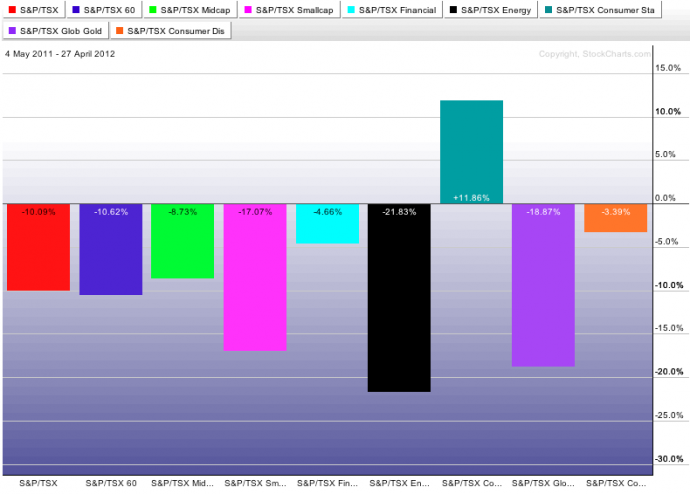

Performance of Key TMX Sub Indices - One Year (May 4, 2011 - April 30, 2012)

Source: StockCharts.com

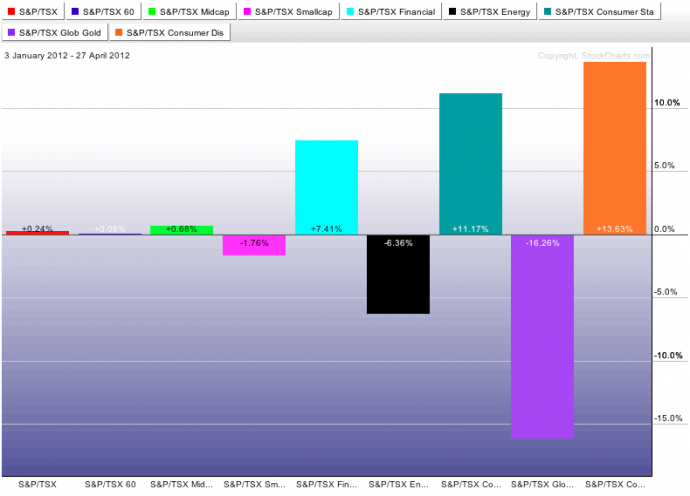

Performance of Key TMX Sub Indices - Year to Date (January 3, 2012 - April 30, 2012)

Source: StockCharts.com

Performance of Key TMX Sub Indices - One Month (March 29, 2012 - April 30, 2012)

Strengths

Home prices move higher in March - The Globe and Mail

Home prices crept higher in March as a slowing Vancouver market was offset by an acceleration in prices in Calgary, Toronto and Montreal, according to a report by the Canadian Real Estate Association. The MLS home price index was up 1.3 per cent in March on an month-over-month basis and up 5.1 per cent per cent compared with a year ago.

Canada March Industrial Product and Raw Materials Prices (Text) - Bloomberg

The Industrial Product Price Index (IPPI) edged up 0.2% in March, led by higher prices for petroleum and coal products. However, the advance of IPPI was moderated by primary metal products (-1.0%). The Raw Materials Price Index (RMPI) declined 1.6%, largely because of mineral fuels.

Weaknesses

Economy posts surprise decline in February - The Globe and Mail

Canada's economy shrank unexpectedly in February, by 0.2 per cent, as factories posted their first drop in output in six months, and mining activity plunged.

Canada Feb. Gross Domestic Product Report (Text) - Bloomberg

Real gross domestic product declined 0.2% in February. Temporary closures in mining and other goods-producing industries contributed to the decline. Decreases in mining and oil and gas extraction, manufacturing, utilities as well as forestry and logging outpaced advances in construction. In service-producing industries, gains in wholesale trade and in the finance and insurance sector outweighed declines in retail trade and in the transportation and warehousing sector.

Canada’s auto parts sector falling behind - The Globe and Mail

Despite a recent rebound in the auto industry, Canada’s auto parts manufacturers have fallen from the ranks of global top 10 exporters because they failed to diversify their markets. Canada’s auto parts sector is losing global market share because it has not found a way to tap into the rapid growth in low-cost locations, Bank of Nova Scotia economist Carlos Gomes said in a report on Wednesday.

Bank of Canada Won't Increase Rates, Stretch Says: Video - Bloomberg

April 30 (Bloomberg) -- Jeremy Stretch, head of currency strategy at Canadian Imperial Bank of Commerce, talks about the outlook for foreign-exchange markets and Bank of Canada interest rates. He speaks with Guy Johnson on Bloomberg Television's "The Pulse." (Source: Bloomberg)

Opportunities

Energy Transfer to buy Sunoco for $5.3-billion - The Globe and Mail

Pipeline operator Energy Transfer Partners LP (ETP-N48.320.400.83%) said it will buy Sunoco Inc. (SUN-N49.188.2720.22%) for $5.3-billion in stock and cash as part of its plan to focus on transporting more crude oil and refined products amid falling natural gas prices. Oil and gas production from shale formations in the United States has surged over the past two years creating a scramble to build infrastructure to get supplies to refining hubs.

Threats

Carney’s debt warnings at odds with monetary policy - The Globe and Mail

Canadians have never been as indebted as they are now. The Bank of Canada expects debt levels to eventually reach near 160 per cent of disposable income – the same level reached by Americans just prior to the crash. These debt warnings have been a constant in Mr. Carney’s public pronouncements over the past few years – just not in his actions. And nothing speaks louder than easy money. Low mortgage rates make larger and pricier homes accessible to more people, pushing home prices higher in a vicious cycle that may not end well.

Moody’s debt-rating downgrade sour news for Ontario - The Globe and Mail

Just two days after the McGuinty Liberals’ first minority government budget passed a crucial vote, one of the world’s major credit rating agencies downgraded Ontario, citing the province’s swollen debt burden and tough economic times ahead. Moody’s Investors Service’s decision Thursday to downgrade Ontario followed a stern warning and dimmer outlook issued one day earlier from Standard & Poor, another influential credit rating agency.

Loonie 6-Month Lead at Risk as First G-7 Rate Gain Looms - Bloomberg

The Canadian dollar’s reign as the best-performing major currency over the past six months is in jeopardy as rising consumer debt loads collide with plans by Bank of Canada Governor Mark Carney to increase interest rates.