by John West, Research Affiliates LLC

For most adults, the New Normal of their personal lives starts not long after saying “I do.” The habits, schedules, hobbies, possessions, and even relationships garnered over the past 10 or 20 years must be altered or outright replaced. Married life changes one’s priorities, and priorities change just about everything. Nowhere is this more evident than in the disappearance of free time. Building a new life together, it turns out, is quite the time commitment. For most men, the big game over the weekend is out—replaced by, paraphrasing Will Ferrell in the movie Old School, “a nice little Saturday” at the Home Depot to buy some wallpaper and flooring. For women, “girls’ night out” becomes a rare treat. Unless the new spouse can find more hours in the day, the discretionary time of our single years fades sharply.

Our 3-D Hurricane1—the interconnected influence of relentless deficits, soaring debt, and an aging demography—is creating a similar demarcation for investors. Old investing patterns—for example, tracking error to the ubiquitous 60/40 blend of mainstream stocks and bonds, the comfortable reliance on “first-world” developed markets, and conventional cap-weighted indexing—may not fit with our new investment priorities: more effective inflation protection, absolute returns and better Sharpe ratios, a greater emphasis on developing economies and markets, and so forth.

In this issue, we explore ways investors can make the break from the “mainstream” investing approaches to which they have become accustomed to approaches that will position them better for the future.

The Volatility of 3-D Hurricane Assets

It is a simple fact that mainstream stocks and bonds empirically do a very poor job of hedging against inflation, especially in the early stages of renewed inflation. It is also self-evident that stock and bond yields—especially in the United States—are both well below historical norms. For these reasons, we suggest that most investors begin building a “third pillar” to their stock and bond allocations. The third pillar would encompass a mix of real return investments. We also suggest that investors adopt a tactical asset allocation component to address the higher volatility and more frequent dislocations found in these asset classes.

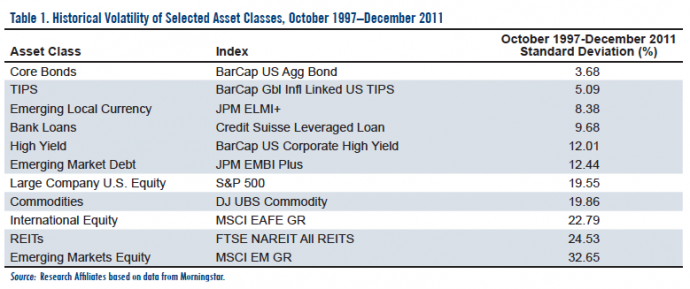

Our inflation fighting toolkit includes an array of assets that can shelter us from the growing 3-D hurricane.2 These include both the traditional real return asset classes (TIPS, commodities, and REITs) and a set of “Stealth Inflation Fighters” such as emerging market debt, high yield, and bank loans. Typically, the volatility of these asset classes is higher than mainstream stocks and bonds, as the highlighted lines show in Table 1. For many investors, these asset classes “feel” even riskier, due to their large “tracking error” relative to our classically invested 60/40 peers. After all, while no investor likes losses, there are few more lonely feelings than “wrong and alone,” as Peter Bernstein liked to say.

Given their credit exposure and in some cases currency and political considerations, it is not surprising that the income-oriented assets like emerging market debt, high-yield debt, and bank loans have higher volatility levels than a core bond portfolio. Even TIPS, immune to credit risks, have posted higher volatility than the BarCap Aggregate Bond Index. Likewise in growth assets, we find the upper end of the risk spectrum’s favored 3-D assets have higher risk profiles than mainstream stocks as measured by the S&P 500. Commodities, REITs, and emerging markets equities all provide additional incremental risk. If volatility is your currency, inflation protection is a pricey proposition.

We expect this trend to continue. None of these assets is as widely held as mainstream asset classes, and are among the first to be abandoned in times of crisis. These asset classes also represent much smaller markets in terms of total size, which makes them susceptible to trend chasing.

