The Plight of the Conservative Retiree

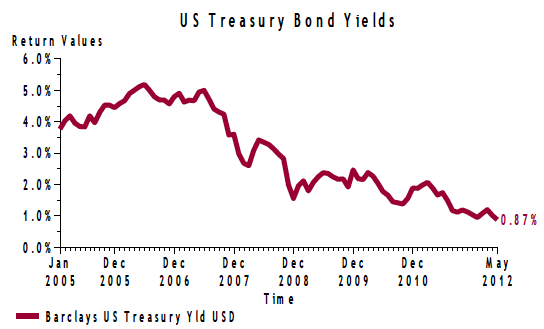

Only a few short years ago, investors demanded a 5.0% yield to invest in AAA rated US Treasuries. Those days are a distant memory. As illustrated below, the yield of Treasuriesi, now AA rated, plummeted to a miniscule .87% at the end of May. Market historians have to go back to World War II when rates were set by the joint agreement of the Federal Reserve and the Treasury Department to find rates so low.

There are a number of reasons behind this precipitous fall. Worldwide there is a growing scarcity of “safe” government bonds as runaway sovereign debt reduces the number of top rated issuers. It is easy to forget that the bonds of both Italy and Spain were once rated triple A by Moody’s. The ultra-low interest rate policy of the Federal Reserve as well as quantitative easing has been a critical factor. Heightened demand has also played a role. Since 2007, US investors have poured nearly a trillion dollars into bond funds, a pace over four times greater than the previous four years.

Today’s extraordinarily low rates on top of a lower equity premium leave conservative retirees with the risk of heightened capital depletion as poorer portfolio returns may be inadequate to offset the combined impact of withdrawals and inflation.

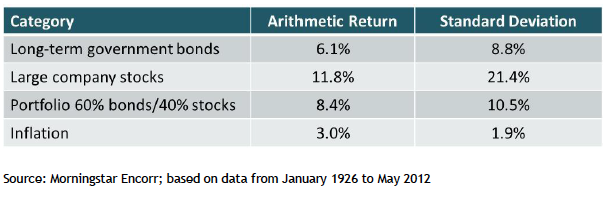

To illustrate the crucial significance of this issue, we analyzed a conservative balanced portfolio of $1,000,000 comprised of 60% US long-term government bonds and 40% US large company stocks. We assumed annual inflation-adjusted withdrawals are made equivalent to 4% of the starting portfolio value for a 30 year period – in other words, an inflation-adjusted annual income of $40,000 for three decades.

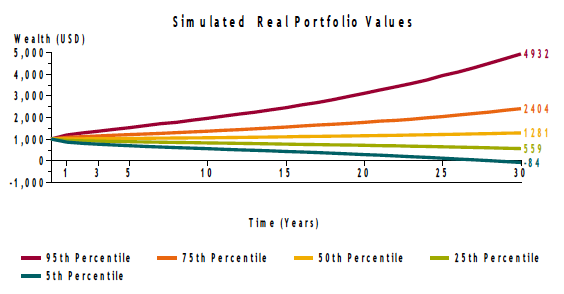

To establish a baseline, we initially analyzed this portfolio using historic returns and inflation (as detailed in Appendix I) and the 4% withdrawal rate. We ran 5000 simulationsii to calculate the expected real value of the portfolio. The following graph Illustrates the expected real value (in 000’s of $) of the portfolio over the next 30 years at different levels of probability - the 5th, 25th, 50th, 75th and 95h percentiles. All numbers are inflation-adjusted in 2012 dollars.

As shown above, an investor withdrawing an inflation-adjusted $40,000 annually has a median expected real portfolio value (i.e. at the 50th percentile in yellow) of $1,281,000 at the end of 30 years. In approximately 50% of future scenarios, they can expect their portfolio to fund their lifestyle and maintain its real value. Even at the 25th percentile (in light green), they never face the issue of capital depletion with an expected real portfolio of $559,000 at the end of three decades. Only at the 5th percentile (in blue) do they eventually deplete their portfolio and even here this does not occur until year 28. Roughly speaking, in this historically based example there is only about a 1 in 20 chance of an investor outliving their capital in the next three decades.

