by Matt Tucker, iShares

A frequent question that I’ve been getting from our clients is around the outlook for high yield bonds. With record low rates creating an income challenge for investors, many are now willing to take on the extra risk involved in a high yield investment in order to potentially add yield to their portfolios – as evidenced by the $29.0 billion in flows into HY mutual funds and ETFs so far this year. Companies have responded to all this demand by issuing $115.1 billion in new high yield bonds YTD, with most of the proceeds going to refinancing existing debt or to fund general operations. But all this high yield hubbub begs the question: Is the high yield trade too crowded?

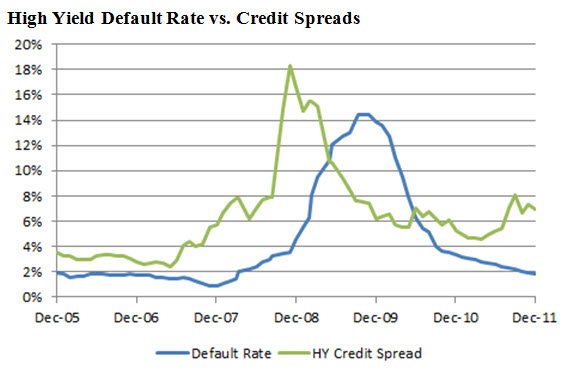

First, let’s review how much more room exists for positive returns. Almost half of high yield’s 4.55% year-to-date return can be attributed to coupon payments, while the remainder was due to capital appreciation from tightening HY credit spreads (currently hovering around 5.5% over US Treasuries, compared to their average level of 6% over the past 10 years). Today’s spreads are lower in part because the level of corporate bond default has been low, at around 2%. In fact, spreads have typically been 4-5% in similar favorable credit environments, so spreads are actually wide relative to the level of corporate defaults (see chart below).

So why are spreads higher than default rates would seem to suggest? The answer is volatility and uncertainty. The forward path of the US economy is still somewhat murky. Our view is that we will remain in a period of low but steady growth for a while, but there are risks that we could see another downturn. The European debt crisis is the other major market dynamic weighing on investors. As the crisis continues without a clear long term solution, investors are naturally more skittish. This skittishness, along with the concerns about the US economic outlook, results in investors demanding a higher level of yield for taking on high yield corporate bond risk. The extra risk premium is what is keeping credit spreads higher than the default outlook would suggest.

Overall, high yield spreads appear to be at a reasonable level, since investors are being paid both for the level of defaults as well as the level of global investment uncertainty. If you are an investor with a long-term time horizon and can handle some volatility, then high yield could still be an attractive place to invest. If high yield spreads reach levels seen in 2004-2006, the bonds could have additional capital appreciation. However, investors have to be aware that negative economic surprises, especially in the US or Europe, could impact prices along the way.

With all this discussion of high yield bonds, it’s important to think about the suitability of these investments in your portfolio. While HY experiences about half the volatility of equities, the bonds are still more volatile than investment grade bonds. However, with yield levels around 7%, yield-hungry investors may find them worth the risk.

Sources: Barclays Capital, Moody’s, Morningstar and Bloomberg as of 3/30/2012

Bonds and bond funds will decrease in value as interest rates rise. High yield securities may be more volatile, be subject to greater levels of credit or default risk, and may be less liquid and more difficult to sell at an advantageous time or price to value than higher-rated securities of similar maturity.