“Precisely Watson?”

by Jeffrey Saut, Chief Equity Strategist, Raymond James

January 30, 2012

Sherlock Holmes: “And, then there was the event of the dog barking in the night.”

Dr. Watson: “But Holmes, there was no dog barking in the night!”

Sherlock Homes: “Precisely Watson!”

According to Wikipedia (as paraphrased by me):

It is precisely on this distinction that Holmes bases his insight. When the inspector asks, “Is there any point to which you would wish to draw my attention? Holmes responds, “To the curious incident of the dog in the night.” But, protests the inspector, “The dog did nothing in the night.” To which Holmes delivers the punch line, “That was the curious incident.”

For Holmes, the absence of barking is the turning point of the case: the dog must have known the intruder. Otherwise, he would have made a fuss. For us, the absence of barking is something that is all too easy to forget. We don’t even dismiss things that aren’t there; we don’t remark on them to begin with. But often, they are just as telling and just as important – and would make just as much difference to our decisions – as their present counterparts. How asking what isn’t there can help us make better decisions.

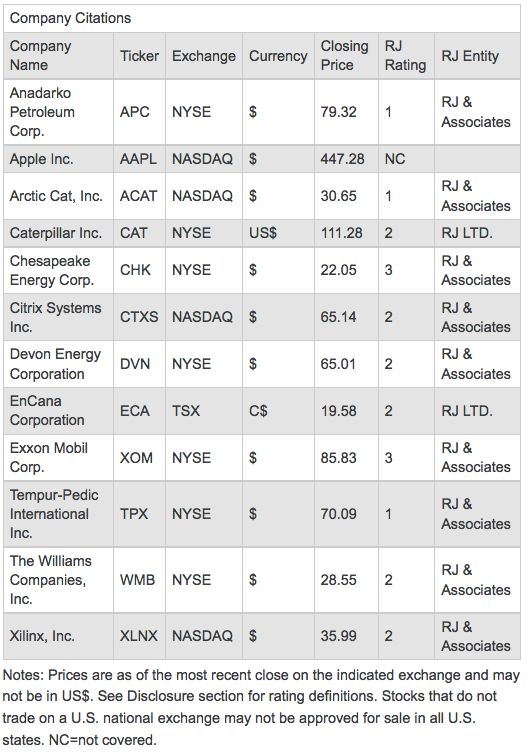

And, last week there was indeed a “dog barking in the night” as Chesapeake (CHK/$22.05/Market Perform) announced it was shutting down numerous natural gas wells due to low gas prices, a signpost coincident with many “bottoms.” On that announcement natural gas futures went from $2.23 per MMcf to $2.75 into last Friday’s closing price. That’s a 23% upside reversal and likely sets the low water mark for natural gas. While our Houston-based research team doesn’t believe it, and they have been more right than me, I think the “lows” for natural gas are “in.” Certainly, major corporations think there is a future for natural gas given the buyout activity over the past few years in the natural gas space. Names for your consideration that are favorably rated by our fundamental analysts include: Anadarko Petroleum (APC/$79.32/Strong Buy); EnCana (ECA/$19.60/Outperform); Williams Companies (WMB/$28.55/Outperform); and Devon Energy (DVN/$65.01/Outperform).

Speaking to Devon, I have mentioned this company before, sparked by my friends at the “must have” Bespoke Investment Group. To wit, January 17th’s missive stated:

“In business school they teach you that investing is all about earnings, and while I think fear, hope, and greed play a role in the investing equation, over the long term earnings indeed play the dominant role. Realizing this, the good folks at Bespoke have assembled a list of companies that have consistently reported the strongest earnings since March 2009 that report between now and February 24th. Names favorably rated by our fundamental analysts making said list include: Citrix Systems (CTXS/$65.14/Outperform); Devon Energy (DVN/$65.01/Outperform); and Tempur-Pedic (TPX/$70.09/Strong Buy).”

Most recently, our exploration and production analyst Andrew Coleman had this to say about Devon:

“On January 5th, we upgraded Devon to a Strong Buy from Outperform. Earlier this week, Devon announced a $2.2 billion joint venture with the Sinopec International Petroleum Exploration & Production Corporation (SIPC). The deal gives SIPC a 33% working interest in Devon's 1.2 million acres across five New Venture plays (e.g. Niobrara, Ohio Utica, and Tuscaloosa Marine shales as well as the Mississippi Lime and the Michigan basin). We value the transaction at $5,500 per acre overall. As a result of the deal, we are raising our production growth expectations for 2012 from 7.5% to 10% (vs. peers at 16%).”