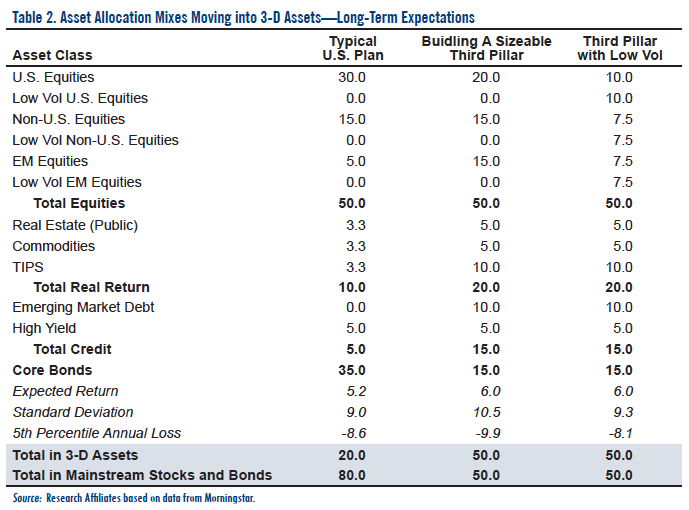

So, how much would volatility increase with the Third Pillar of real return assets? To estimate the increased volatility, we compare a “Typical U.S. Plan” with one that includes a third pillar of real return assets.3,4 The Typical U.S. Plan shown in Table 2 sports an 80% mainstream markets/20% Third Pillar split, and a projected long-term (10-plus years) volatility of around 9%—not all that different from the realized standard deviation of a 60% S&P 500/40% BarCap Aggregate Bond Index over the past 20 years. We contrast this with a 50/50 blend of mainstream and Third Pillar assets (labeled “Building a Sizeable Third Pillar”), which results in an annual portfolio volatility of 10.5% versus the 9.0% standard deviation level for the Typical U.S. Plan. To be sure, the Third Pillar assets have some diversification benefit, but their near-universal higher volatility levels still result in a 16% increase in total portfolio standard deviation.

When the overwhelming trend is to de-risk client portfolios, such an outcome would be unacceptable regardless of the perceived long-term benefits of such an approach. Even if the headline optics can be overcome, a poor start would likely doom such a strategy (and importantly the investment officer who recommended it!). This situation begs the question, “Can we reduce risk in other areas to allow us to spend more of our risk budget on these 3-D favored assets?”

Luckily, we see a spectrum of attractive options for investors concerned with volatility. As part of our ongoing work on alternative betas,5 we have devoted substantial time and resources exploring why low-beta stocks tend to generate higher returns than their high-beta brethren. Our research suggests that low-volatility strategies do indeed reduce risk and increase return, allowing them to be a critical component of an effective asset allocation for the challenging times ahead. Their potential role is reflected in the third column of Table 2. We’ll come back to this point shortly.

Enter Low Volatility Equity

A natural first step in any budgeting process is to examine the largest outlays for potential cuts first. Risk budgeting is no different. The vast majority of portfolios—pension, endowment, target maturity DC funds, and retail—are dominated by equity risk. Depending on the level of diversification, equity risk typically comprises between 90% and 99% of the total portfolio level of volatility.6 In our effort to “make room” in our risk budget, any reduction of equity volatility is a welcome first step, as long as we don’t have to forego our much-needed “equity risk premium.” At least historically, we don’t!

As you have probably noticed, the arena of non-price-weighted indices (also known as alternative beta) has become quite crowded since we introduced the Fundamental Index® methodology in 2005. Among the new entrants are a number of strategies targeting low-volatility stocks and/or minimum variance. The low-volatility strategies fall into two broad categories: (1) Optimized Strategies, which model expected returns, volatilities, and correlations of individual stocks (using a variety of statistical methods and risk models) to build a minimum volatility portfolio, and (2) Heuristic Strategies, which use rules to exclude high beta/high volatility stocks, and/or assign greater weights to lower beta/volatility stocks.

