentiment is very pessimistic—a contrarian indicator. For tactical investors we would suggest adding to equities during pullbacks and trimming outsized positions during any fierce rallies.

This commentary originally appeared at Schwab.com

Important Disclosures

The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States and Canada. As of May 27, 2010, the MSCI EAFE Index consisted of the following 22 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

The MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 27, 2010, the MSCI Emerging Markets Index consisted of the following 21 emerging-market country indexes: Brazil, Chile, China, Colombia, the Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

The S&P 500® index is an index of widely traded stocks.

Indexes are unmanaged, do not incur fees or expenses and cannot be invested in directly.

Past performance is no guarantee of future results.

Investing in sectors may involve a greater degree of risk than investments with broader diversification.

International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Investing in emerging markets can accentuate these risks.

The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. This report is for informational purposes only and is not a solicitation or a recommendation that any particular investor should purchase or sell any particular security. Schwab does not assess the suitability or the potential value of any particular investment. All expressions of opinions are subject to change without notice.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.