Investment Outlook, March 2012

Silent Waters Run Deep

by Alfred Lee, CFA, CMT, DMS, Vice President & Investment Strategist

BMO ETFs & Global Structured Investments, BMO Asset Management

alfred.lee[@]bmo.com

As we articulated in last month’s report, equity market volatility remains eerily quiet given the number of macro-economic issues that remain largely unresolved. With the news of Greece agreeing to a debt restructuring deal, the concern of a European sovereign debt crisis has been put on the back burner and the market has shifted its focus to U.S. economic data, which continues to come in better than expected. The decision by the International Swaps and Derivatives Association Inc. (ISDA) to deem the Greek bond deal a default, also restores faith in credit default swaps (CDS)1 as a viable insurance policy for debt issuances, which will help European sovereigns keep their yields lower over the short-term. Although, U.S. economic data continues to impress, concerns of the other, and larger, PIIGS2 nations, are being overlooked.

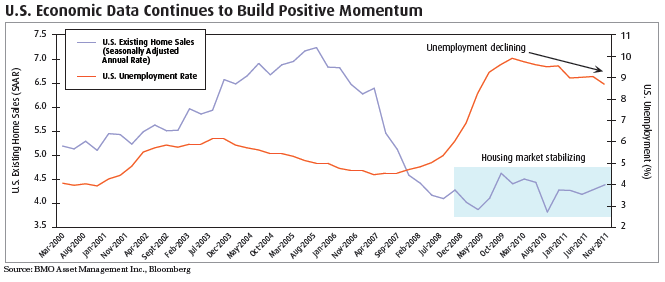

The continuation of the current rally does hinge to a degree on U.S. economic data and its ability to continue gathering positive momentum. Most notably, unemployment is down to 8.7% in its December reading, from 9.1% in September. In addition, there is a growing, albeit small, trend of “on-shoring” where manufacturing jobs are coming back stateside, due to rising labour costs in certain emerging markets. Recent optimism of the U.S. economy has led the market to quell their expectations for an additional round of quantitative easing, or further stimulus from the U.S. Federal Reserve (Fed). As a result, our short-term momentum indicators show that gold prices have stalled, and is the reason we remain neutral on precious metals.

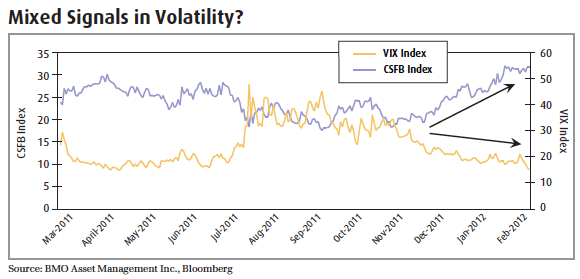

Despite the re-pricing of asset markets to reflect improving U.S. economic fundamentals and a lower perception of tail-risk3, the CBOE/S&P Implied Volatility Index (“VIX”)4 remains abnormally suppressed. In mid-March, the VIX had an intraday print of 13.99, which would be considered low during a secular bull-market and well below its long-term average of 20. As volatility has a tendency to quickly revert to its average, we remain cautiously optimistic on risk assets. While we have moved overweight to equities, we remain defensively positioned in our equity exposure, in order to better distribute risk across our strategy. Although we have become more positive on equities over the mid-term, we believe there are unresolved structural issues which will weigh on equities in the long-term.

Notable Changes to the Mix

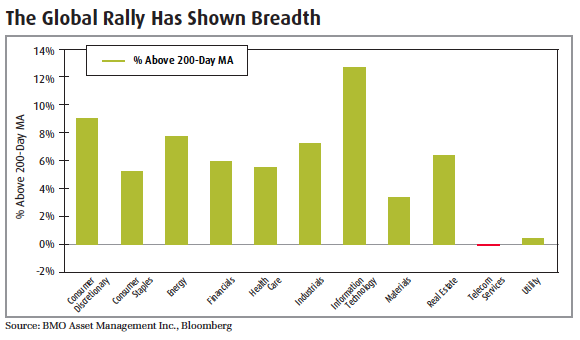

- Global equities have rallied significantly over the course of the last five months with the MSCI All Country World Index (ACWI) gaining 23.9% from its October lows. More encouraging has been the breadth of the rally, with all sectors contributing to the strength of its ascent. As the overhangs on the market have been more macro-economically related, a rising tide lifts all boats as the markets have re-priced a lower probability of an immediate tail-risk event.

