by Douglas Coté, ING Investment

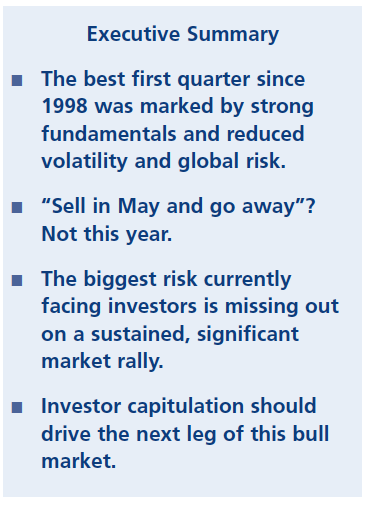

We just wrapped up the best first quarter since 1998, volatility has dropped to almost boring levels, fundamentals are relentlessly marching forward and global risks appear to have returned to a morenormal state.

We just wrapped up the best first quarter since 1998, volatility has dropped to almost boring levels, fundamentals are relentlessly marching forward and global risks appear to have returned to a morenormal state.

To the astonishment of the bears, volatility, inflation and global risk are down while profits, employment and manufacturing are up — and markets have been gaining momentum with an aura of sustainability. Could it be that the vicious cycle of the past few years has been broken? Could we have entered into the type of virtuous cycle in which positive data beget more positive data, as has marked prior sustained bull markets?

“Sell in May and go away” and other bear strategies that have worked in prior years will likely be ineffective this year, driven in large part by strong fundamentals and global risks that have been excessively discounted.

Fundamentals Remain the Key to Market Success

Our “ABCDs” of fundamentals are the primary drivers of markets but have been slow to capture investor attention. This oversight has created an investment opportunity given the compelling strength in all of these drivers.

Advancing corporate profits. Fourth quarter earnings season started with a few significant misses and a lot of handwringing in the media before momentum ultimately picked up, driving double-digit year-overyear earnings growth. Sales growth was not too shabby either, with top-line revenue growth of 8.3%. The media may lament the deceleration of earnings growth, but we are, after all, continually setting the bar higher — corporate earnings reached an all-time high in 2011, and we expect a new record in 2012.

Broadening manufacturing. U.S. manufacturing has reemerged as a powerhouse, with the ISM manufacturing index expanding for 31 consecutive months. Who says “made in the U.S.A.” is fairytale of yore? Despite the rise of China and other emerging economies, the U.S. still contributes 20% to the world’s manufacturing pie; if the U.S. manufacturing sector was a country, it would be larger than Canada, India or Russia. The emerging countries have been playing catch-up, but as their wage levels increase and their productivity levels tail off, their advantage markedly decreases. Couple that with the fact that the U.S. is number one in productivity, and we say “game on”.

Manufacturing powers the entire economy

— the Bureau of Economic Analysis calculates that every $1 of manufacturing GDP drives an incremental $1.42 of economic activity in nonmanufacturing sectors.

Consumer strength underestimated. A variety of data points suggest the consumer is emerging as a game-changer. The unemployment rate, at 8.3%, is at its lowest level in three years, and the leading employment indicator, initial unemployment claims, are at 2008 lows. While high gas prices may take a bite out of consumer paychecks, it is more important that consumers are actually receiving paychecks. Personal income and personal consumption expenditures have reached all-time highs. February retail sales again surpassed the $400 billion mark to reach the highest monthly level ever. Even housing has shown signs of life, with the best January/February in five years.

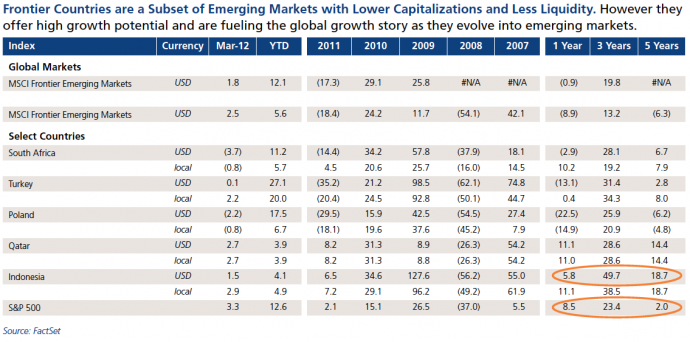

Developing economies are driving global growth. Emerging markets continue to be a key catalyst for U.S. corporate revenue. With signs of a potential hard landing in China, there are concerns that weakness in this important corporate growth catalyst may put the bull market in jeopardy. No way — any slowing in China and other emerging markets will be picked up by the “frontier” or newly emerging markets. Indonesia is a good example. Indonesia, the fourth most populous country in the world, recently made headlines when its sovereign debt was upgraded to investment grade. But other good news abounds for the archipelago.

Indonesia is the largest economy in Southeast Asia and grew by 6.5% in 2011, the fastest pace in 15 years. Although 60% of their GDP is fueled by emerging middle-class consumers, Indonesia is also basking in the light of global trade as a large exporter of oil, natural gas, coal and palm oil, and it is home to the second-largest copper mine in the world.