Interestingly, the reciprocal to my natural gas “dog barking in the night” theme is Apple (AAPL/$447.28), which had a “blow out” earnings quarter last week. Indeed, Apple reported 1Q12 sales of $46.33 billion and profits of $13.1 billion. That was the second highest quarterly profit for any company ever! Such metrics lifted the company’s cash hoard to $97.6 billion, making its cash position larger than the market capitalization of 448 of the companies in the S&P 500. Apple sold 37 million iPhones in the quarter for a y/y growth rate of 128%; and, has now sold a total of 315 million iPhones, iPads, and iPod Touch devices. On the earnings release Apple’s shares leapt from $420.41 (last Tuesday’s close) to Wednesday’s opening price of $454.44, making Apple the world’s most valuable company ($417 billion) by exceeding Exxon’s (XOM/$85.83/Market Perform) market capitalization of $413 billion. Clearly, an astounding quarterly report that caused one old Wall Street wag to exclaim, “When the news can’t get any better I sell.”

Turning to the stock market, in last week’s report I wrote:

“The recent rally has not been accompanied by a noticeable increase in Buying Demand as measured by Lowry’s Buying Power Index. Rather the rally has occurred more from a reduction in Selling, which is reflected in Lowry’s Selling Pressure Index. Then too, the percentage of stocks above their respective 10-day moving averages (DMAs) has failed to confirm the upside and the New High list is not expanding. In fact, 40% of my short-term indicators are now bearish and none are bullish. Meanwhile, the NYSE McClellan Oscillator is overbought, the stock market does not have much internal energy left for a big rally, the S&P 500 is three standard deviations above its 20-DMA, the Volatility Index is telegraphing too much complacency, and we have negative seasonality for the next few weeks. Nevertheless, I continue think it is a mistake to get too bearish because I believe any pullback in the various indices will be contained.”

The conclusion to last Monday’s missive was to look for a short-term trading peak followed by either a pause or a correction that could pull the S&P 500 (SPX/1316.33) down to the 1280 – 1290 level. And, the week turned out to be just a “pause” saved by a rally attempt on the more dovish than expected FOMC statement. While the pause didn’t really correct the overbought nature of the NYSE McClellan Oscillator (see the chart on page 3), it has somewhat rebuilt the stock market’s internal energy. It should be noted the D-J Industrial Average (INDU/12660.46) edged above its July 2011 closing high on an intraday basis last Thursday, as well as that the new rally highs in the INDU and SPX have been confirmed by new rally highs in the Cumulative Net Points and Cumulative Volume Indices. Meanwhile, the NYSE Advance/Decline Line continues to move to new all-time highs. Interestingly, given the year-to-date strength, there have been no 90% Upside Days, a reflection of the aforementioned reduced volatility. Also of interest is that unlike prior quarters fundamental analysts are not raising their earnings estimates as earnings season is underway. This could be because the current earnings “beat rate” is not nearly as robust as past quarters.

To be sure, I have repeatedly commented that earnings comparisons were going to get more difficult because the trailing four quarter’s earnings reports have been so strong; and, that’s precisely what is happening. For example, with 180 of the S&P 500 companies reporting, there has been 1.81 upside earnings surprises for each disappointment versus a more normal ratio of 3:1. Accordingly, it makes sense to screen for companies producing “Triple Plays” – that would be companies beating earnings and revenue estimates and also raising forward earnings guidance. Three names from our research universe that qualify as Triple Plays and are favorably rated by our fundamental analysts for your consideration, include: Arctic Cat (ACAT/$30.65/Strong Buy); Caterpillar (CAT/$111.28/Outperform); and Xilinx (XLNX/$35.99/Outperform).

The call for this week: Well, I am traveling the balance of this week to see institutional accounts, speak at an Investment Banking Conference, and present at a handful of retail seminars. Consequently, there will be no verbal strategy comments for the rest of the week. Therefore, I will leave you with these thoughts. The January Barometer has sounded the “all clear” signal with a monthly gain for the INDU of 3.36% and a 4.67% rise in the SPX. History suggests double-digit returns for the rest of the year with positive returns occurring more than 80% of the time. Two sectors have been the main drivers of this January Jump, namely Consumer Discretionary and Technology. Unsurprisingly, the Consumer Discretionary, Technology, Industrial, and the Materials sectors are all beating earnings estimates at the highest “beat rate,” while Consumer Staples, Energy, Financials, and Healthcare are not. While I remain somewhat timid on a short-term trading basis, I continue to believe the year of the Water Dragon will bestow the five Chinese blessings of harmony, virtue, riches, fulfillment, and longevity. That adds even more weight to my growing belief that 2012 will be about breakthroughs, not disasters.

P.S. – As an aside, maybe participants should consider that Warren Buffett is not paying too little a percent of income tax, but rather his secretary is paying too high a percent!

Click here to enlarge

Copyright © Raymond James