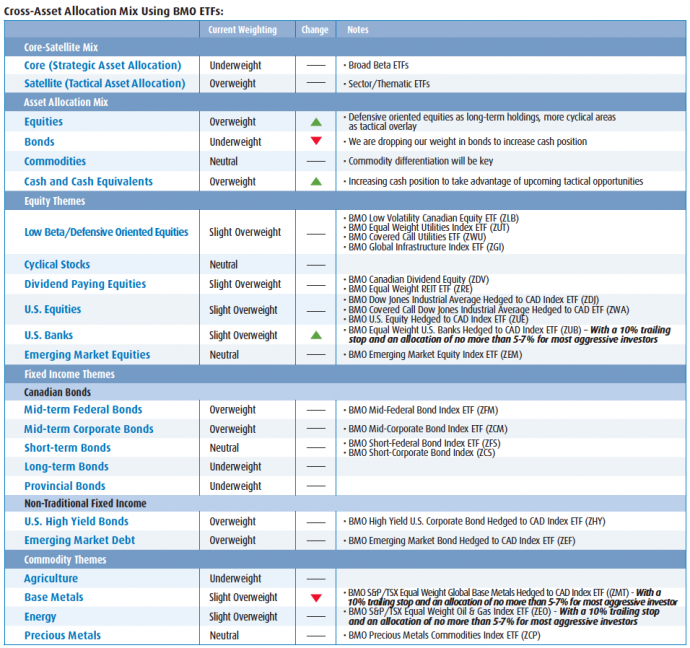

- We have decreased our allocation to fixed income and increased our weight in equities and cash. Though attractive from a fundamental perspective, the equity market continues to look overbought in the short-term based on technical and quantitative-based momentum indicators. Consequently, we anticipate some short-term consolidation. By increasing our cash position, it allows us to be more nimble and take advantage of any upcoming opportunities and slowly increase our weight towards tactical opportunities in equities. In addition, the ongoing equity rally could put upward pressure on interest rate expectations, which is why we have over-weighted the short-and mid-part of the yield curve to lower our duration risk.

- Coming into the new year, we were bearish on Canadian equities. Though we have raised our positioning to neutral, we believe that weaker gold prices and concerns over China targeting lower growth expectations will weigh on the S&P/TSX Composite Index (TSX). We do however remain bullish toward certain areas within Canadian equities such as lower volatility equities and dividend paying equities, and we are recommending the BMO Low Volatility Canadian Equity ETF (ZLB) and BMO Canadian Dividend ETF (ZDV), respectively, to access these areas.

New Additions/Deletions to Strategy:

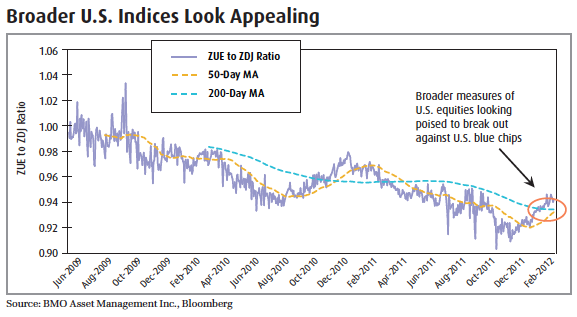

- One of the areas where we have been bullish over the last sixteen months has been U.S. equities. More specifically, we were bullish on the large-cap blue chip companies, the reason why we have been recommending the BMO Dow Jones Industrials Average Hedged to CAD Index ETF (ZDJ). Though we still favour the stocks in the Dow Jones Industrial Average (Dow), higher oil prices and a buoyant U.S. dollar, will weigh on the multinationals in the Dow. Moreover, improving economic conditions and on-shoring will likely lead to an improving business environment for some of the smaller, more locally based U.S. companies. We are therefore paring back some of our exposure to ZDJ in favour of the BMO U.S. Equity Hedged to CAD Index ETF (ZUE) in our strategy mix.

