The [Recovery] Has No Clothes

By Eric Sprott & David Baker, Sprott Asset Management

"I believe that there have been repeated attempts to influence prices in the silver markets. There have been fraudulent efforts to persuade and deviously control that price. Based on what I have been told by members of the public, and reviewed in publicly available documents, I believe violations to the Commodity Exchange Act (CEA) have taken place in silver markets and that any such violation of the law in this regard should be prosecuted."

- Bart Chilton, Commissioner, U.S. Commodity Futures Trading Commission (CFTC), October 26th, 20101

What a difference a month makes. Now that Greece has been papered over, the bulls are back in full force, pumping up the equity markets and celebrating every passing data point with positive exuberance. Let's not get ahead of ourselves just yet, however. Very little has actually changed for the better, and it's certainly too early to start cheerleading a new bull market.

Take the latest US unemployment numbers, for example. There was much excitement about the latest Bureau of Labor Statistics (BLS) report which announced that US unemployment remained unchanged at 8.3% during the month of February.2 The market was particularly enamored by the BLS's insistence that non-farm payrolls increased by 227,000 during the month, as well as its upward revision of the December 2011 and January 2012 jobs numbers. Lost in all the excitement was the Gallup unemployment report released the day before, which had February unemployment increasing to 9.1% in February from 8.6% in January and 8.5% in December.3 Granted, the Gallup methodology is slightly different than that used by the BLS, but even if Gallup had applied the BLS's seasonal adjustment, they would have still come out with an unemployment rate of 8.6%, which is considerably higher than that produced by the BLS.4 We all know which number the pundits chose to champion, but the Gallup data may have been closer to the truth.

For every semi-positive data point the bulls have emphasized since the market rally began, there's a counter-point that makes us question what all the fuss is about. The bulls will cite expanding US GDP in late 2011, while the bears can cite US food stamp participation reaching an all-time record of 46,514,238 in December 2011, up 227,922 participantsfrom the month before, and up 6% year-over-year.5 The bulls can praise February's 15.7% year-over-year increase in US auto sales, while the bears can cite Europe's 9.7% year-over-year decrease in auto sales, led by a 20.2% slump in France.6, 7 The bulls can exclaim somewhat firmer housing starts in February8 (as if the US needs more new houses), while the bears can cite the unexpected 100bp drop in the March consumer confidence index9, five consecutive months of manufacturing contraction in China10, and more recently, a 0.9% drop in US February existing home sales.11 Give us a half-baked bullish indicator and we can provide at least two bearish indicators of equal or greater significance.

It has become fairly evident over the past several months that most new jobs created in the US tend to be low-paying, while the jobs lost are generally higher-paying. This seems to be confirmed by the monthly US Treasury Tax Receipts, which are lower so far this year despite the seeming improvement in unemployment. Take February 2012, for example, where the Treasury reported $103.4 billion in tax receipts, versus $110.6 billion in February 2011. BLS had unemployment running at 9% in February 2011, versus 8.3% in February 2012.12 Barring some major tax break we've missed, the only way these numbers balance out is if the new jobs created produce less income to tax, because they're lower paying, OR, if the unemployment numbers are wrong. The bulls won't dwell on these details, but they cannot be ignored.

Then there are the banks, our favourite sector. Needless to say, the latest Federal Reserve's bank stress test was a great success from a PR standpoint, convincing the market that the highly overleveraged banking system is perfectly capable of weathering another 2008 scenario. The test used an almost apocalyptic hypothetical 2013 scenario defined by 13% unemployment, a 50% decline in stock prices and a further 21% decline in US home prices. The stress tests tested where major US banks' Tier 1 capital would be if such a scenario came to pass. Anyone who still had 5% Tier 1 capital and above was safe, anyone below would fail. So essentially, in a scenario where the stock market is cut in half, any bank who had 5 cents supporting their "dollar" worth of assets (which are not marked-to-market and therefore likely not worth anywhere close to $1), would somehow survive an otherwise miserable financial environment. The market clearly doesn't see the ridiculousness of such a test, and the meaninglessness of having 5 cents of capital support $1 of assets in an environment where that $1 is likely to be almost completely illiquid.