A detailed review of our research effort into the many flavors of low-volatility equity investing is well beyond the scope of this discussion, but we can highlight a few points here:

- Low-volatility strategies—both optimized and heuristic—produce returns 1–3% above their respective cap-weighted benchmark indices, using U.S. data back to the 1960s. International and emerging markets results offer similar gains over shorter stretches.

- Both Optimized and Heuristic approaches show very tightly clustered risk reduction, averaging about 25% less volatility than the cap-weighted benchmark (e.g., reducing volatility from 16% for the S&P 500 to about 12% for a low-volatility strategy).

- Nearly all methods tested produced sizeable tracking errors (8–10%) to cap weighting.

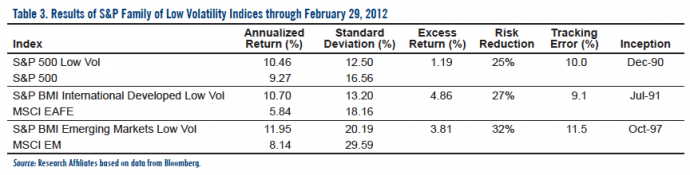

We can validate these findings by examining the published results of the S&P Low Volatility series, a heuristic-based approach that selects low beta stocks and weights them by the inverse of beta.7 Launched in 2011 with data backfilled to various start dates, Standard and Poor’s has a U.S., a non-U.S., and emerging market variant of the low volatility strategy.

As Table 3 shows, the S&P Low Volatility indices are consistent with our simulated research results. For the U.S. market, the S&P 500 Low Volatility Index produced an annualized return of 10.5% versus 9.3%. This 1.2% percentage point excess return was accompanied by a 25% reduction in portfolio volatility (12.5% versus 16.6%). The non-U.S. and emerging markets low-volatility strategies produced even better risk-adjusted results. And, consistent with our research, the tracking errors for all of these indices are very large—9% to 11%.8

Of course, the traditional backtesting caveats apply to these results, especially in the case of low volatility strategies spanning a decade dominated by the bookend bear markets of the Tech Bubble and Global Financial Crisis. On the opposite side of the ledger, the excess returns for the low-volatility strategies are very similar to other non-price-weighted indices over the same time periods. If such disparate weighting methods as the Fundamental Index methodology and equal weighting produce similar excess returns, then an excess return from weighting by the inverse of volatility should have a similar expected result. Shocking to the casual observer, high-vol and low-vol both beat the market, by comparable margins, as long as the portfolio weights are indifferent to price!

Of course, we are comparing paper portfolios that do not reflect the real friction of transaction costs and market impact. In the real world, these costs are significant and investors should take steps to minimize them. Therefore, an efficient low-volatility equity portfolio ought to:

- maximize liquidity,

- minimize turnover, and

- maintain some semblance of economic representation.

In addition to these portfolio attributes, the construction methodology should be easy to understand and replicate, given the proclivity of passive investors for simple and transparent solutions. Our research has indicated that the current low-volatility indices all fall short on one or more of these goals, so they arguably cannot be used as core strategies.

Putting it Together

A 25% reduction in equity volatility is meaningful. If we can save that much with our dominant total portfolio risk contributor, we should have the risk budget to include higher-risk real return asset classes, right? The answer is “yes,” as we show in the third column of Table 2 (Third Pillar with Low Vol). Here, we replace half of each equity exposure with a comparable low-volatility exposure. Consistent with our empirical findings, we assumed each low-volatility equity strategy would outperform its cap-weighted counterpart by 1% per annum.9 We also assumed the low-volatility strategies would produce volatility levels 25% below that of the cap-weighted portfolios.

Overall, for the Third Pillar with Low Vol option, portfolio volatility declines to a similar level as the Typical U.S. Plan while expected return increases by 80 basis points to 6% per annum. To be sure, this return estimate still falls short of, and in some cases well short of, investors’ targeted returns, which are typically in the 7–8% range.10

Naturally, as with any “new” idea, there will be early critics aplenty. “It’s just a backtest… past is not prologue” or “it’s just a clever repackaging of Fama–French.” But this is not a “new” idea; Low Volatility was touted by Bob Haugen11 20 years ago. And “past is not prologue” has been used to dismiss ideas throughout history—some prematurely.

