From John Goltermann of Overmeyer Asset Management

Volatility ≠ Risk

John Bogle, the founder and CEO of Vanguard Funds, appeared on CNBC a few weeks ago to be queried on the Facebook IPO debacle. In his interview, he provided a great nugget of wisdom with the following statement: “Betting on value is an intelligent way to own property as compared to trading in stocks.” During the interview, he also commented that there are way too many people speculating on price and very few who focus on value. As usual, John’s clearthinking conveys the right way to approach investing. We agree that value, or lack of value, is the true source of reward and risk.

Dramatic price moves and the substantial volatility of recent years is why many people struggle with the current market. Volatility understandably creates anxiety, especially with the cost of living rising as it is. Many would rather take a zero return in cash and bank deposits than be subjected to the emotional adversity of a negative month. This is a situation that will likely remain the case for some time, but this is also why values abound!

Let’s face it: downward volatility is really the only type that unnerves investors. Upward volatility is welcome all day long. While I ultimately want to focus on framing the reality of market volatility, it may help to provide some background on one of the major sources of its occurrence.

Joseph Schumpeter, an economist and political scientist, wrote that an economic “recovery is sound only if it does come of itself. For any revival which is merely due to artificial stimulus leaves part of the work of depressions undone and adds, to an undigested remnant of maladjustments, new maladjustment of its own…” These words cogently remind us that while government stimulus – through low rates or other measures – can help in the near term, ultimately it does not actually solve problems. It merely moves them around and defers them. It is important for investors to realize that many still look to the U.S. government to address the festering problems of high unemployment and declining competitiveness (the true legacies of excessive debt expansion), but they fail to realize that it was the government and the central bank that were largely responsible for those problems in the first place.

By providing stimulus after stimulus during periods when the system was trying to cleanse itself, needed adjustments were deferred to later periods and possibly even handed it off to subsequent generations. Today, the continued clamor for government solutions empowers Congress, the President and the Fed to try to tweak, minister, guide, cajole and jawbone the economy, making for a highly charged political backdrop and a very unpredictable, volatile investment environment.

Some may point to Wall Street as the source of today’s problems, but the truth is that banks simply acted on incentives that were put in place by Congress (through Fannie Mae and Freddie Mac), by the Federal Reserve (through monetary policy), by the Glass- Steagall Act of 1933 (which created the FDIC) and by the repeal of the provisions of the Banking Act of 1933 that limited affiliations between commercial banking and securities firms.

In the last 25 years, the government has done much to encourage private sector borrowing and relax regulation, and in the process has created a speculative economy with high debt levels.

Increasing debt levels was a politically convenient way to mask declining real wages and a way for people to maintain their living standards. While the government will likely continue to pick winners (speculators) and losers (savers), it can do very little to fix current imbalances or create a competitive economy.

For jobs, it can only hire people directly or encourage industries to expand through subsidies; but without offsetting tax increases, this furthers a rapidly deteriorating fiscal condition, which in turn impairs confidence. In a similar vein, trying to stabilize housing and improve wealth creation by holding interest rates too low simply encourages speculation to the peril of those who don’t speculate well and to the benefit of those who do. Actions have reactions, and not all of them are constructive.

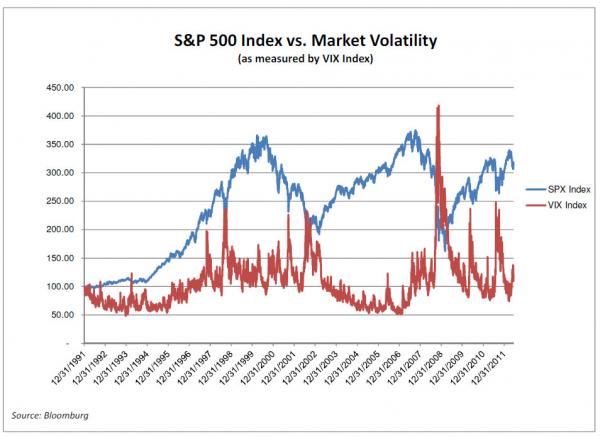

I could write ad nauseam about what’s happening in investment markets, but what should ultimately matter to an investor is “value” – that is, what is received in return for capital invested. Price volatility, which is independent of value, too often is regarded as something to be avoided. In fact, the best assets often have high levels of price volatility. Downward volatility itself causes a momentum effect of continued selling, which brings prices that make for attractive entry points. As the chart below indicates, high volatility (as indicated by the VIX index) occurs often at the moment of the lowest price (greatest value), and is coincident with the highest fear, lowest lagging returns and the best subsequent returns. While high volatility doesn’t predict future average returns, it can be a useful guide for productive investing.

