July 13, 2012

by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.,

and Brad Sorensen, CFA, Director of Market and Sector Analysis, Schwab Center for Financial Research

and Michelle Gibley, CFA, Director of International Research, Schwab Center for Financial Research

Key Points

- Equity markets rebounded from their lows, but the move has been less than enthusiastic and convincing. Earnings season is upon us and corporate commentary and outlooks may take the focus away from the macro world—at least for a time.

- Muddling through is the popular phrase on the Street for what's occurring in the US economy. But how long before a break is made one way or the other—both in the economy and the markets?

- Any progress made at the most recent European Union (EU) Summit appears to have been short-lived and any credible long-term solutions remain illusive. Additionally, Chinese growth continues to slow and concerns over a "hard landing" are growing.

Muddling through. Not the most inspiring phrase and we must admit that we are already tired of hearing it, even as we use it ourselves. But it appears to be the best description of what's occurring in so much of the world currently. In Europe, policymakers continue to take one step forward, followed relatively quickly by one step back; avoiding a complete collapse, but really coming no closer to an actual resolution to their debt crisis and economic problems—muddling through. In China, growth has slowed and policymakers have been slow to respond and appear willing to accept a lower pace of improvement in exchange for deflating a real estate bubble and containing inflation—muddling through. And in the United States, stocks appear to be largely trading in a range, with neither the bulls nor the bears able to grab the reins and establish a trend; while economic data is mushy, but not overtly negative—muddling through.

The question is how long before the muddling stops and a sustainable direction is established? Unfortunately, while we believe a day of reckoning is drawing nearer and the ability of policymakers to use slight of hand to "fool" the markets into thinking solutions may be forthcoming is growing thin; it appears to still be at least a few months away, and the largely sideways action in stocks is likely to persist.

That doesn't mean that investors who need to add to their equity exposure should wait until a definitive trend is established. By that time, much of the move will likely be passed and there is always the possibility of unforeseen events impacting the markets to a substantial degree—the so-called fat tail scenarios discussed in the last Schwab Market Perspective. For investors that have a time horizon of five years or longer, we continue to believe equities are attractive here. Valuations appear reasonable, but there are ample near-term hurdles, including the "fiscal cliff," China's growth, the US slowdown and the ongoing eurozone debt crisis. If the expectations hurdles have been set low enough , we could see some sharp rallies unfold among riskier asset classes, but there remain negative tail risks as well, and volatility and uncertainty are not likely going away in the near-term.

As we head into the peak of second quarter earnings season, corporations have the spotlight as the macro picture has entered a quieter zone. Judging by the elevated preannouncement ratio for the quarter, we expect to hear uncertainty and caution in the outlooks, as tax policy remains uncertain, the ultimate outcome in Europe continues to be illusive and China's growth is slowing. With many companies having preemptively announced negative developments with their second quarter performance, expectations have been lowered, which would traditionally set up the possibility of upside surprises. However, we're concerned that there may be further disappointments to come as the global economy continues to weaken. Regardless, it's hard to imagine the corporate picture driving action for long as macro developments will likely again take hold as fall approaches.

Recession increasingly likely?

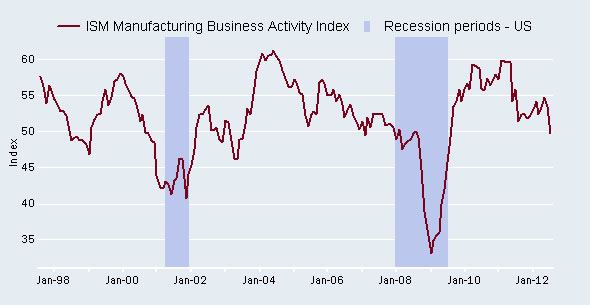

As mentioned above, the US economy appears to be muddling through, but concerns over a return to a recession have grown. Chief among the disappointing reports was the Institute for Supply Management's (ISM) Manufacturing Index, which came in at 49.7, down from 53.5 and below the 50 level that denotes the dividing line between an expanding or contracting manufacturing sector. This was the lowest reading since July of 2009, but it's important to note that the index traditionally doesn't start to indicate recession for the broader economy until it drops below 44.

ISM indicates softness but no recession-yet

Source: FactSet, Institute for Supply Management. As of July 6, 2012.

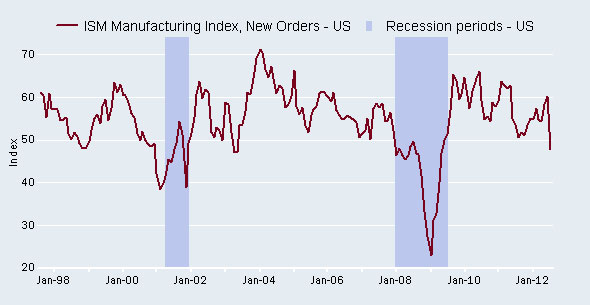

More concerning was the new orders component-the more forward-looking part of the report-collapsing by 12.3 points, which was its biggest monthly drop since October 2001.