Regardless of the criticisms, low-volatility equities have important asset allocation implications for investors, especially when the traditional anchor to windward for most U.S. investors—U.S. Treasuries—sport dangerously low yields and rising credit concerns. We think it merits serious consideration.

Conclusion

While my personal experience of hurricanes is fortunately minimal, one nearly postponed my own 2006 nuptials in Baja, California. While we spent a few days fretting, the storm passed with minimal damage a day before the guests began to arrive. Not long after, like many new husbands, it didn’t take long for me to realize that life, as I knew it, had changed. Rest assured, the changes are for the better, but married life was still an adjustment for me—the big screen TV still called on Saturdays! But the miracle of TiVo and the digital video recorder eased the transition.

Today’s investors similarly are confronted with a future that will be different from everything they’ve grown accustomed to over the past 20 or 30 years. As they look to change priorities with relatively constrained risk budgets, we assert that low-volatility equities, like my DVR, can help ease the transition. By no means can they miraculously solve all of investors’ dilemmas, but they can be a simple and low cost tool to effectively broaden diversification and risk posture in the decades ahead. We look forward to sharing more of our research into this investment approach in the coming months.

[Download PDF]Endnotes

1. We have written extensively about the rising threat of soaring debts and deficits and worsening demographics for developed markets. For example, see Fundamentals from November 2009, August

2010, and October 2011. This is correctly seen as the other side of the coin described in PIMCO’s “New Normal.”

2, See “A Complete Toolkit for Fighting Inflation,” Fundamentals, June 2009.

3, The “Typical Plan” was defined using a study of public funds published for the California State Association of County Retirement Systems (SACRS).

4. We list a toolkit of liquid asset classes and deliberately excluded hedge funds, owing to the difficulty of forecasting a return for the asset class.

5. See Tzee-man Chow, Jason Hsu, Vitali Kalesnik, and Bryce Little, 2011, “A Survey of Alternative Equity Index Strategies,” Financial Analysts Journal, vol. 67, no. 5 (September/October):37–57. The article

was selected by The FAJ Advisory Council and Editorial Board as a Graham and Dodd Scroll Award winner. The article also won the FAJ’s Readers’ Choice Award.

6. Skeptics should try this themselves with the classic 60/40 portfolio. A passive portfolio invested 60% in the S&P 500 and 40% in the Barclays Aggregate has a correlation of about 99%,

when compared with the S&P 500 over the past 10, 20, 30, and 40 years. The bonds mostly offer risk reduction, with precious little diversification.

7. See S&P Low Volatility Index Methodology: http://www.standardandpoors.com/servlet/BlobServer?blobheadername3=MDT-Type&blobcol=urldata&blobtable=MungoBlobs

&blobheadervalue2=inline%3B+filename%3DMethodology_SP_Low_Volatility_Indices_Web.pdf&blobheadername2=Content-Disposition&blobheadervalue1=application%2Fpdf&

blobkey=id&blobheadername1=content-type&blobwhere=1244081870056&blobheadervalue3=UTF-8

8. Brennan and Li (2008) posited that the low-volatility outperformance anomaly will be hard to arbitrage away because many institutional investors have benchmarking constraints to minimize tracking

error and so must own higher beta, lower returning stocks.

9. Note, we believe this is a conservative estimate; 1% is at the low end of the empirical results range and is also below the live results of popular non-price weighting methods such as the Fundamental

Index methodology and equal weighting.

10. For more on building a portfolio with a better chance of achieving expected return assumptions, please see our October and November 2010 Fundamentals, “Hope is Not a Strategy” and “The Glad Game.”

11. Former finance professor and head of Haugen Custom Financial Systems.