by Matt Tucker, iShares

Investors are spooked. They are so spooked that they are buying an asset that currently has a negative yield. What is the culprit causing so much concern? Curiously, it’s inflation. Investors appear to be so concerned about inflation that they are seeking protection against it without much regard to the cost of that protection.

This phenomenon is playing out in the market for Treasury Inflation Protection Securities, or TIPS. The US Treasury auctions TIPS securities every six weeks. In the last few auctions, the demand for TIPS by investors has been oversubscribed by almost 3X. All this demand for inflation protection has contributed to negative real yield level across the entire TIPS curve.

Why might investors be clamoring for inflation protection?

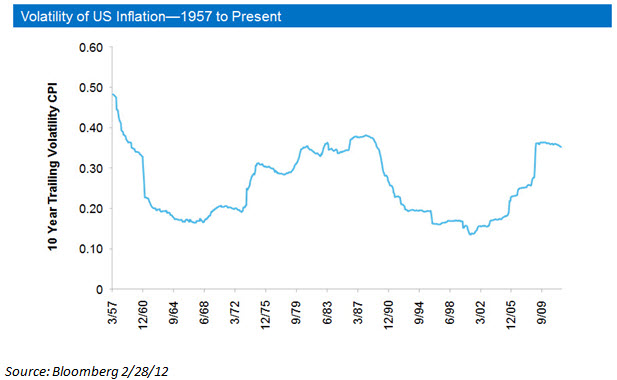

TIPS are the only financial asset that directly protects an investor’s principal from changes in realized inflation. While real estate and commodities are indirect means of inflation protection, the principal on TIPS adjust with changes in the non-seasonally adjusted consumer price index. But current levels of volatility are making it difficult for businesses and investors to know if this is a risk they should hedge. The uncertainty regarding the direction and impact of inflation is at 30-year highs. The chart below show the volatility of the CPI index over the past 50 years.

What is making this sudden increased demand for inflation protection so curious is that despite the rapid expansion of the money supply in the past four years, inflation has not gotten out of control. In fact a warmer winter caused deflation of 0.5% in the fourth quarter of last year as energy prices fell. While the money supply has increased as the Fed has injected liquidity, the weak economy and tight lending environment have not put upward pressure on prices. All this liquidity has not translated into current inflation.

For investors, having a strategic allocation to TIPS or the iShares Barclays TIPS Bond Fund (TIP) as part of an overall portfolio may be prudent. However, it might make sense to ask yourself what your view is on inflation before investing in TIPS. Negative real yields in this context may be viewed as the “cost” of realized inflation protection, so you should have a view on how long that cost will likely be incurred before the payoff in actual inflation occurs.

No matter what your view is on inflation, you can look at these signposts for keys to future inflation – bid-to-cover ratio at TIPS auctions, flows into TIPS investments like ETFs, monthly changes in the CPI and market expectations of future inflation through “breakeven inflation” levels (the difference between nominal and real rates). Hopefully these clues will give you some guidance on when to add inflation protection to your portfolio.

Bonds and bond funds will decrease in value as interest rates rise. TIPS can provide investors a hedge against inflation, as the inflation adjustment feature helps preserve the purchasing power of the investment. Because of this inflation adjustment feature, inflation protected bonds typically have lower yields than conventional fixed rate bonds and will likely decline in price during periods of deflation, which could result in losses. Government backing applies only to government issued securities, not iShares exchange traded funds.