New orders are more concerning

Source: FactSet, Institute for Supply Management. As of July 6, 2012.

However, the service side of the ledger was a bit more positive. Although weakening, the ISM Non-Manufacturing Index remained above 50 at 52.1.

Additionally, the labor market continues to disappoint, although we do continue to see job additions. The ADP Employment report surprised on the upside at 176,000 new jobs for June but the broader government labor report was again disappointing, as only 80,000 new jobs were added. In contrast to the previous month, the unemployment rate remained unchanged at a still-elevated 8.2%. Remember, the unemployment rate is one of the most lagging of all economic indicators, and we have recently seen a positive reversal in unemployment claims, a leading economic indicator.

There are some automatic stabilizers that can help to stimulate economic growth when it slows. One that has been working quite well lately is the reduction in oil prices as demand growth has slowed, helping to put more money in consumers' pockets. Additionally, other commodity costs have eased as well, although there is growing concern that the heat wave hitting much of the country is causing corn crop problems which has resulted in elevated corn prices. With corn used in so many food items, as well as in ethanol and other products, it is something we are keeping an eye on moving forward.

Government…muddling is thy name!

It's difficult to imagine employers gaining a lot of confidence and willing to take additional risk by hiring a lot of new workers when they have so much uncertainty surrounding taxes, regulations and ongoing healthcare costs…exacerbated by the looming fiscal cliff. And while politicians on both sides of the aisle appear to recognize the problems this uncertainty is causing, definitive action still appears unlikely. At this point, we believe the most likely scenario is that the lame duck Congress following the elections will pass a three-to-six month extension of current policy so the new Congress can deal with it in 2013—thus avoiding the worst case scenario, but still leaving it hanging out there. One important note, however, due to the WARN Act, government contractors have to preannounce potential job cuts ahead of time. So if we still don't have a deal before the election, we will likely have multiple mass layoff announcements made, especially from defense contractors, which could have a negative drag on sentiment.

Europe struggles to make progress

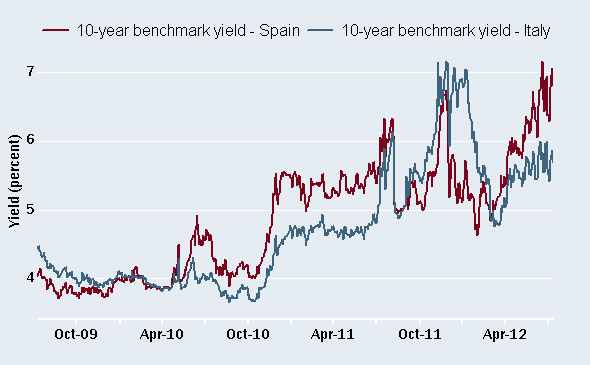

Speaking of a negative drag on sentiment, European policymakers have taken squabbling to an art form. More than two years into the sovereign debt crisis, progress remains disappointingly slow. Yet another European summit to curb the sovereign debt crisis has come and gone, and despite unveiling another "grand plan," doubts remain, and muddling along continues.

The aim for the recent summit was to break the vicious cycle between weak peripheral countries and their weak banks. Low expectations were exceeded, but market relief was short-lived amid lack of details and still-missing components that are likely needed to quell the crisis. Meanwhile, each successive "grand plan" has had a shorter relief rally, as market participants are becoming less patient, while policymakers appear to lack urgency.

Market relief remains tenuous

Source: FactSet, iBoxx. As of July 10, 2012.

Spain remains a concern because its banking system needs capital, estimated at 37 billion euros by the International Monetary Fund (IMF), and 51-62 billion euros in stress tests conducted by consultants hired by the Spanish government. A separate audit on an individual bank-by-bank basis is due in late July.

The problem is the source of capital infusions for Spain's banks:

- If banks are bailed out by the Spanish government, the Spanish government itself may need a bailout.

- One outcome of June's summit potentially allows bailout funds to directly recapitalize banks. However, common eurozone-wide bank supervision is required first, and this is a complicated process that may not happen until the second half of 2013.

- The latest "plan du jour," is to give Spanish banks 30 billion euros in emergency funding without expanding Spain's government balance sheet. However, this stop-gap plan will not bolster confidence definitely in our opinion, as it not large or quick enough and lending nations remain resistant.

Incompatible cultures and politics hamper agreement on broad solutions and time has been wasted. As the debt crisis has become a crisis of confidence, each successive failure increases the risk that market confidence cannot be restored – once confidence is lost, it is difficult to gain back. From a long-term perspective, a break up of the euro remains an increasing possibility, which could improve the longer-term outlook, but would likely be accompanied by extreme volatility at the time of occurrence.