That anyone still takes these tests seriously is somewhat of a mystery to us, and we all remember how Dexia fared a mere three months after it passed the European "stress tests" last October. There has since been some good analysis on the weaknesses of the US stress tests, including an excellent article by Bloomberg's Jonathan Weil that explains the hypocrisy of the testing process.13 Weil points out that stress-test passing Regions Financial Corp. (RF), which has yet to pay back its TARP bailout money, has a tangible common equity of $7.6 billion, and admitted in disclosures that its balance sheet was worth $8.1 billion less than stated on its official balance sheet. An $8.1 billion write-down plus $7.6 billion in equity equals bankruptcy. But the Federal Reserve's analysts didn't seem to mind. It came as no surprise to see that Regions Financial took advantage of its passing "stress test" grade to raise $900 million in common equity on Wednesday, March 14, which it plans to put toward paying off the $3.5 billion it received in TARP money. Well played Regions Financial. Well played.

Our skepticism would be supported if not for one thing - the recent weakness in gold and silver prices. Given our view of the market, the recent sell-offs have not made sense given the considerable central bank intervention we highlighted in February. Although both metals have had a dismal March, we must point out that they were both performing extremely well going into February month-end. Gold had posted a return of 14.1% YTD as of February 28th, while silver had appreciated by 32.5% over the same period. And then what happened? Leap Day happened.

In addition to being Leap Day, February 29th also happened to be the day that the European Central Bank (ECB) completed its second tranche of the Long-Term Refinancing Operation (LTRO), which amounted to another €529.5 billion of printed money lent to roughly 800 European banks. February 29th also happened to be the day that Federal Reserve Chairman Ben Bernanke delivered his semi-annual Monetary Policy Report to Congress. Needless to say, during that day gold mysteriously plunged by over $100 at one point and closed the day down 5%. Silver was dragged down along with gold, dropping 6%. Any reasonably informed gold investor must have questioned how gold could drop by 5% on the same day that the European Central Bank unleashed another €530 billion of printed money into the EU banking system. But all eyes were on Bernanke, who managed to convince the market that QE3 was off the table for the indefinite future by simply not mentioning it explicitly in his Congress speech. Given that Treasury yields have recently started rising again and that US federal debt is now officially over $15 trillion, do you think QE3 is officially off the table? We don't either. Just because Bernanke signals that the Fed is taking a month off doesn't mean they're done printing. It doesn't mean they have suddenly become responsible. It's simply a matter of timing.

Looking back at the trading data on February 29th, the sell-off in gold and silver appears to have been an exclusively paper-market affair. We were surprised, for example, to note that between the hours of 10:30 am and 11:30 am, the volume of the COMEX front month silver futures contracts equaled the paper equivalent of 173 million ounces of physical silver. Keep in mind that the world only produces 730 million ounces of physical silver PER YEAR. The problem from a pricing standpoint is the simple fact that the parties who were on the selling side of those 173 million paper ounces couldn't possibly have had the physical silver to back-up their sell orders. And the way the futures markets are designed, they don't have to. But if that's the case, how can the silver price be smashed by sell orders that don't involve any real physical?

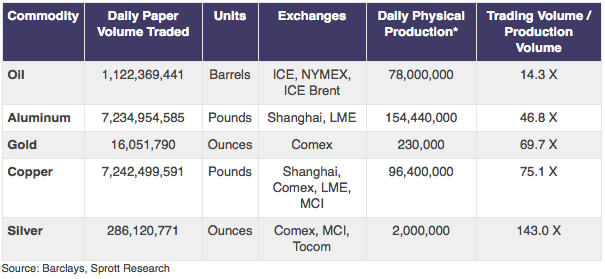

Looking at this issue from a broader perspective, we've discovered that silver is indeed in a unique situation from a paper-market standpoint. We compared the daily paper-market futures volume of various commodities against their estimated daily physical production. We discovered that silver is disproportionately traded 143 times higher in the paper markets versus what is produced by mine supply. The next highest paper market commodity is copper, which is traded at roughly half that of silver on a paper market volume basis.

