The Situation

Europe, UK and the US are all currently mired in a Balance Sheet Recession (BSR). A term for the current “rare disease” the global economy is suffering from coined by Richard Koo in his seminal book “The Holy Grail of Macroeconomics” where he provides a blueprint for our current malaise and provides what I think is the most comprehensive solution to date. This is my attempt to use his template, laid out in the book, to look at our world today. I am not an economist, for that I am grateful, but if I’m wrong on anything please do correct me!

The length of time it takes for the various countries to emerge from their BSR will depend on the policy responses enacted in each economic zone. One precedent is provided by the Great Depression where it took 30 years, from 1929 to 1959 before interest rates returned to their average level of the 1920s. These are once in a generation events and we have never had one affecting such a large bloc of Global GDP simultaneously.

“Recessions are typically characterized by inventory cycles — 80% of the decline in GDP is typically due to the de-stocking in the manufacturing sector. Traditional policy stimulus almost always works to absorb the excess by stimulating domestic demand. Depressions often are marked by balance sheet compression and deleveraging: debt elimination, asset liquidation and rising savings rates. When the credit expansion reaches bubble proportions, the distance to the mean is longer and deeper.” David Rosenberg

What is a Balance Sheet Recession?

“To understand the Great Depression was the Holy Grail of Macroeconomics” Ben Bernanke

A Balance Sheet Recession comes to pass when a plunge in asset prices damages private sector balance sheets so badly as to bring about a shift in the mindset and priorities of the asset owners; from profit maximisation to debt minimisation; and from forward looking to backward looking. When the value of assets like equities and real estate falls but the loans used to purchase them remain, borrowers find themselves with a negative net worth and in a struggle to survive.

As with the asset bubbles that precede them, Balance Sheet Recessions are rare and prolonged events. When they do happen, they render useless the standard economic policy responses taught in universities and practiced by Investment Bankers and Central Bankers globally.

In Japan, as today in the US, UK and Europe, we have a situation where many corporate and personal balance sheets are underwater but “core operations” for most companies and families remain reasonably robust – profits are healthy and cash flow/incomes are solid. In this situation, any rational actor will commit themselves to diligently repaying their debt and adding low risk assets to repair their balance sheet as quickly as possible.

A nationwide plunge in asset prices eviscerates the asset side of the balance sheet but leaves the liabilities intact. The entire economy experiences a “fallacy of composition” which means an action that is most appropriate for each individual becomes ruinous if everyone engages in it at once. In this example, we mean repairing balance sheets.

Koo’s example is as follows – a household earns $1,000 and spends $900, saving $100. The $900 spent becomes someone else’s income and circulates in the economy, the $100 goes to a bank where it is then lent out to individuals or corporates which would then spend or invest it, circulating it back into the economy. Therefore spending and savings both continue to circulate – keeping the $1,000 “in play”. If there are no willing borrowers for the $100 then the banks will lower the interest rate they charge until the demand is created.

But in Japan and in the Great Depression, and to some extent now, there is no demand for the $100 despite interest rates at 300 year lows.

The $100 just sits in the bank being neither borrowed nor spent. Only $900 is spent in the economy and the next household receives only that $900 of which it saves 10% to the bank, which again cannot lend that $90 because there is no loan demand so it stays as reserves. The next household receives only $810 in income and so on. This is a deflationary spiral which would serve only to exacerbate falls in asset prices making balance sheets worse rather than better.

Add to this simple model the additional problem of corporates also in balance sheet repair mode and you have an idea of the problem faced. The economy loses demand equivalent to the sum of net household savings and net corporate debt repayment each year.

This is exactly what happened in the Great Depression taking Gross National Product down by almost 50% in 4 years.

According to Koo, the only solution for this problem is for sustained fiscal policy support via direct government borrowing and spending on real projects to keep the economy afloat whilst private sector balance sheets are fully repaired.

How do we know we are in a Balance Sheet Recession?

- Private Sector is Paying Down Debt

- Monetary Policy is Impotent

- Quantitative Easing Doesn’t Work

- Silent and Invisible

- Debt Rejection Syndrome

1. Private Sector is Paying Down Debt

Now, as in Japan, it was argued by many that the banking sector was primarily responsible for the recession. It is believed that a struggling banking sector is choking off the flow of money to the economy – we see this in politicians jawboning about “forcing banks to lend to businesses so they can invest” and so on.

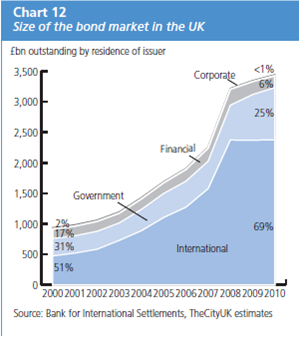

For a company in need of funds the closest substitute to a bank loan is corporate bond issuance. Any company that wants to borrow but can’t because the “banks won’t lend” should, in theory, be able to issue bonds on the market. So do the numbers bear out this idea that firms have been going to the market for funding? Not really….Good data was hard for me to find as much of it is polluted by huge government issuance and therefore doesn’t reflect private sector demand – but this is what I got.

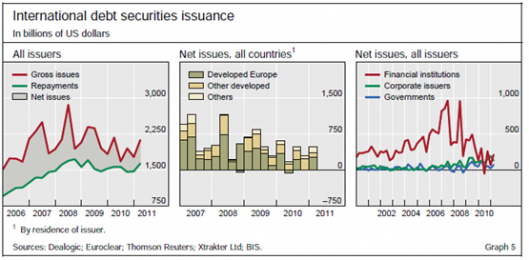

Global bond issuance totalled $1.8 trillion in the first quarter of 2011, down 4% on the same period in the previous year.

Issuance by non-financial corporations in 2010 overtook that by financial institutions for the first time since financial sector issuance started to grow in the early 1990s. The $925bn issued by non-financial institutions in 2010 was down from $1,080bn in the previous year. Issuance from financial institutions declined more quickly during the year from $1,487bn to $576bn. All shrinking.

This says to me that corporate demand is at best tepid, especially relative to the bumper years in the mid 2000s. What makes this even more remarkable is that this is the face of ZIRP! These companies can borrow for costs so low they couldn’t have dreamt of them just a few years ago, and yet they still can’t be coerced.