by Ravi Mattu and William G. De Leon, PIMCO

- Duration is often used as a shorthand way to communicate the interest rate risk of a fixed income portfolio. It is important to note that this sensitivity measure is related to, but not identical to, a security’s or a portfolio’s expected volatility.

- We frequently encounter duration quotations presented as though no subtleties exist. These quotations average duration exposures across maturities and across currencies, implicitly assuming that yields across maturities and currencies are equally volatile and perfectly correlated.

- We approach the task of understanding interest rate risk with a more complete view of the risk dynamics driving interest rate sensitivity.

Duration, or the sensitivity of an investment to interest rate levels, is the single most important risk metric for a fixed income portfolio. It is important to note that this sensitivity measure is related to, but not identical to, a security’s or a portfolio’s expected volatility. Yet even though textbook treatments of duration present it as a simple, unambiguous concept, in fact numerous factors influence interest rates and hence the measurement of “duration” can be nuanced.

Two factors contribute to this complexity. First, the measurement of an individual security’s interest rate sensitivity may depend upon complex valuation models that are approximations to the actual economic value delivered by the security. Second, for portfolios that are exposed to multiple interest rates across both the maturity spectrum and different currencies, quoting a single “duration” requires balancing the relative volatility and correlation among these interest rates.

Despite these nuances, we frequently encounter duration quotations (for example, published durations on fixed income benchmarks) presented as though no such subtleties exist. These duration quotations average duration exposures across maturities and across currencies, implicitly assuming that yields across maturities and currencies are equally volatile and perfectly correlated. Additionally, securities with credit risk are often treated as having no default risk when calculating duration.

These assumptions are what economists call heroic, and while they may facilitate coming to a single quoted figure for interest rate risk, they are not the whole story. At PIMCO, we approach the task of understanding interest rate risk with a more complete view of the risk dynamics driving interest rate sensitivity, and we encourage our clients and other investors to do the same.

Our approach aims to incorporate sophisticated security valuation analytics drawing on our proprietary research on interest rate dynamics, mortgage prepayments, defaults, and other factors determining security cash flows, as well as empirical research into the relative volatility and correlations among interest rates across maturities and currencies. To be sure, the markets are dynamic and we dynamically revisit our own methods to find better ways to measure and manage risk for our clients and their portfolios. While we are always striving to provide better metrics, we recognize that a number of these advances depart from industry conventions. Looking at the portfolio through a prism that breaks the risk into finer gradations adds to our understanding and ability to manage risk, but we still maintain more traditional measures in our systems for comparability with other sources and for those clients who match fixed income assets to liabilities calculated using more traditional methods.

The factors cited above may be understood as corresponding to, in the first place, a subtlety related to the proper measurement of security-level interest rate sensitivity, and in the second, a subtlety related to the proper estimation of portfolio risk.

- Interest rate sensitivity: Given a specific mathematical model of security cash flows and capital market variables such as interest rates, the measurement of a security’s interest rate sensitivity is, indeed, an unequivocal mathematical exercise. But the specification of the mathematical model for security cash flows and capital market variables is a highly non-trivial task. Different market participants make different choices about modeling callability; prepayment behavior; the likelihood, timing, and payoffs associated with corporate defaults; and interest rate volatility, to name only a few variables that enter the equation.

- Portfolio risk: If interest rates were all perfectly correlated and equally volatile, then the average of security-level interest rate sensitivities would provide a good representation of interest rate sensitivity for portfolios. However, because interest rates are imperfectly correlated and differentially volatile, the notion of “interest rate sensitivity” of a portfolio is a subtle concept. By interest rate sensitivity, should we mean the interest rate sensitivity of the portfolio to a change in the five-year U.S. Treasury yield, to the 10-year Treasury yield, to the 10-year bund yield, or to something else? At any particular time, these yields move by different amounts and may move in different directions – what is the “correct” interest rate sensitivity of a portfolio with exposure to all of them?

We do not mean to imply that there is absolutely no consensus on these points in the market. Indeed, academics and industry practitioners agree broadly that duration should reflect the factors we have named: callability, prepayments, defaults, and interest rate volatility, along with other factors. Academics and practitioners also certainly agree that global yield curves and yields of different maturities are imperfectly correlated and differentially volatile. However, the consensus falls far short of specific agreement upon or synchronization of the details or the models used, and the differences, in some cases, are large enough to create substantial differences in stated durations.

Duration isn’t so simple

Duration is often used as a shorthand way to communicate the interest rate risk of a fixed income portfolio. Textbook duration is defined as the percentage change in the price of a portfolio for every 1% (100 basis points) change in all interest rates. If the entire yield curve were to move in parallel – along with global yield curves moving in tandem – and the timing and magnitude of cash flows were known, then duration would be an unambiguous measure of effective interest rate exposure. This measure does not account for initial conditions and allows for negative yields. While the market has occasionally observed negative yields, most market participants consider zero the lower bound and calculations which use negative rates may be misleading in determining rate sensitivities.