- Last week, the Fed released the results of the U.S. bank stress test, which came in overwhelmingly positive. Of the 19 banks, 15 were given passing grades. Furthermore a number of the banks were given approval by the Fed to raise its dividends. This news added a further tailwind to the U.S. banking sector, as it continues to show leadership amongst the U.S. equity sectors. Currently, the BMO Equal Weight U.S. Banks Hedged to CAD Index ETF (ZUB), which tracks the Dow Jones U.S. Large-Cap Banks Equal Weight Total Stock Market Index CAD Hedged Index, trades at a forward price-to-earnings (P/E) ratio of 11.9x, a discount to the 13.5x forward P/E of the S&P 500 Composite Index. Our technical indicators suggests that positive momentum in ZUB has returned, something we like to see in assets trading at attractive valuations as we want to avoid value traps. Given the sector remains vulnerable we recommend investors consider utilizing a trailing stop loss order of no more than 10% and limit their allocation to mitigate risk.

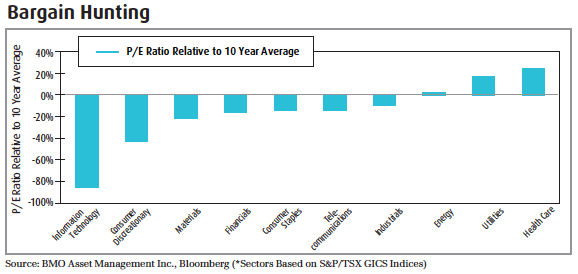

Things to Keep and Eye On

Last month, we mentioned that most broad equity market indices, including the TSX, were trading at a discount to their respective 10-year averages. This month we wanted to take a closer look at the TSX to determine which of the sectors look more attractive from a valuation standpoint. We used the current price-to-earnings (P/E) ratios of the sector index relative to its own 10-year average using historical daily data. It should be noted that 10-years may not be a long enough period to demonstrate the secular trend in equities; however, the 2008 financial crisis should also compress a 10-year average P/E ratio, making a more stringent benchmark for determining which sectors are attractive on a historical basis. In addition, investors should also note that since the TSX lacks depth in a number of its sectors, the valuation of those sectors can be heavily impacted by individual companies. Information technology and health care are prime examples of sectors lacking depth.

Recommendation: A number of the sectors trading at a discount to their 10-year average in terms of P/E are well represented in the BMO Low Volatility Canadian Equity ETF (ZLB). Although the market has rotated into more cyclical oriented areas, we continue to favour lower volatility areas in the equity market as a long-term core holding. As mentioned, in our recent BMO Trade Opportunity report, a combination of ZLB with the BMO S&P/TSX Equal Weight Global Base Metals Index ETF (ZMT) provides investors with a solid long-term holding combined with a more tactical oriented opportunity.

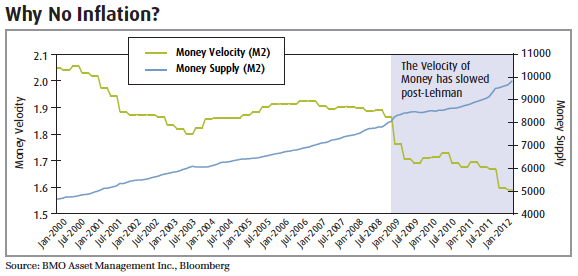

Since the 2008 financial crisis, there has been an increasing concern of runaway inflation due to the stimulative measures and accommodative monetary policies of central banks around the world. Although it can be argued that the Consumer Price Index (CPI) is not a good representation of true inflation, especially given the elevated prices of hard assets over the decade, CPI for the U.S. remains at 2.9%, well below its long-term average of 3.4%. One of the key reasons why an increase in money supply has not translated to inflation is due to a slower money velocity7, which has decreased substantially since the 2008 financial crisis as a result of greater uncertainty with the business environment. Should the recent improvement in U.S. economic data and unemployment prove to be a sustained trend, the rate at which money changes hands could increase, eventually making inflation a concern.

Recommendation: As U.S. monetary policy indirectly affects the actions of other central banks and particularly the Bank of Canada, investors should keep an eye on the actions of the Fed. Although not an immediate concern, an uptick in money velocity could potentially make inflation a problem several years down the road. As a result, we continue to favour short- and mid-term bonds as a means of decreasing interest-rate risk (See Cross-Asset Allocation Mix Table for our recommended exposures).

In recent weeks, there has been much discussion about the diverging trends between the VIX and the Credit Suisse Fear Barometer Index (CSFB)5. Both indices are used as a gauge of market sentiment with higher readings indicating increased nervousness with investors. In recent months, the VIX has dropped significantly whereas the CSFB has steadily risen. The VIX is reflective of the market’s current anticipation of volatility over the next 30-days, annualized. The CSFB, on the other hand, is calculated as a zero-cost collar6, using three-month options. As such, there are a number of differences in the two indices, including different maturity terms of the underlying options, making a divergence possible depending on the term structure in volatility. Also worth mentioning, is that the VIX calculates volatility using options on individual companies whereas the CSFB uses index options.