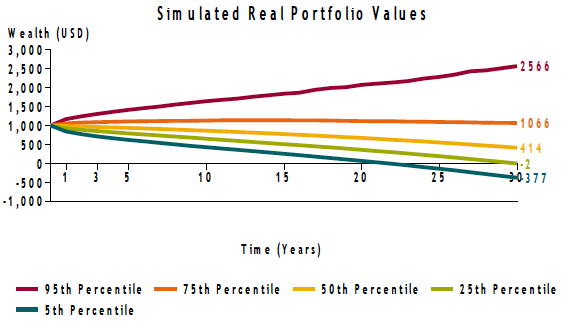

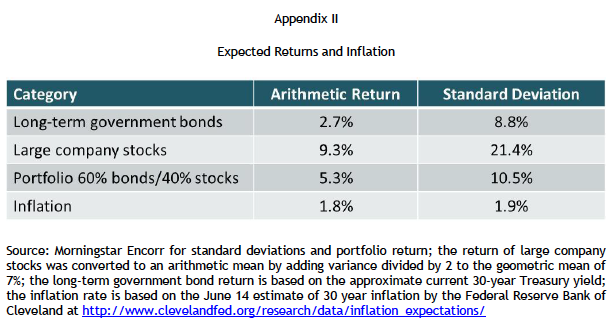

Unfortunately, given current bond yields and stock valuation levels, we believe that neither bonds nor equities offer the prospect of expected returns near historic rates. We therefore ran 5000 simulations using expected annual returns of 2.7% for bonds and 7.0% for stocks (see Appendix II for more details). The following graph Illustrates the expected real value of the same portfolio (in 000’s of $) over the next 30 years based on the 4% withdrawal at various levels of probability.

As illustrated above, there is a dramatic rise in the likelihood of capital depletion compared to the historic case. The probability of maintaining the portfolio’s real value at $1,000,000 is now at the 75th percentile instead of the 50th percentile. Capital depletion now occurs at the 25th percentile in the 30th year. In effect, the chance that an investor in this portfolio will outlive their capital over 30 years has risen to about 1 in 4 – dramatically higher than the historic odds of 1 in 20.

Investors are rightly concerned with today’s magnified economic uncertainty and market volatility. Conservative investors nearing or in retirement have a much greater challenge – unless they have a plan that accounts for today’s lower yields and expected returns, they may unknowingly exchange safety today for peril tomorrow.

Disclosure

Tacita Capital Inc. (“Tacita”) is a private, independent family office and investment counselling firm that specializes in providing integrated wealth advisory and portfolio management services to families of affluence. We understand the challenges of affluence and apply the leading research and best practices of top financial academics and industry practitioners in assisting our clients reach their goals.

Tacita research has been prepared without regard to the individual financial circumstances and objectives of persons who receive it and is not intended to replace individually tailored investment advice. The asset classes/securities/instruments/strategies discussed may not be suitable for all investors and certain investors may not be eligible to purchase or participate in some or all of them. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Tacita recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor.

Tacita research is prepared for informational purposes. Neither the information nor any opinion expressed constitutes a solicitation by Tacita for the purchase or sale of any securities or financial products. This research is not intended to provide tax, legal, or accounting advice and readers are advised to seek out qualified professionals that provide advice on these issues for their individual circumstances.

Tacita research is based on public information. Tacita makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to inform any parties when opinions, estimates or information in Tacita research changes.

All investments involve risk including loss of principal. The value of and income from investments may vary because of changes in interest rates or foreign exchange rates, securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time limitations on the exercise of options or other rights in securities transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Management fees and expenses are associated with investing.

Footnotes:

i The Barclays US Treasury Bond Index reflects the public obligations of the US Treasury with a remaining maturity of one year or more.

ii Morningstar Encorr was used to provide the historic return and inflation information and to model and simulate the hypothesized portfolio. Long-term bond and large company stock returns are from the Ibbotson series.