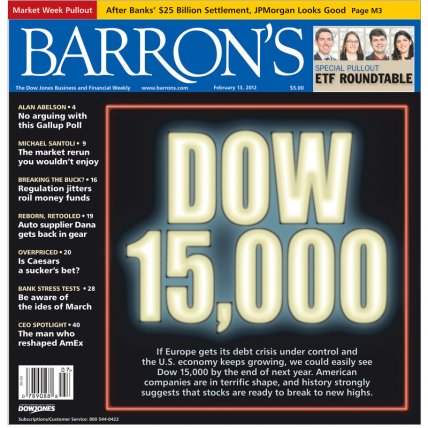

This past weekend's Barron's cover story is certain to leave folks thinking that, perhaps, the latest round of market euphoria hasn't perhaps gone over the top.

The story is based on the work of Wharton finance professor and Stocks For The Long Run author Jeremy Siegel, who sees a strong likelyhood the Dow can reach 15,000, or perhaps even 17,000.

The argument has two angles.

First, based on cycles going back to the 1800s, the market is due for an upswing.

The market history draws on 141 years of equity performance, from which a fairly straightforward cyclical pattern can be discerned: a strong tendency for periods of worse-than-average returns to be followed by periods of better-than-average, and vice versa. Since the past five years have been squarely in the worse-than-average category, better-than-average returns in the two-year period just begun are now likely.

Second: In reality, these numbers are based on some pretty reasonable assumptions, given that the Dow closed Friday just over 12,800:

WHILE DOW 15,000 AND 17,000 may sound like dramatic targets, from at least two perspectives -- earnings and inflation -- they are actually rather modest objectives.

WHILE DOW 15,000 AND 17,000 may sound like dramatic targets, from at least two perspectives -- earnings and inflation -- they are actually rather modest objectives.

In 2011, earnings per share on the Dow grew 12%. Assume a slowdown to half that rate over the next two years, or 6% per year, which is lower than consensus estimates of 9% per year. Since Dow 15,000 from the Thursday's close requires an annual increase of just 8%, the price-earnings ratio on the index would only need to edge up, from the current 13.1 to a still-modest 13.6. Also, if earnings were to grow at consensus expectations, Dow 15,000 could be reached with a P/E of 12.8.

On the same 6% earnings-growth assumptions, Dow 17,000 in two years would boost the P/E on the blue-chip index to 15.4, still average by most standards.

Similarly, in inflation-adjusted terms, Dow 15,000 and 17,000 are actually modest targets (see chart). Assuming price inflation of 2.5% annually over the next two years (last year, it ran 3%), Dow 15,000 in 2007 dollars would still be below its 2007 high. Dow 17,000 would be a new high in 2007 dollars, but would exceed the 2007 highs by only about 7%.

Given the climate, its a bold call, and for that reason, Siegel's conviction is a real standout. You can read the whole story here.