FIGURE 1: MULTIPLES OF DAILY PHYSICAL PRODUCTION TRADED IN FUTURES MARKETS

Source: Barclays, Sprott Research

We don't know why the paper market for silver is so huge, but we have our suspicions. Silver is obviously a much, much smaller market than that for copper, gold or oil. It could very well be that paper market participants like silver because they don't need as much capital to push it around. The prevalence of paper trading in the silver market is what makes the drastic price declines possible by allowing non-physical holders to sell massive size into a relatively small market. It's not as if real owners of 160 million ounces of physical silver dumped it on the market on February 29th, and yet the futures market allows the silver spot price to respond as if they had.

Same goes for gold. Although gold paper-trading isn't as lopsided as silver's, it too suffers from the same paper-selling issue. Indeed, as we discovered for February 29th, it appears to be one large seller of gold that single handedly downticked the spot price by $40/oz in roughly ten minutes.14 The transaction represented approximately 1.8 million ounces, representing roughly $3 billion dollars' worth of the metal. Who in their right mind would even contemplate dumping $3 billion of physical gold in so short a time span? Dennis Gartman's Letter on March 2, 2012, also mentioned an unnamed source who described an order to sell 3 million ounces of gold that same day, with the explicit order to sell it "in just a few minutes". As the Gartman Letter source states, "No investor or speculator would 1) handle it this way and 2) do it at the fixing only… This [has] happened this way three times in the last year, yesterday being the fourth time. Ben Bernanke had done nothing yesterday to trigger this the way it happened. I [have done] this now for 30 years and this was no free market yesterday."15

The following three charts show the price action and volume for the February, March and April Comex Gold contracts. You'll notice that the February contract stopped trading on February 27th to allow time for settlement between the buyers and sellers who intended on closing the contracts in physical. The March contract had hardly any volume at all, leaving the majority of gold futures that traded on February 29th taking place in the April contract. This speaks to our frustration with futures contracts. The majority of trading that produced the February 29th gold price decline took place in a contract month that won't settle until April 26th at the earliest, giving plenty of time for the shorts to cover and exit without having to back their sales with physical delivery.

FIGURE 2: FEBRUARY COMEX GOLD CONTRACT Source: Bloomberg

Source: Bloomberg

FIGURE 3: MARCH COMEX GOLD CONTRACT Source: Bloomberg

Source: Bloomberg

FIGURE 4: APRIL COMEX GOLD CONTRACT Source: Bloomberg

Source: Bloomberg

All of this nonsense brings us to the crux of our point. If we are right about gold and silver as currencies, and if we are right about the continuation of central bank printing, both gold and silver will continue to appreciate in various fiat currencies over time. If there is indeed some sort of manipulation in the futures market that is designed to suppress the prices for both metals so as to detract from the mainstream investor's interest in them as alternative currencies, then both metals are likely trading at suppressed prices today. This means that there is an opportunity for investors to continue accumulating both metals at much cheaper nominal prices than they would do otherwise. While the volatility of the price fluctuations may be unsettling, they ultimately won't change the underlying fundamental direction of both metals, which is upwards.

The equity market rally that began in late December appears to be generated more by excess government-induced liquidity than it does by any raw fundamentals. We continue to scour the data for signs of a true recovery and we are simply not seeing it. Until those signs come through, we would be very wary of participating in the equity markets without a strong defensive stance. We would also expect the precious metals complex to enjoy renewed strength as the year continues. One bad month does not change a long-term trend that has been building over 10 years. Gold and silver will both have an important role to play as the central bank-induced printing continues, and we expect more on that front in short order.

