by Douglas Coté, ING Investment Management

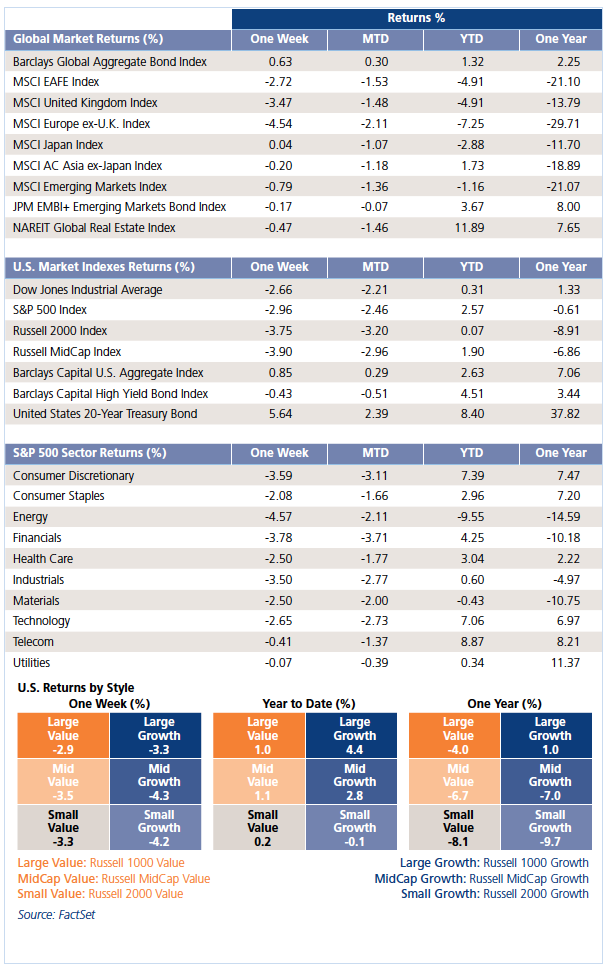

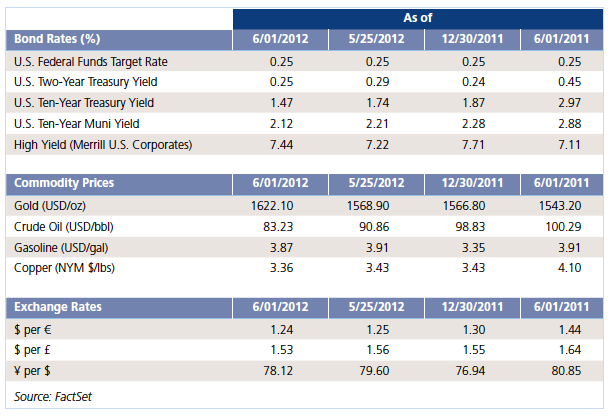

- Disappointing U.S. economic data combined with continued concern about the fate of Europe to send investors fleeing to safety. Global equity markets fell to finish off a brutal May, while benchmark tenyear U.S. Treasuries hit a new all-time low of 1.46%. The German two-year bond yield fell below 0%, meaning investors preferred a guaranteed loss to the uncertainties of holding other securities.

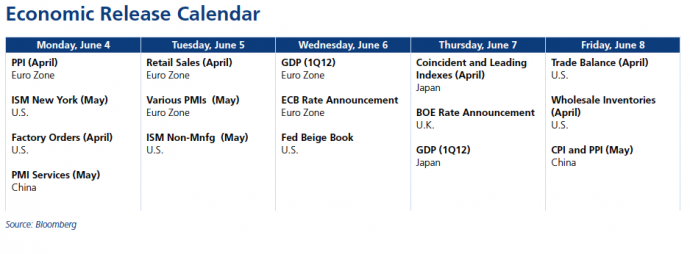

- First quarter economic growth was restated down to 1.9% from the previous estimate of 2.2%, as inventory building and government spending were markedly weaker than expected. Corporate profits, however, posted their largest quarterly gain since fourth quarter 2009.

- Jobs data were disappointing. Nonfarm payrolls came in at 69,000 for May, far short of the 155,000 economists had expected. Separately, ADP reported the addition of only 133,000 private sector jobs; the consensus estimate had been 150,000. New unemployment claims increased for the fourth consecutive week, while the unemployment rate rose from 8.1% in April to 8.2% in May. Median unemployment duration rose to over 20 weeks, with 43% of the unemployed out of work more than six months.

- Pending home sales in the United States unexpectedly fell to a four-month low, tempering some of the recent positive data in the housing market. Meanwhile, the Case-Shiller home-price index ended March at its lowest level since the housing crisis began.

- Though investors took comfort in a survey suggesting that Greece may be able to form a government following its June 17 elections and abide by its bailout plan, the situation in Spain grew more precarious, sending yields on Spanish debt close to euroera highs. Bankia, the country’s third-largest bank, has asked for government assistance to the tune of €19 billion, and a number of other banks are also thought to need recapitalization.

- The Indian economy grew at its slowest pace in almost ten years during the first quarter. GDP growth of 5.3% fell short of the consensus estimate of 6.1% as both the manufacturing and agricultural sectors foundered.

Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. Past performance is no guarantee of future results.

Copyright © ING Investment Management