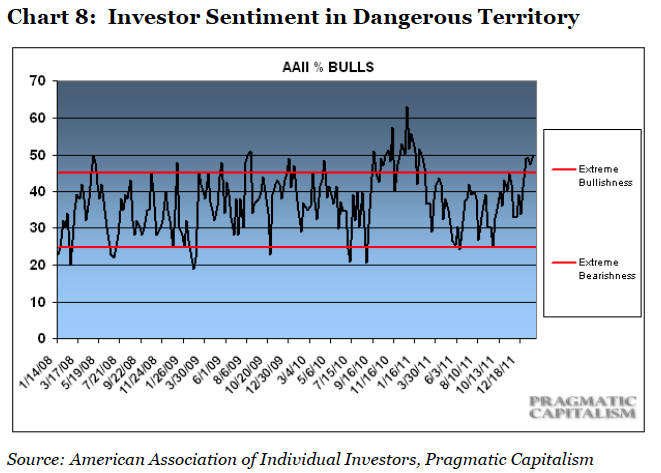

But the eurozone crisis is not my only worry. After a decent run in equity markets, individual investor euphoria is on the rise and is now in dangerous territory – at least in the US (chart 8). This is not a dead sure indicator, but when sentiment reaches these levels, it often precedes a sell-off (small or large).

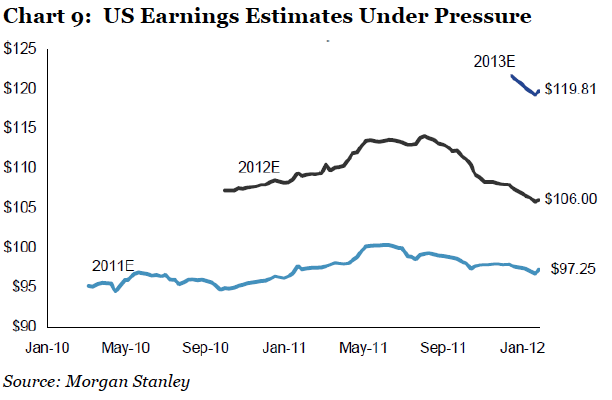

If individual investors are perhaps getting a bit carried away, Wall Street analysts certainly aren’t. Earnings estimates for 2012 have come down significantly over the last few months (chart 9) at a time where the US economy has surprised pretty much everybody by its strength. This doesn’t add up. Are analysts overly pessimistic (not usually in their DNA) or is this an indication that the current upswing in US economic fundamentals will prove short-lived? The last thing Europe needs now is for the US to lose momentum again. It can hardly afford it.

I wish the list would stop there but it doesn’t. I am concerned about China (don’t think they tell the truth about the true extent of the current slowdown) and I agonize over the situation in Iran (the world economy is too fragile right now to withstand an oil price at $150). Most of all, I worry about pension liabilities in Europe (see here) which continue to grow without any serious attempts being made to address the problem.

In other words, there is plenty to keep me awake at night; however, to use an old cliché, equity bull markets have always had to climb walls of worry and this is no different. At least for now, valuations are sufficiently attractive (see our October 2001 letter here for a detailed discussion of current valuation levels) to keep this bull market going.

Is it the beginning of a structural bull market? I doubt it. We are still in a risk-on / risk-off environment where investors blow hot and cold. One of the fallouts of the crisis of the past 3-4 years is a shortening of investors’ time horizon (stat of the day: did you know that the average holding period for US equities is now 22 seconds?7). Long term investors have become an endangered species and the effect on markets is there for everyone to see. I doubt this will change any time soon but, for now, it is risk on.

This is not the time to be fully invested but neither is it the time to be side lined. We are in a nervous market where great opportunities present themselves at regular intervals. We recommend holding 25-50% in cash or cash like instruments (depending on your risk profile) which can be deployed at short notice when those opportunities arise.

We have recently produced a brief strategy document where we outline a number of investment strategies which we believe fit into this type of environment. This document is available to clients of Absolute Return Partners. Please contact either Nick Rees or myself if you would like a copy.

Niels C. Jensen

3 February 2012

© 2002-2012 Absolute Return Partners LLP. All rights reserved.

Footnotes

1 See for example ‘Spain the domino that is too big to fall; the economy is falling, the data is lying’, Veneroso Associates, 5 December 2011

2 If Spain is cooking its books, it is not the first, and neither will it be the last, country to do so. Back in December, the Japanese government announced that it is has decided to include interest rate spreads earned by financial institutions when calculating GDP. The changed methodology will add 1-2% to Japan’s GDP (see here for details). Quite miraculously, Japan will – for a while at least – appear to be firmly back on a growth track. Only the most naive would not expect other countries to use similar tactics to give their national accounts a ‘face lift’.

3 Source: http://www.debtdeflation.com/blogs/2012/01/28/economics-in-the-age-of-deleveraging/

4 ‘Big ESCB QE’, Veneroso Associates, 16 January 2012.

5 LTRO stands for Longer Term Refinancing Operations which is a funding programme offered to the eurozone banks by the ECB whereby the banks can fund themselves on attractive terms. The programme announced in December offered three year loans.

6 Sadly, Tony Dye passed away in 2008.

Copyright © Absolute Return Partners