There’s been talk in the blogosphere lately about whether or not developed economies are deleveraging, i.e. winding down their debt.

Some recent posts, under headlines such as “The Age Of Consumer Deleveraging Is Over” and “Deleveraging is So 2011,” have argued that at least in the United States, consumer deleveraging appears to be a thing of the past.

My take, however, is that in many sectors of the US economy, deleveraging hasn’t happened at all. In fact, the notion that the United States is deleveraging is mostly a myth.

Now to be fair, deleveraging has occurred in at least one sector of the economy: The US financial sector, which has significantly reduced its debt. But once you move outside of the financial sector to the real economy — households, corporations and government — the great deleveraging idea evaporates.

The dirty little secret is that US non-financial debt rose by more than $5 trillion from the end of 2007 through the third-quarter of 2011. In the last year alone, the real economy has added roughly $1.4 trillion in debt to the overall US non-financial total.

It’s true that US household debt has contracted in recent years, but the contraction has been modest and is mostly due to bank write-offs. Since a debt peak in early 2008, US households have shed roughly $800 billion in debt. And as pointed out by the blog posts cited above, new US consumer credit numbers show increasing consumer debt.

At the same time, corporate debt has been rising as companies take advantage of record low yields. Since 2008, corporations have added approximately $500 billion in debt to their balance sheets.

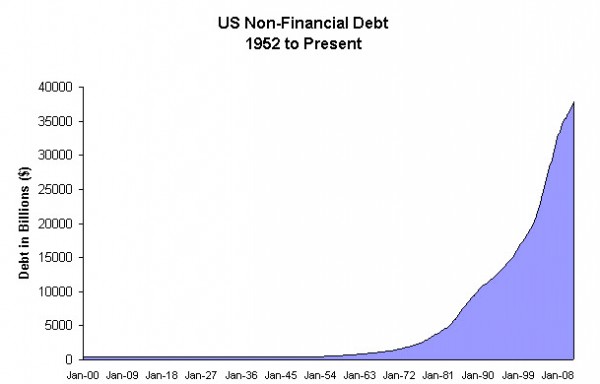

This half-trillion increase, however, pales in comparison to the debt binge of the federal government. Publically traded or net federal debt has risen by more than $5 trillion since late 2007. As you can see in the chart below, this puts overall US non-financial debt at a bit under $38 trillion (for the purists, this arguably understates the total by $5 trillion as it ignores government debt held by the Social Security Trust Fund).

In short, it’s hard to argue that the US economy has deleveraged. Since 2009 the US debt burden has been relatively stable when compared to GDP. Essentially, nominal private sector debt has stabilized, while public sector debt has skyrocketed in an attempt to ease a collapse in consumption.

In short, it’s hard to argue that the US economy has deleveraged. Since 2009 the US debt burden has been relatively stable when compared to GDP. Essentially, nominal private sector debt has stabilized, while public sector debt has skyrocketed in an attempt to ease a collapse in consumption.

As I’ve mentioned before, this can continue for a while longer. In a world in which investors are short of safe investments, most are still willing to give the benefit of the doubt to the US government and lend long for the privilege of a safe place to park their money.

But for those who believe that debt levels are still unsustainably high — as I do — there does eventually need to be a reckoning. When this eventually happens, lending to the government for 2% may no longer seem like a safe haven.

Source: Bloomberg