by Saumil H. Parikh, PIMCO

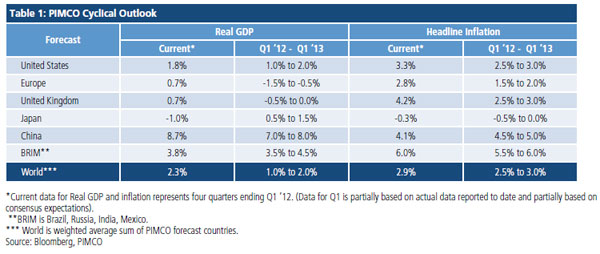

- We expect the eurozone economy to experience a recession in 2012 on the back of continuing pro-cyclical fiscal austerity measures.

- We expect 2012 to be the year in which the residential construction sector begins to gradually contribute to U.S. economic growth after a long and painful five-year hiatus.

- Major emerging market economies are struggling with domestic over-investment, rising income inequalities and inflation risks. Therefore, PIMCO expects major emerging market economies to be less of a global engine of growth in 2012-13.

The global economy finds itself sailing through calmer waters and clearer skies this quarter. Most financial asset prices have improved substantially in recent months. Liquidity conditions across markets have eased. Forced balance sheet deleveraging has slowed, and as a result, global economic growth has found a footing of sorts compared to last quarter.

The recent improvement in liquidity conditions and financial asset prices in Europe on the back of two Long-Term Repo Operations (LTROs) carried out by the European Central Bank (ECB) in early December and early March is of great importance to the evolving nature of PIMCO’s cyclical economic outlook. These operations have succeeded in providing highly at-risk European financial institutions with nearly a trillion euros in much needed financing to meet accelerating deposit flight, pay bond redemptions, secure longer-term funding and address asset-liability mismatches. Additionally, they have also driven positive spillover effects for certain sovereign bond markets (in particular Italy and Spain). In turn, this has slowed down the vicious European deleveraging feedback loop that was threatening the global economic outlook coming into 2012.

But the critical question for the year ahead is whether the ECB has done enough to halt and reverse deleveraging and change the course of the eurozone and global economic outlook on a sustainable basis? That is, is the global economy in the eye of the hurricane or has the hurricane passed over completely?

At PIMCO, we recognize the dynamics of economic and balance sheet healing but remain concerned that, in some key areas, they have not yet reached critical mass. This is particularly the case in Europe, where ECB liquidity provisions are necessary, but insufficient to deal with the twin underlying problems of too little growth and too much debt.

Eurozone’s Challenges Continue

In our view, it is still too early to give the all clear sign for the eurozone outlook. The fundamental problem facing the eurozone remains one of uneven competitiveness, currency rigidity and the lack of a coordinated vision shared between monetary and fiscal policy institutions.

We expect the eurozone economy to experience a recession in 2012 on the back of continuing pro-cyclical fiscal austerity measures, which will make eurozone sovereign risk indicators cyclically worse before they are given a chance to get secularly better.

This raises the specter of more downgrades, further destruction of demand for eurozone debt and the need to further deleverage balance sheets in the coming months and quarters. Spain has already raised its hand, demanding permission to run higher fiscal deficits than promised just a few months ago. The situation in Greece remains critical, and, along with Portugal, highlights the inadequacy of liquidity provisions to cure real solvency problems once debt dynamics move beyond the point of no return.

The future solvency of eurozone sovereigns can only be improved via the realization of much higher nominal growth and the reduction in sovereign borrowing costs which will require a lender of last resort. Rates need to drop to a level low enough to make debt burdens sustainable even at economic growth rates below the eurozone’s full potential. Neither of these solvency improving options are being offered to the troubled eurozone economies today.

As a result of our expectations for a eurozone recession, rising political risks across important countries and also the lack of critical solvency conditions, we believe the deleveraging feedback loop in Europe will remain in place and will continue to be the defining central feature of the global cyclical economic outlook. Like we said in December, as goes the eurozone deleveraging, so goes the global economy over the next six to 12 months.

