by Gregory Hahn, Winthrop Capital Management

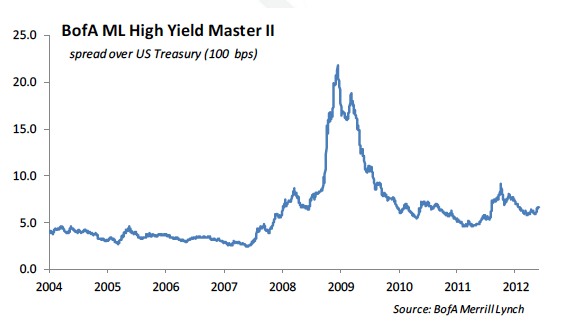

Valuations in the domestic high yield market appear stretched and we are concerned that opportunities for incremental return are fewer over a near term horizon. In this article we provide an analysis of the structure of the high yield market and a rationale for investing in specific short duration and callable high yield bonds which offer investors a better risk/reward trade-off in the current environment.

Following the Financial Crisis of 2008, the Federal Reserve implemented extreme monetary policies that were designed to protect the banking system, stimulate economic growth and keep the capital markets functioning. One of the intended consequences was that we have the lowest level of interest rates in economic history. This has allowed corporations that can access the capital markets the ability to refinance their debt at lower rates, therefore helping to cut interest expense and improving operating margins.

With interest rates on the ten year US Treasury note near 1.75% and spreads over US Treasuries for both investment grade and non-investment grade credits extremely tight, yields on corporate bonds of all sectors are low. For example, a recent issue of Kellogg’s 10 year notes came to market at a spread of +145 over

Treasury yields earning a yield of 3.23% for investors. One result of the Federal Reserve’s liquidity policies is that domestic companies are now operating at their lowest cost of capital in history.

As investors searched the landscape for yield over the past year, the high yield corporate sector has proven to be an excellent opportunity. High yield bonds offer investors a unique blend of income and price appreciation and are often considered less sensitive to changes in interest rates. As a result, high yield bonds often outperform investment grade bonds in periods of rising interest rates.

Structure of the High Yield Bond Market

The high yield market is estimated to be over $1.0 trillion in size having grown from an estimated $15 billion in 1980. In addition to the traditional buyers of high yield debt which include life insurance companies and mutual funds, hedge funds and Exchange Traded Funds are now significant buyers. Through mid May of 2012, mutual funds and Exchange Traded Funds combined reported a record amount of over $260 billion in assets according to Lipper Analytical Services.

The weighted average characteristics of the high yield market are masking some of the risks within the market. With a weighted average yield to worst of 7.23% on the Barclays High Yield Index (BCHYI) and an annualized total return of 16.5% over the past three years, it has consistently been one of the best performing asset classes according to data from Barclays Capital.