by Richard Shaw, QVM Group

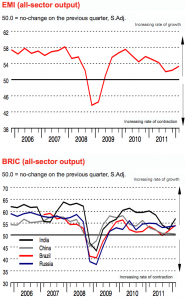

HSBC Emerging Markets PMI Index rises to 53.4 from 52.4 for 2012 Q1

Stephen King, HSBC’s Chief Economist, said:

“The latest HSBC EMI underlines the relative immunity of emerging nations to the economic permafrost of the developed world. Emerging nations still have many years of economic “catch-up” ahead of them, suggesting that their growth rates – driven by continuous urbanisation alongside productivity gains linked to improved access to global capital – should remain significantly higher than in the west. They also have considerably more policy ammunition to deploy, including rate and reserve ratio cuts and, if necessary, fiscal stimulus.

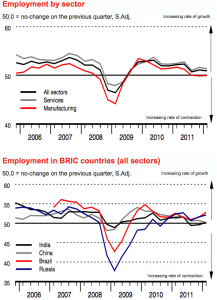

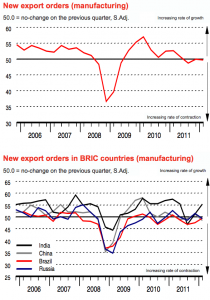

Despite two successive quarters of strength, EMI remains at a relatively low level, thanks largely to further deterioration in Chinese export orders but also domestic demand as a result of attempts to tame inflationary pressures through quantitative tightening. Emerging market inflation has generally eased outside India, despite the return of higher oil prices, and policymakers are returning their focus to promoting growth over limiting inflation.

Emerging nations still have to balance the risks of too little growth against the threat – if not yet the reality – of commodities-driven inflation. But the outlook remains encouraging with China, India, Brazil and Mexico all set to be top ten global economies by 2050.”

source: HSBC Emerging Markets Index 2012 Q1