June 20, 2012

by Kathy A. Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research

Key Points

- The Fed voted to extend Operation Twist — the program where they swap short-term treasury securities for long-term—through the end of the year, as expected. They also indicated that they expect rates to remain “exceptionally low” through late 2014. But they left the door open to another round of quantitative easing if economic conditions warrant more action.

- Slower growth domestically and global financial market stress are the main reasons cited by the Fed for extending OT. Although the Fed indicated that the economy is still growing “moderately”, they noted the slow down in employment growth and consumer spending, as well as strains in the global financial system as reasons for the extension.

- Extending Operation Twist is likely to have a limited impact on the markets and the economy, in our view. It should continue to keep long-term interest rates low, which can help the housing sector, although the Fed does not intend to buy mortgage backed securities in this operation.

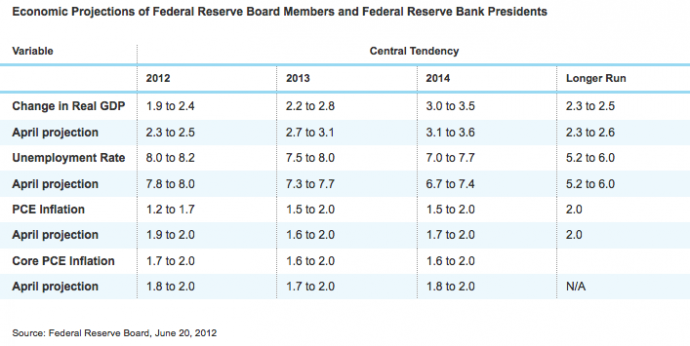

- The Fed's economic projections showed a minor downgrade to expectations for growth and inflation. While noting that they expect growth to remain "moderate" the Fed's future projections for growth and inflation were lowered slightly.

Less is More

The Fed's decision to extend OT was in line with consensus expectations, although the quantity of securities being shifted at $267 billion is smaller than the previous round that involved $400 billion in securities. The Fed will sell treasury securities with less than three years to maturity and buy those with more than six years to maturity. Since the Fed's balance sheet is already heavily weighted to longer-term securities, there isn't as much room to "twist" as there was in the first round. Since the size of OT 2.0 is smaller than the last time around and long-term interest rates are already near record lows, the impact on the economy may be limited.

Federal Reserve Maturity Distribution of Treasuries, Agencies, and Mortgage-backed Securities

Source Federal Reserve, as of June 13, 2012

However, even though extending OT may not have a big impact on the economy on the upside, it can help limit the downside. The Fed has accounted for over 50% of long-term treasury purchases under the first Operation Twist, so without the Fed in the market, other investors would need to step in. The Fed has made the argument that it is the stock of money that they hold, not the flow that matters. But we think the flow has helped hold down long-term rates as well. Keeping long-term rates low is intended to help the housing industry's nascent recovery and keep borrowing rates low for consumers and corporations.

Fed members also maintained their estimate that short-term rates would remain at zero until the end of 2014. However, they did note the recent slow down in the pace of job growth and consumer spending as well as declining inflation pressures. In fact, the Fed's projections for GDP growth, employment and inflation were downgrade from the April projections. Particularly disappointing was the Fed's view that the unemployment rate is not likely to fall below 7% between now and the end of 2014, which is less optimistic than the April projections.

In his press conference, Fed Chairman Bernanke left the door open to further moves by the Fed down the road. Given the uncertainties surrounding Europe's debt crisis, the recent sluggish economic data domestically, and the approach of the "fiscal cliff", it's not surprising that the Fed Chairman would want to keep the option open for further action — either more quantitative easing or a coordinated move with other central banks.

Lower for longer

The bottom line is that the Fed's move to extend Operation Twist gives the appearance that the central bank is buying more time before making a decision on further policy actions. Over the next few months, the markets face continued uncertainty about Europe's economic and banking problems, as well as potential fiscal tightening the "fiscal cliff" in the US at the end of this year. For now, they appear to have chosen to "do no harm" by keeping operation twist in place. However, the markets may be disappointed by the prospect of ongoing slow economic growth and interest rates that look likely to remain lower for longer.

Important Disclosures

This report is for informational purposes only and is not an offer, solicitation or recommendation that any particular investor should purchase or sell any particular security or pursue a particular investment strategy. The types of securities mentioned herein may not be suitable for everyone. Each investor needs to review a security transaction for his or her own particular situation.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. We believe the information obtained from third-party sources to be reliable, but neither Schwab nor its affiliates guarantee its accuracy, timeliness, or completeness.

Diversification strategies do not assure a profit and do not protect against losses in declining markets.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.