PS - if there is any group that can effectively address silver's continued paper market imbalance, it is the silver miners themselves. Despite the best efforts of a select few at the CFTC, it is unlikely that there will be any resolution to the CFTC's investigation announced back in September 2008.16 Silver miners have the most to lose from the continued "fraudulent efforts" that Commissioner Bart Chilton refers to in the opening quote above. They also have the most to gain by confronting the continued paper charade head-on.

| 1 | Chilton, Bart (October 26, 2010) "Statement at the CFTC Public Meeting on Anti-Manipulation and Disruptive Trading Practices". U.S. Commodity Futures Trading Commission. Retrieved March 15, 2012 from: http://www.cftc.gov/PressRoom/SpeechesTestimony/chiltonstatement102610 |

| 2 | BLS News Release (March 9, 2012) "The Employment Situation - February 2012". Bureau of Labor Statistics. Retrieved March 15, 2012 from: http://www.bls.gov/news.release/pdf/empsit.pdf |

| 3 | Jacobe, Dennis. (March 8, 2012) "U.S. Unemployment Up in February". Gallup. Retrieved March 16, 2012 from: http://www.gallup.com/poll/153161/Unemployment-February.aspx |

| 4 | Carroll, Conn (March 9, 2012) "Why is Gallup's unemployment number so high?". The Washington Examiner. Retrieved March 17, 2012 from: http://campaign2012.washingtonexaminer.com/blogs/beltway-confidential/why-gallups-unemployment-number-so-high/420266 |

| 5 | SNAP/Food Stamp Participation (December 2011) "More Than 46.5 Million Americans Participated in SNAP in December 2011". Food Research and Action Center. Retrieved on March 20, 2012 from: http://frac.org/reports-and-resources/snapfood-stamp-monthly-participation-data/ |

| 6 | Oberman, Mira (March 1, 2012) "US auto sales accelerate despite fuel price jump". Associated Foreign Press. Retrieved March 20, 2012 from: http://news.yahoo.com/chryslers-us-sales-jump-40-february-142923285.html |

| 7 | AAP (March 16, 2012) "Europe new car sales down 9.7% in February". Australian Associated Press. Retrieved March 20, 2012 from: http://news.ninemsn.com.au/article.aspx?id=8435962 |

| 8 | Homan, Timothy (March 20, 2012) "U.S. Housing Heals as Starts Near Three-Year High: Economy". Bloomberg. Retrieved March 21, 2012 from: http://www.bloomberg.com/news/2012-03-20/housing-starts-in-u-s-fell-in-february-from-three-year-high.html |

| 9 | Reuters (March 16, 2012) "March consumer sentiment dips, inflation view up". Reuters. Retrieved March 20, 2012 from: http://www.reuters.com/article/2012/03/16/us-usa-economy-umich-idUSBRE82F0S420120316 |

| 10 | Mackenzie, Kate (March 22, 2012) "China flash PMIs *down*". Financial Times. Retrieved March 23, 2012 from: http://ftalphaville.ft.com/blog/2012/03/22/933081/china-flash-pmis-down/ |

| 11 | Schneider, Howard and Yang, Jia Lynn (March 21, 2012) "Housing report disappoints as existing-home sales dip in February". Washington Post. Retrieved on March 22, 2012 from: http://www.washingtonpost.com/business/economy/housing-sales-report-disappoints/2012/03/21/gIQAAcgqRS_story.html?tid=pm_business_pop |

| 12 | BLS News Release (March 9, 2012) "The Employment Situation - February 2012". Bureau of Labor Statistics. Retrieved March 15, 2012 from: http://www.bls.gov/news.release/pdf/empsit.pdf |

| 13 | Weil, Jonathan (March 15, 2012) "Class Dunce Passes Fed's Stress Test Without a Sweat". Bloomberg. Retrieved March 15, 2012 from http://www.bloomberg.com/news/2012-03-15/stress-tests-pass-fed-s-flim-flam-standard-jonathan-weil.html |

| 14 | CIBC Sales Commentary Mining Morning Note (March 1, 2012) |

| 15 | The Gartman Letter L.C. (March 2, 2012) |

| 16 | Silver Market Statement (November 4, 2011) "CFTC Statement Regarding Enforcement Investigation of the Silver Markets". U.S. Commodity Futures Trading Commission. Retrieved on March 20, 2012 from: http://www.cftc.gov/PressRoom/PressReleases/silvermarketstatement |

Copyright © Sprott Asset Management