As pointed out by Frank Veneroso4, the ECB’s balance sheet has expanded almost 50% in the last six months to €2.7 trillion and it doesn’t stop there. The balance sheets of the 17 eurozone central banks have grown even faster and now add up to €1.7 trillion, creating a consolidated balance sheet in the European central bank system of €4.4 trillion, almost twice the size of the Fed’s balance sheet. And this is before you add in the €489 billion provided through the LTRO programme announced on the 8th December5. This certainly hasn’t gone unnoticed in European equity markets which have performed much better since the announcement.

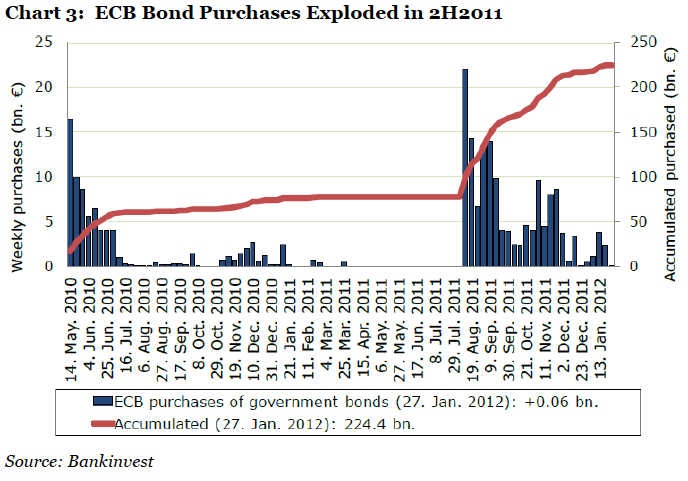

What’s more, European banks are set to more than double their crisis loans from the ECB when the next LTRO auction opens on 29th February according to a survey in the Financial Times (see here). The conclusion is crystal clear: It is not a question of whether the ECB should or should not engage in QE. The ECB is already knee deep in a QE programme that has been firing on all cylinders since last August, and there is a lot more to come.

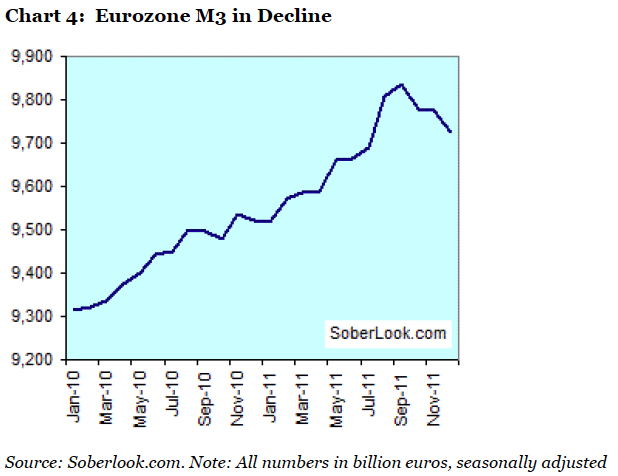

There is no question that the liquidity made available by the ECB has eased the liquidity squeeze in the European banking system and thus provided some much needed energy to the equity markets; however, in order to fully understand what is going on, you need to look at chart 3 in conjunction with chart 4. It is no coincidence that M3 (a broad measure of money supply) has begun to fall at the same time as the ECB has expanded its balance sheet aggressively.

As the crisis in the European banking industry has mounted over the past couple of years, the only type of interbank lending that has continued to work well is repo lending (secured lending usually, but not necessarily, with government bonds provided as security), but repo lending is not ideal for banks in the current environment as it is mostly short term finance.

Having the ability to finance their liquidity needs longer term would give the banks much needed stability and that is precisely what the ECB programme provides and why so many banks took up the ECB offer. This has had the effect of draining the interbank market of collateral (which is now with the ECB). Since repos are included in the M3 but secured lending provided by the ECB is not, the M3 drops as banks shift from the repo market to the ECB.

You may say, so what? However, this is not only of academic relevance. Obviously the need for the ECB to step in and offer an alternative to repo funding is a signal that the credit conditions in Europe are far from ideal. If one drills one level deeper, it is possible to obtain information as to which countries have seen the biggest drop in repo funding, which should be a proxy for relative credit conditions. Not surprisingly, Italy accounts for almost 50% of the drop in repo funding with Spain accounting for almost 20% and Belgium for about 15% (see here for details).

Now, this information has been used by some commentators to suggest that Italy is being suffering a slow and painful death in the euro system. Ambrose Evans-Pritchard wrote a stinging article in the Daily Telegraph a couple of weeks ago, suggesting that “The euro is pushing Italy into depression” (see here). Using chart 5 below, he argued that:

“There is no clearer indictment of the dysfunctional nature of monetary union. Italy is being pushed into depression. Criminal.”

Now, remember what I said earlier. Repos count towards M3. ECB secured funding doesn’t. So, when Italian banks move away from the repo market and fund themselves through the ECB instead, the effect on M3 will be profound. Italian banks are much better off with the ECB programme but M3 looks ugly as a result. Sometimes there is more to the story than first meets the eye.