by Guy Lerner, The Technical Take

In the weekly sentiment round up we noted the bull signal generated by the “dumb money” indicator, yet there was very little supporting evidence from our other measures of investor sentiment. Specifically, I stated: “the current extreme reading in the “dumb money” indicator is not supported by other measures of investor sentiment. For example, the Rydex market timers are still showing extremes in bullishness and in some sense, they have been unwinding their bullish positions over the past several months. By no means are they bearish, and this data series is looking more like a market top than a market bottom.”

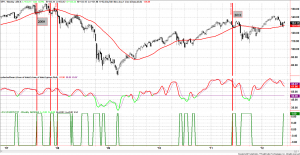

While the data is limited, it appears that the lack of consensus across all the sentiment data would suggest caution going forward, and that the current bull/ buy signal should NOT be honored. When it comes to market data and making decisions with your money, it is better to have more points of light shining on the issue. The “dumb money” indicator, which primarily uses opinion data, is showing modest extremes in bearishness. The Rydex data, which assesses asset flows and how investors are putting real money to work, shows too many bulls and has been more consistent with a market top. This discrepancy is shown in figure 1, a weekly chart of the SP500. The indicator in the middle panel is a ratio of all the assets in bullish and bearish Rydex funds. The indicator in the lower panel is an analogue representation of the “dumb money” indicator; when the indicator is up, there are too many bears, which is a bull signal.

Figure 1. SP500/ weekly

The red vertical lines are those times when the “dumb money” was bearish (i.e., bull signal) and the Rydex data did not confirm. While only 4 prior occurrences, they happen to be noteworthy. 3 of these occurred during the 2008 market top, and the fourth was just prior to the 2011 market swoon, which saw the SP500 drop 20% in 4 weeks.

top, and the fourth was just prior to the 2011 market swoon, which saw the SP500 drop 20% in 4 weeks.

In the final analysis, the lack of consensus amongst the sentiment indicators suggests caution, and based upon the limited observations, we can infer that deeper extremes of bearishness are needed prior to a tradeable rally.