U.S. Economic Growth Prospects

While the struggling eurozone economy will likely prevent the U.S. from achieving above-trend growth, some sectors of the U.S. economy have genuinely improved and are re-emerging from secular lows. This is clear in automobile output and more generally in manufacturing. One important inflection point in the story of U.S. deleveraging is the flattening out and reversal of the negative contribution of residential construction to overall economic growth. We expect 2012 to be the year in which the residential construction sector begins to gradually contribute to U.S. economic growth after a long and painful five-year hiatus. While we don’t expect the total contribution from this sector to be large (῀0.3%-0.4%), it does set the stage for a potential multi-year recovery in residential construction that we expect will eventually see a return to balance between household formation rates and new construction. This will add jobs and create income for many American workers that have endured a long depression in the sector. This is great news.

Another positive for the U.S. economy in 2012 is the nascent revival of availability of consumer credit. In recent months, this has become most clearly evident in the areas of student loans and also automobile financing. The latter was a critical component in the recovery of automobile sales to a 15 million annualized sales rate in February 2012 (a level of activity not seen in the sector since March of 2008) according to the U.S. Department of Commerce.

An important question, however, is whether this recovery in consumer credit availability will filter deep enough and wide enough in the household sector to allow for a sustained and continued drop in the U.S. household savings rate, which will be needed to sustain cyclical U.S. economic growth in the face of a weakening outlook for fiscal stimulus and exports. The potential certainly exists and will be strengthened significantly if current improvements in employment and income can be sustained into 2013.

Emerging Market Slowdown

Europe and the emerging markets are very important destinations for U.S. exports. Brazil, Russia, India, China and Mexico, in total, are the largest market for U.S. exports, followed by Canada, followed closely by Europe. While we believe Europe is almost certainly going to encounter a recession in 2012, recent evidence from the major emerging market countries suggests that there is a significant cyclical slowdown underway there as well, especially in China, Brazil and India.

Our cyclical outlook for the major emerging markets is for growth to settle at the sector’s full potential, with risks of under-shooting due to policies designed to opportunistically contain inflation. Emerging market economies have played an outsized role in the global economic recovery since 2008.

Because of much better initial conditions, and also greater policy effectiveness, fiscal and monetary stimulation of major emerging market economies provided important external demand for both U.S. and European commodity and capital goods exports during fragile periods of post-crisis growth. But, we expect this external demand source to wane during 2012.

Major emerging market economies are struggling with domestic over-investment, rising income inequalities and inflation risks. Therefore, PIMCO expects major emerging market economies to be less of a global engine of growth in 2012-13.

Potential Grey Swans

Finally, there are three grey swans on the cyclical horizon.

The U.S. elections in November will be critical in determining the shape of U.S. fiscal policy going into 2013 and beyond. As is well known by now, the U.S. economy faces a “fiscal cliff” in January of next year, when tax stimulus and government spending worth approximately 3.5% of GDP are scheduled to be cut. Even if the new president and incoming congress are able to avoid the debilitating fiscal contraction in 2013, the risk remains that as we approach the “fiscal cliff,” political theatrics and uncertainty regarding the outcome will hinder confidence and animal spirits as they did before the debt ceiling debate of 2011.

There are also presidential elections in France, a country that is key to resolving the European debt crisis. We will be following developments there closely, with particular focus on their potential impact on the French policy stance, Franco-

German collaboration and the outlook for Europe.

It is the third swan that disturbs us most. The quietly rising tensions in the Middle East between Israel and Iran must be addressed by global leaders in a unified manner before long. The existence of known unknowns is exerting unwelcome pressure on oil prices at a time when the global economy is only beginning to stabilize and grow out of vicious secular deleveraging process. Any global complacency on this front will quickly embed itself in oil prices, which in turn will render our best cyclical forecasts useless during a time in which visibility is already poor on all points across the horizon.

While we are sailing through calmer seas and clearer skies this quarter, the horizon in most directions remains grey and visibility remains very poor. A sustainable resolution to the eurozone sovereign crisis, continued gains in U.S. employment and consumption and a peaceful resolution to Middle East tensions are all necessary before we can declare secular smooth sailing ahead.