Recommendation: As we noted at the onset of the year, the term structure in the VIX futures curve is currently upward sloping and relatively steep in the first three contracts, which has made a divergence between the two “fear indices” possible. The term structure for VIX can be interpreted as the market’s current expectation for volatility in the future. Although the term structure for the VIX futures changes over time, and it is possible that the term structure could flatten, the VIX is well below its long-term average and cannot get much lower. We continue to advise investors that short- and mid-term bonds should not be neglected as a risk mitigation tool and that investors should continue to maintain exposure to defensive oriented areas in the equity market.

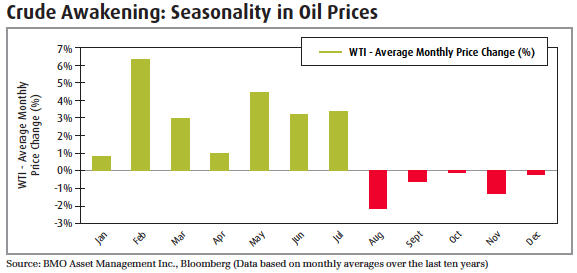

Oil prices have seen a steady rise since early October reflecting an increase in optimism of a global economic recovery. Though political turmoil has had more of a direct impact on the prices of Brent crude (Brent), West Texas Intermediate (WTI) which is more reflective of North American oil prices has seen an indirect impact due to a changing demand and supply equilibrium. Last year on September 26, we recommended investors invest in energy through our BMO S&P/TSX Equal Weight Oil & Gas Index ETF (ZEO), which has gained 13.7% on a total return basis since. Energy companies remain our top investment idea within the commodity sector based on global macro-economic and political forces. Moreover, both Brent and WTI prices tend to strengthen the first seven months of the year, which could provide an additional tail-wind for oil prices.

Recommendation: Although we would never make an investment recommendation based on seasonality alone, the tendency for oil to gain in the first half of the year does provide us with an additional reason to be positive on energy companies. However, as we mentioned last month, since oil does have a tendency to be very reactive to macro-economic risk, we continue to recommend a trailing stop-loss order of 10% on BMO S&P/TSX Equal Weight Oil & Gas Index ETF (ZEO). Investors that acted on the trade in October may also want to consider paring back their exposure to their original allocation.

Cross-Asset Asset Allocation Mix using BMO ETFs (click to enlarge)

Footnotes

1 Credit Default Swaps (CDS): A swap agreement where the seller of the CDS will compensate the buyer in the event of a loan default or other credit event. The buyer of a credit default swap receives credit protection, whereas the seller of the swap guarantees the credit worthiness of the debt security. In doing so, the risk of default is transferred from the holder of the fixed income security to the seller of the swap. As such, a rising CDS price indicates an increasing probability of a default on a fixed income issue, while a declining price indicates a lower probability.

2 PIIGS: An acronym used to refer to the five eurozone nations, which were considered weaker economically following the financial crisis: Portugal, Italy, Ireland, Greece and Spain.

3 Tail-risk: The risk of an outlier or improbable event occurring. Statistically, the event is said to be three standard deviations or more away from the mean, under a normally distributed curve.

4 CBOE/S&P 500 Implied Volatility Index (VIX): shows the market’s expectation of 30-day volatility. It is constructed using the implied

volatilities of a wide range of S&P 500 index options. This volatility is

meant to be forward looking and is calculated from both calls and puts.

The VIX is a widely used measure of market risk and is often referred to

as the “investor fear gauge”.

5 Credit Suisse Fear Barometer (CSFB): measures investor sentiment for 3-month investment horizons by pricing a zero-cost collar. The collar is implemented by selling of a 10% out-of-the-money call (OTM) option on

the S&P 500 Composite (SPX) and using the proceeds to buy an OTM put.

The CSFB level represents how far OTM that SPX put is.

6 Zero-cost collar: consists of the simultaneous sale of one option and using

the proceeds towards the purchase of another option at different strikes.

7 Money velocity: average frequency with which a unit of money is spent on new goods and services produced domestically in a specific period of time.