However, we don't believe Europe will achieve either full union or break-up in the near-term, resulting in muddling through as the most likely scenario. As such, the rollercoaster loop of sentiment is likely to remain in place, and we continue to believe European stocks will be under-performers.

Global synchronized slowdown

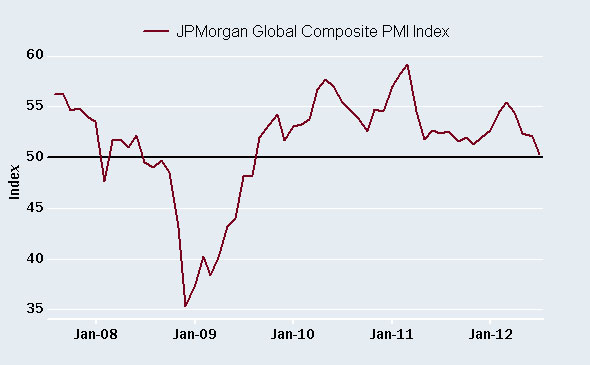

The economic slowdown has gradually spread from Europe in the fall of 2011, to China in the first quarter of 2012, and now the United States appears to be joining. As a result, the JPMorgan Global Composite Purchasing Manager Index (PMI) shows global economic growth falling perilously close to contraction territory.

Global economy losing steam

Source: FactSet, Bloomberg. As of July 10, 2012.

A look under the hood is even more concerning, as the JPMorgan Global Manufacturing PMI has fallen to 48.9. The service economy has been a source of relative strength, but manufacturing has dropped, and manufacturing tends to lead economic trends, as it is more tied to the business cycle. Additionally, the new orders component of global PMIs dropped significantly in June, evident not only in the US ISM report mentioned earlier, but even China cited the United States as a new sign of weakness in June. Lastly, with inventories falling at a slower pace than orders globally, the implication is that an inventory destocking cycle could be upon us, which could result in lower economic activity in the future.

Is there a hard landing in China?

The gloomy sentiment stick appears to have been handed off from Europe, where slow growth appears to be "accepted" by markets, to China. The definition of a hard landing in China is debatable. We think of it as roughly a 3% decline from the potential growth rate of the economy, similar to the decline to zero growth in the United States. This would equate to roughly a 6% level for a hard landing in China, in our opinion.

If China's gross domestic product (GDP) is still growing more than the 6%, what's the fuss? We want to redirect the conversation away from "China hard landing" to the "stall speed" concept, where growth slows enough to become self-reinforcing. While an imprecise science, particularly in an immature economy, it feels to us like we are hovering around stall speed in China, much like we are in the United States.

We believe more fiscal stimulus needs to begin quickly to stave off the economic downturn in China. China's response has been underwhelming thus far, either because growth hasn't fallen enough, aging demographics have resulted in slower tolerable growth, the desire to not repeat prior mistakes and bubbles, or a desire to prudently allow steam to come out of the economy as it transitions to a consumer-based economy. Regardless, slower growth is likely to be the new normal for the Chinese economy in our view, a concept with which markets are still grappling.

China's growth has global stock investment implications. Unrelated to economic growth, we believe the Chinese stock market has become less attractive over the intermediate term due to profit-reducing bank reforms, and the large weight of the financial sector in Chinese indexes.

However, we are still believers in the growth story of emerging markets (EM) as a group relative to developed markets. A more forceful fiscal stimulus in China has the ability to stimulate economic growth and stock performance in many Asian nations, which constitute the largest portion of the EM universe.

While a lot of negativity appears to be priced into EM stocks, the impact of the global slowdown is still being priced into developed market stocks, where earnings misses and negative stock reactions indicate that the extent of the weakness may not yet be priced in.

Lastly, we'd be remiss if we didn't mention nuggets of good news, including inflation falling globally, a change in attitude from austerity to growth, and global central bank easings. Our base case is a global slowdown, not a crash, and investment opportunities remain. Read more international research at www.schwab.com/oninternational.

Important Disclosures

The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States and Canada. As of May 27, 2010, the MSCI EAFE Index consisted of the following 22 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

The MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 27, 2010, the MSCI Emerging Markets Index consisted of the following 21 emerging-market country indexes: Brazil, Chile, China, Colombia, the Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

The S&P 500® index is an index of widely traded stocks.

Indexes are unmanaged, do not incur fees or expenses and cannot be invested in directly.

Past performance is no guarantee of future results.

Investing in sectors may involve a greater degree of risk than investments with broader diversification.

International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Investing in emerging markets can accentuate these risks.

The information contained herein is obtained from sources believed to be reliable, but its accuracy or completeness is not guaranteed. This report is for informational purposes only and is not a solicitation or a recommendation that any particular investor should purchase or sell any particular security. Schwab does not assess the suitability or the potential value of any particular investment. All expressions of opinions are subject to change without notice.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.