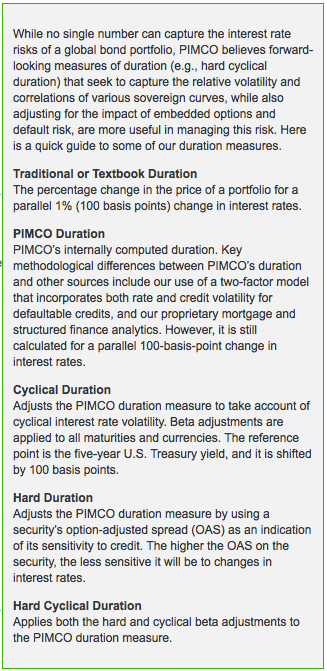

Furthermore, all interest rates are not equally volatile, and bonds have both embedded options and default risk. At PIMCO, we adjust for these effects by modifying the traditional measure of duration in an effort to more accurately convey the interest rate risk of a bond or portfolio.

Some of the most important factors that PIMCO considers in assessing the interest rate exposure in the context of variable interest rate volatility and default risk are:

- Bonds with default risk have a shorter duration than that implied by their stated maturity. It would be naive to assume that a portfolio of bonds issued by highly levered companies would earn the promised yield with certainty. An analogue to this is that the effective maturity of a credit portfolio may be shorter than its stated maturity because some of the bonds will default (with investors receiving the recovery amount). The higher the default risk of a portfolio, the more what we refer to as traditional duration will overstate the interest rate risk.PIMCO uses a two-factor model of rates and spreads to estimate the interest rate sensitivity of corporate bonds, Build America (municipal) Bonds and bank loans, as well as foreign-currency-denominated bonds of emerging market sovereigns. Default rates are imputed from current spreads, and the default-adjusted duration is calculated on these expected cash flows, not on the promised cash flows.PIMCO’s standard duration uses this model in computing security- and portfolio-level durations as we believe it is a more accurate measure of the overall sensitivity of credit-based securities to changes in rates. PIMCO durations may differ from other vendors’ calculations as a result.

- Yield volatilities of various maturity government bonds are not equal. With central bank policy rates extremely low, the short end of government yield curves are close to the zero bound in many countries. Since the Federal Reserve in early August 2011 said it would not raise rates until at least the middle of 2013 (and in January 2012 said it would hold rates low until late 2014), the two-year Treasury rate has exhibited almost zero volatility, while the five-year yield has been 75% as volatile as the 10-year yield. Conventional measures of duration will overstate the volatility of short-maturity bond portfolios relative to longer-maturity portfolios.PIMCO’s measure of cyclical duration adjusts for the relative volatility of various maturities by assigning a yield beta to various parts of the Treasury curve based on our forward-looking estimate of their volatilities. We use the five-year point of the U.S. curve as a reference point. Therefore, our cyclical duration measures the projected percentage change in the portfolio for a 100-basis-point move in five-year U.S. Treasury yields, while accounting for the varying levels of volatility across the curve.

- Yield volatilities of sovereign curves are not equal. Just as short rates are currently less volatile than long rates, yields on similar-maturity government bonds vary across the world. Simply aggregating security durations to measure interest rate risk across countries implicitly assumes that yields across the world are equally volatile and perfectly correlated. This is clearly not the case even for countries with close trade linkages, similar monetary policies and very little sovereign risk. For instance, Japan has historically had lower inflation than the U.S. and does not need overseas investors to purchase its debt. Consequently, Japanese government bond yields are lower and less volatile than yields on comparable-maturity U.S. government bonds. In 2011, Japanese government bond yields (for maturities exceeding five years) exhibited approximately 20% of the volatility of U.S. Treasury yields. Thus, traditional duration will overstate the volatility of a yen- vs. a U.S.-dollar-denominated duration fixed income portfolio.PIMCO estimates yield betas of yield curves in all currencies relative to the five-year point of the U.S. sovereign yield curve. These betas are then used in calculating the movement in country-specific rates relative to the U.S. For some sovereigns with significant default risk, these betas can even be negative. The cyclical duration of a global bond portfolio estimates the return volatility for a 100-basis-point change in five-year U.S. Treasury yields.

- Credit spreads tend to be negatively correlated with rates. The empirical duration of corporate bonds tends to be even lower than that suggested by the model. The risk-on/risk-off mode in which the markets have traded recently has accentuated the effect of this negative correlation between rates and spreads. PIMCO uses the option-adjusted spread (OAS) of a security as an indicator to determine the forward-looking correlation between rates and spreads. The hard duration of a portfolio estimates the return volatility for a 100-basis-point change in yields assuming that spreads are negatively correlated with rates.

In addition to these factors, PIMCO also combines the concept of cyclical duration and hard duration into a single measure which we refer to as “hard cyclical duration” (see term definitions in sidebar). This measure incorporates both the concept of forward-looking sensitivities of yield curves and the sensitivity of credit spreads to rates.

Duration takeaway

In comparing portfolio risk to its benchmark, investors should ensure that they are using consistent measures. Further, in the current environment of extremely low global policy rates and the emergence of sovereign risk in developed economies, some traditional measures of risk may have lost some of their usefulness in the risk management of portfolios.

PIMCO’s investment process seeks to ensure that changing macroeconomic conditions are reflected in both portfolio construction and risk management.

The authors would like to thank Peter Matheos, Riccardo Rebonato, Susan Wilson, Roger Nieves and Barbara Callao for their many valuable suggestions and comments.

All investments contain risk and may lose value. This material contains the current opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Pacific Investment Management Company LLC. ©2012, PIMCO.