Jonathan Tepper of Variant Perception (who co-wrote the book Endgame: The End of the Debt Supercycle and How It Changes Everything with John Mauldin) has produced a paper on the eurozone crisis called A Primer on the Euro Breakup: Default, Exit and Devaluation as the Optimal Solution (which you can find here). Jonathan is no lightweight in our industry and, in the paper, he sets out a compelling case in favour of a euro exit combined with a sizeable devaluation of the currency of the departing member country.

History is on Jonathan’s side.

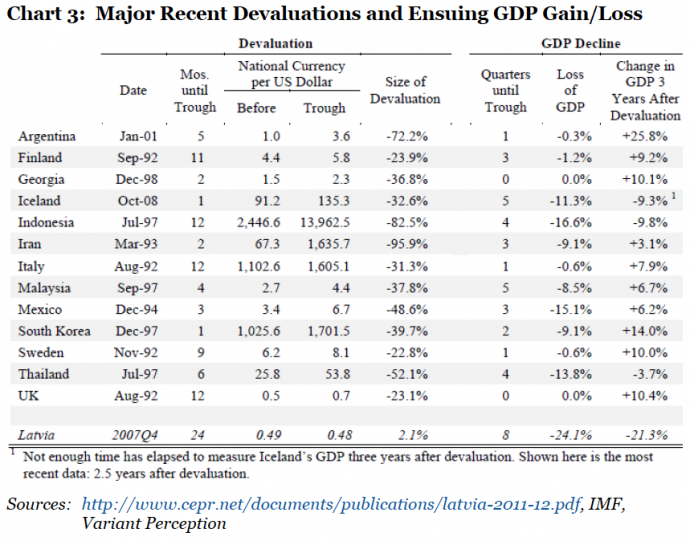

According to data from the IMF, the majority of large devaluations in recent years have had exactly the effect one would expect; economic growth was reinvigorated - if not immediately, then within 3 years of devaluing the currency (see chart 3). Economic growth is precisely what is needed around the Mediterranean. Austerity may bring you all sorts of things but certainly not economic growth.

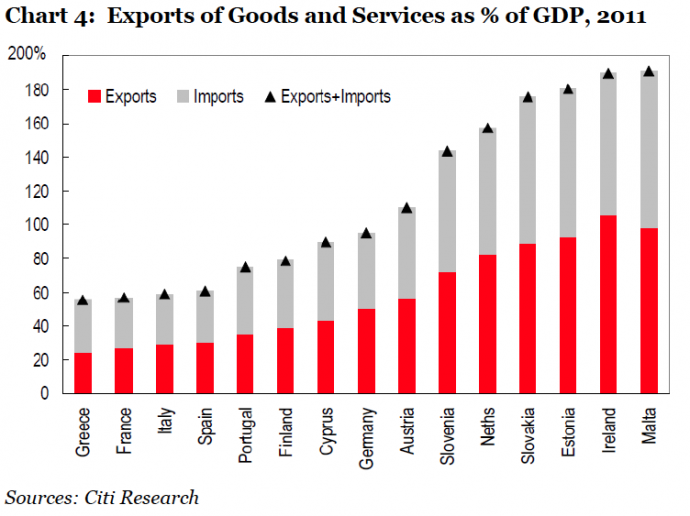

It is generally assumed that because the Mediterranean countries are all relatively weak export countries (see chart 4), an exit from the eurozone combined with a large devaluation of the re-introduced local currency would be of limited value to them. Furthermore, or so the theory goes, the problem is compounded by the fact that the main trading partners of Greece, Spain, Portugal and Italy are other European countries. What good would it do to devalue by 50% if consumer demand in the rest of Europe is so weak that the renewed competitive advantage cannot be capitalised on?

However, this argument sorely misses the point that Greece, France, Italy, Spain and Portugal all compete with each other for the global tourist trade and the first country to devalue its currency will be handed a monumental first mover advantage. I am writing these lines from Mallorca. As most readers will be aware, tourism is enormously important to the Spanish island. Summer hotel bookings in Mallorca are the strongest ever and up almost 15% over last summer. Apparently, during the peak of the summer holiday period, there is not a single bed available on the island.

The reasons are straightforward.

Bookings from France are strong because the Arab spring damaged the North African tourist industry, traditionally a big taker of French tourists. Bookings from Germany are up because no German in his right mind will go to Greece this summer. Last but not least, bookings from the UK are ahead of last year as sterling has strengthened meaningfully against the euro since last spring when bookings were made for the summer of 2011, showing the importance of exchange rates in the tourist trade.

I can only reach one conclusion.

If Germany doesn’t back off soon and relaxes its ‘Nein Policy’, it is only a question of time before one of the Mediterranean countries reaches the same conclusion I have come to, i.e. that life outside the union might in fact be better. And that country is not necessarily Greece.