by Peter Tchir, TF Advisors

Markets are up a little this morning, basically getting back the late day fade. S&P Futures up 4. IG18 is ¾ of a bp tighter.

In Europe, bonds in Spain and Italy are better after an initial round of weakness. As far as I can tell, they both bounced on rumors that the EU was going to help out the Spanish banks. Maybe it’s too early today, but I’m beginning to have trouble seeing the logic of rallying sovereign debt on a story that the banks need help. I continue to be a little surprised that Italy is back to moving up and down in lock-step with Spain, as I think Spain is doing a lot to distinguish itself – and not in a good way. Italian 5 yr CDS is actually 4 bps wider on the day at 371 while Spanish 5 yr CDS is 2 tighter at 423.

I will dig into the Spanish debt issuance and budget issues in more detail, but yesterday’s news should scare investors. The deficit in the first two months of the year was worse than expected, and worse than last year because they transferred money to various regions and municipalities. Now they will just guarantee debt of those regions, so no transfer, and improved deficit. All fixed? Hardly, just accounting games and another sign that somehow Europe does not understand that guarantees count.

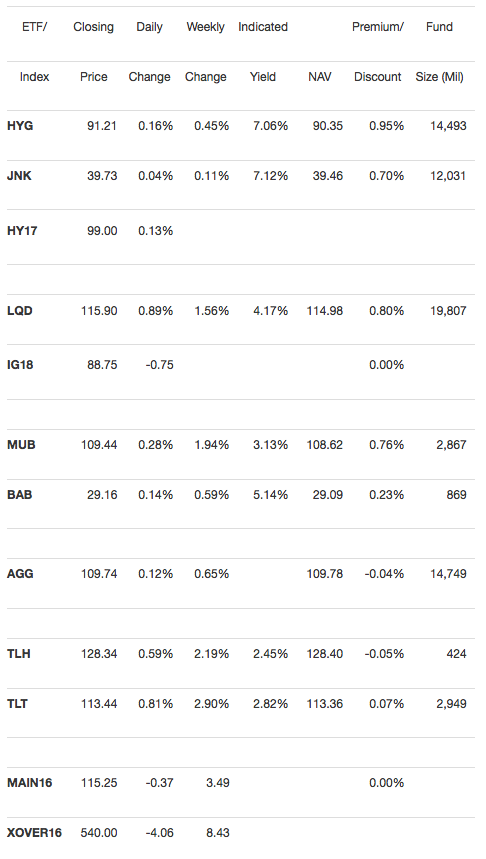

Yesterday in fixed income ETF’s, we saw gains across the board, but with treasury related assets outperforming credit assets. Junk bond ETF’s had the smallest gains, but that was a bit of catch up from the prior day, and the reality is that they are running out of room for any significant upside, which is why we still like HY17 vs HYG. HY17 is back to 99 and does seem to be benefitting from the roll. We are also finally seeing some “compression” as HY outperformed IG. That trade has been hurting people as the “compression” story has been compelling, but the market hasn’t played nice with that trade. Looking at it now, but not yet in it. IG18 still seems like a reasonable short. Even with creeping back into 88.75 this morning, it feels like the market is underhedged and even a bit long and it has failed to come back to its tights of 85.5 in spite of a spirited stock market.

Durable goods orders have a chance to break the trend of weak data, but that series is so volatile, I’m not sure a positive reading does much. My guess is that we miss this number as well, but in this day and age of central banks dominating market moves, that miss might not do much.

VIX and TVIX (trading with almost no premium again) both bounced. Stocks leaked, but the reality is that everyone is still digesting Monday’s move and really trying to figure out if all that matters is central bank liquidity. I think that has its limits, and we have had sell-offs with big central bank policies in place, but even my faith was shaken on Monday as Ben seemed almost single-minded in his pursuit of more ways to “accommodate” the market, in spite of our concerns that he may be doing more harm than good to the economy, both in the short run and in the long run.

Copyright © TF Advisors