Global Risks Continue to Wane

Europe’s PIIGS (Portugal, Ireland, Italy, Greece and Spain) remain in the news — the latest speculation is that Spain will need bailout funds to effectively recapitalize its banks. We agree. Spain is no Greece, however, and has taken strong austerity measures to contain its crisis. Spanish Prime Minister Mariano Rajoy recently announced €27 billion in budget cuts in a bid to convince the troika of the European Commission, European Central Bank and International Monetary Fund that Spain has its house in order. Alas, these troubled European countries have tended to underestimate their problems, while the market tends to overestimate their impact on the global economy with excessive worry.

The worry is unjustified. The effective fence around the European debt crisis was further bolstered at the end of March with a €700 billion boost to the permanent €500 billion European Stability Mechanism (ESM). This latest round of funding, while maybe not as ambitious as some would have liked, proves that European leaders are willing to do whatever it takes to stem the tide of contagion. Additionally, as the firewall around Europe gets stronger, it opens the door for the IMF to step in, as other countries have pledged to help contain the crisis if Europe takes those first concrete steps.

Why a Market Rally Is a Risk

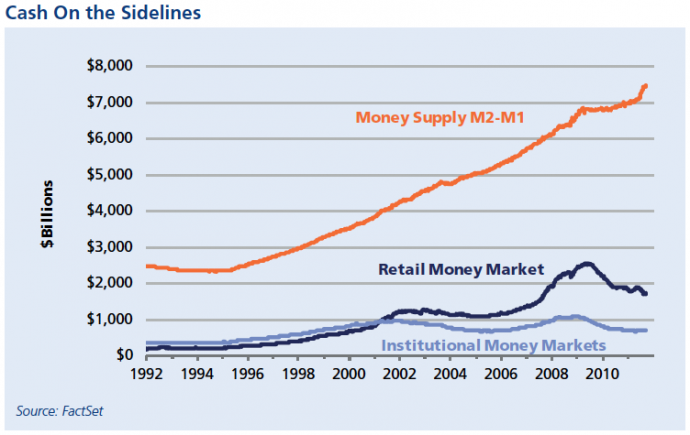

There is a bigger risk looming on the horizon, bigger than all of the global and geopolitical risks omnipresent in the media. The biggest risk facing investors is a sustained, pronounced U.S. market rally — while they continue to watch from the sidelines. As equity markets move higher month after month, there remains a cadre of wouldbe investors sidelined by lingering fears of an event — i.e., the 2008 Credit Crisis — that has been over for three full years.

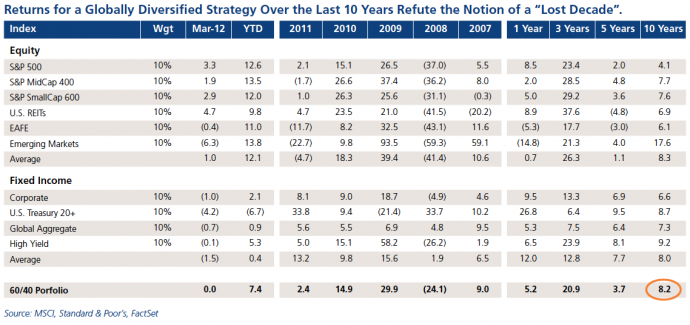

We get it: The credit crisis was the worst market disaster since the Great Depression. But since March 2009, the market’s postcrisis bottom, investors have missed out on double-digit equity and fixed income returns; in fact, the S&P 500 has returned almost 100% since March 2009. Many investors have downgraded themselves to “savers” by cowering in cash — $7.5 trillion to be exact

— as they wait for the dust to settle, missing a golden opportunity to build wealth.

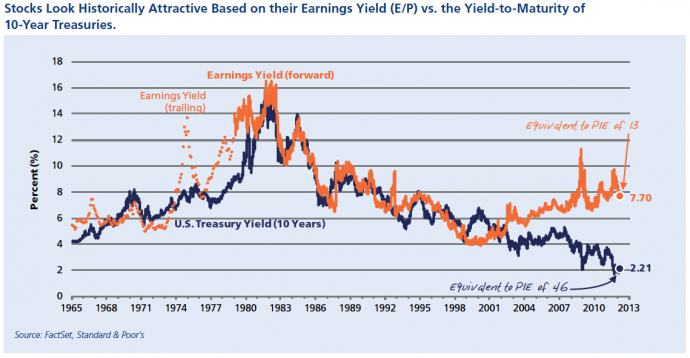

We believe the next phase of the market rally will be driven by savers that are compelled to “capitulate” (or “throw in the towel”) and get back into the market due to a fear of being left behind. This fear is warranted; the S&P 500 is trading at a very compelling priceto- earnings ratio (P/E) of only 13.5, relative to its historical average of 15.0. An expansion of the P/E multiple to the historical average would send the S&P 500 to an all-time record high of 1575 at our earnings target of $105 per share. Compare this to a Treasury bond, which at a yield of 2% is selling at the equivalent of a 46 P/E ratio.

Historically cheap valuations are icing on the cake. Global risks are always looming, but we believe investors need to put fear aside, grab a red cape and jump into the ring with this raging bull.

Download a PDF of this Report

This commentary has been prepared by ING Investment Management for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities.

The opinions, views and information expressed in this commentary regarding holdings are subject to change without notice. The information provided regarding holdings is not a recommendation to buy or sell any security. Fund holdings are fluid and are subject to daily change based on market conditions and other factors.

Past performance is no guarantee of future results.

©2012 ING - 230 Park Avenue, New York, NY 10169