Last year, mega-cap companies were cheaper and more profitable than their smaller counterparts. That’s why I continuously advocated for mega-cap, quality stocks as a defensive play amid last year’s market volatility, economic shocks and political paralysis. Ultimately, investing in mega caps in 2011 was a good call.

Now, after last year’s flight to safety, many investors are asking if mega-cap stocks are still a bargain. As I write in my recent Market Update piece, the answer is a resounding yes.

Despite outperforming in 2011, mega caps are still trading at a historically high discount to other segments of the market. Let’s take US mega caps, for example. At the end of 2011, the S&P 100 Index traded at 12x trailing earnings, while the broader Russell 3000 Index traded at 14x.

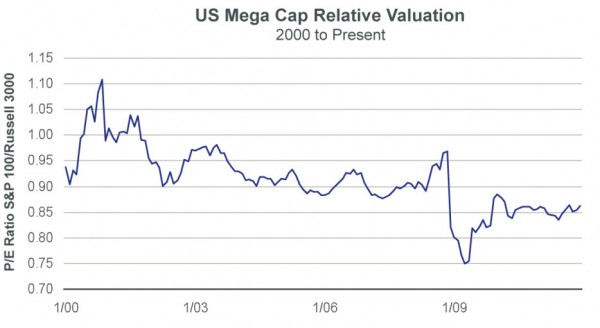

This represents a discount of approximately 15% for mega caps and compares favorably with a long-term average discount for the stocks of around 9%. The chart below nicely shows how the relative valuation of US mega caps has generally been declining over the last decade.

Source: Bloomberg, 12/31/2011.

The situation looks even more favorable for global mega caps. They currently trade at 11x earnings. In comparison, the MSCI World Index currently trades at 13x earnings.

Large stocks in most defensive sectors also still appear to be a bargain. The one exception: US utilities. Of the four classic defensive sectors – utilities, consumer staples, healthcare and telecommunications – only utility stocks are trading above their long-term average valuations.

Given the prospect for more volatility and politically-driven risk this year, I expect large, dividend paying stocks to continue to outperform. In short, there is a compelling argument for sticking with the mega-cap trade in 2012 (potential iShares solutions: OEF, IOO, DVY, IDV and HDV).

Source: Bloomberg

Disclosure: Author is long IOO and DVY.

Past performance does not guarantee future results.