by Tom Brakke, Research Puzzle

What is “the worst deal”? Well, there are a lot to choose from — witness the bath that Microsoft took on aQuantive.

But it’s hard to argue with an article from the Wall Street Journal that the Bank of America (BAC) purchase of Countrywide Financial (CFC) ranks right up there. Eddy Elfenbein posted an excerpt of it that included this:

“‘It is the worst deal in the history of American finance,’ said Tony Plath, a banking and finance professor at the University of North Carolina at Charlotte. ‘Hands down.’”

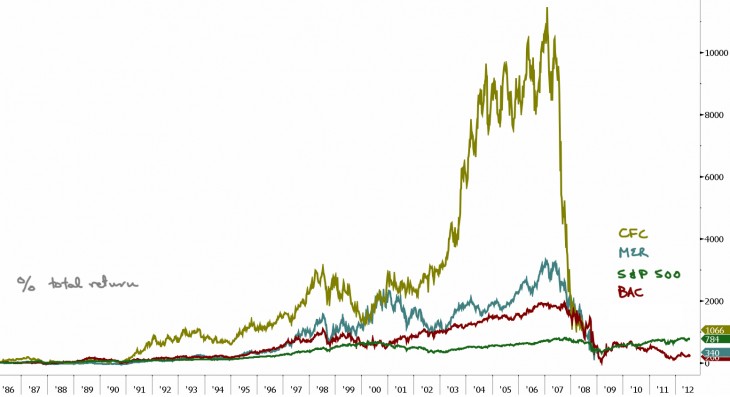

The chart above illustrates the total returns over the last quarter century for BAC and the S&P 500. Also shown are the returns for CFC and Merrill Lynch (MER) from 1986 until BAC bought them in mid-2008 and early 2009 respectively. I threw MER in there to show the extraordinary returns it had and then lost, just as CFC and BAC did.

I once wrote about the Green Tree Financial saga and the “securitization of assumptions.” Countrywide was like that, with an overly-tanned pitchman that pumped those assumptions on CNBC. Eager for product to feed the machine, the sell-side played along. The failure of the buy-side is harder to explain. (Chart: Bloomberg terminal.)

the enormous radio

It’s just a few pages long — no, not the latest research puzzle posting, which is way shorter than that. Rather, the short story by John Cheever that inspired it. What if you had an enormous radio that you could use to tune into investment deliberations?