This concept also applies to individual investments. Assuming the fundamentals of the investment haven’t permanently changed for the worse, great investments can be subject to significant downside volatility for no apparent reason and can stay below their value for long periods of time. This is what makes patience and focus invaluable attributes of successful investors.

Adverse markets come and go, as do market liquidity and confidence, but it is a universal truth that long-term investments (not speculations) are better made in adverse markets than in euphoric markets because good values are more pervasive. The question is not when and by how much something might go up, but what the risk is and how much you get paid to take it! And everything has risk of some kind, including cash and CDs; one just needs to pick the risks that are best to take.

What makes for a good investment is price. Price is everything. You need to receive value in excess of the price paid. An investment’s value is the amount of real cash its underlying assets can reasonably be expected to deliver to its shareholders in the future, discounted for its risk – period. The investment’s price will either be higher than its value (an uncompensated risk), the same as (neutral) or lower than its value (a compensated risk). But since value is an imprecise measurement, the best one can do is to build in a margin of safety by buying investments that are at deep discounts to a reasonable estimated value.

Too many investors let an investment’s short-term price movements, or perceptions of short-term price movements drive their decisions. But since short-term price moves are unknowable, irrelevant and independent of investment merits, this is not worthy of any time spent analyzing.

If short-term price moves were knowable, then a cadre of top-performing chartists and market technicians would have far greater net worths than Warren Buffett, Charlie Munger and the Saudi Royal Family. They would need only apply leverage to their process and repeat it a few times in order to accrue hundreds of billions of dollars. Question: How many market technicians occupy the Forbes 400? Answer: Zero. Why? Because successfully guessing future price moves based on charts, MACD indicators or tea leaves is not a repeatable process. Investors who do this generally have poor outcomes because they are pursuing answers to the wrong question.

The right question is: where is the value?

The Facebook IPO was a perfect demonstration of this. Many people bent over backward to procure shares in the offering because of the strong consensus that it was a one-way bet that would rise in price post-release. A month of television airtime was spent ahead of the opening trade talking about the IPO. The focus on price, without regard to value, cost many individuals and institutions significant amounts of capital.

This leads to the definition of risk. Unfortunately for many, the investment industry often operates on the premise that price volatility equals risk and is something to be minimized or avoided. This reflects faulty logic because price volatility is independent of risk. Seth Klarman of the Baupost Group properly defines risk as 1) the size of a potential loss and 2) the probability of its occurrence. He refers to losses of a permanent nature (not volatility-related), and I would add that they need to be measured in real (i.e, after inflation) terms. For example, cash has lost significant value through time as it is continually debased by the Fed.

Although cash experiences no price volatility, it is risky.

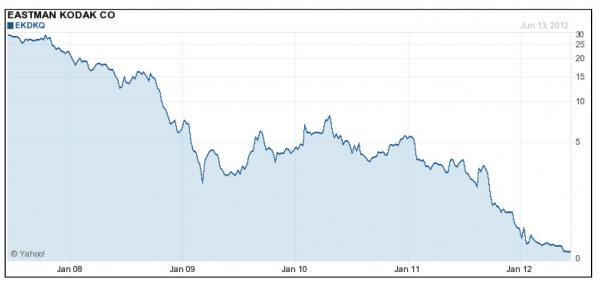

To illustrate what risk really is, consider the following chart:

Kodak cameras and film enjoyed product ubiquity at one time, but this didn’t prevent a 100% loss of capital for buy-and-hold investors who became complacent about the company’s dividend, management and/or the brand name. Ubiquity does not provide a margin of safety and great companies can see abrupt and permanent losses in their primary assets’ value. And if someone tells you that that can’t happen to certain companies, and gives you a host of reasons why not, put one hand over your wallet!

No level of financial analysis performed when business is good can tell you what will happen when a company’s assets begin to lose relevance or deplete. Kodak, RIMM, Nokia and a multitude of others, serve as cautionary tales as to what can happen to a business and its stock price when its intellectual property loses its usefulness. This is risk.

To avoid such risk, attention needs to be paid to price, and conservative assumptions need to be made to estimate value. This will go a long way towards stacking the odds in your favor of having successful outcomes over time, and can help relieve the anxiety that comes with gutwrenching market gyrations and gloomy projections of the future.

For today’s challenging environment, mental preparedness and a focus on what truly matters is paramount. While these are indeed tremendously tricky times to invest due to the macroeconomic and political factors that receive so much attention, these are also great times for those who have both capital and time and who focus on value. For those who speculate on price, these are perilous times because of the pervasive view that volatility is risk and the huge amounts of capital that is traded accordingly. Great assets bought well give comfort that no matter what prices do, there is something tangible and real that backstops the price and reduces risk.