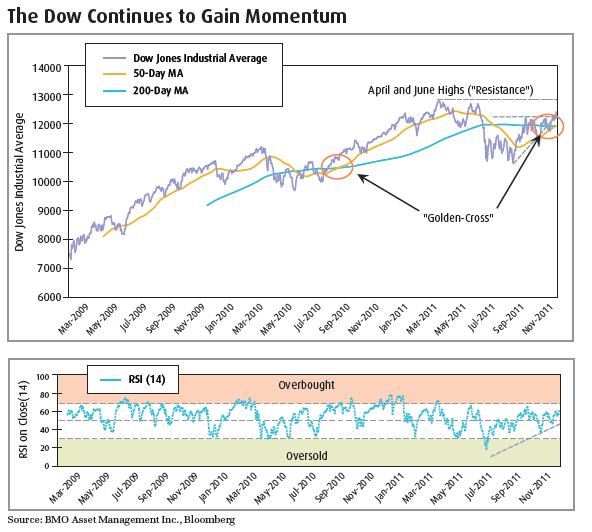

As the year progresses, a higher U.S. dollar and oil prices may warrant a shift out of multi-nationals and into a broader-based U.S. equity ETF, that is comprised of more locally oriented businesses.

Potential Investment Ideas:

- BMO Dow Jones Industrial Average Hedged to CAD Index ETF (ZDJ)

- BMO Covered Call Dow Jones Industrial Average Hedged to CAD ETF (ZWA)

- Dividend paying equities continue to be in high demand: As we mentioned in the October edition of the Monthly Strategy Report, the spread between the current 2.0% yield of a generic 10-year Bank of Canada (BoC) note and the 2.8% dividend yield of the S&P/TSX is negative. Although, it’s likely this negative spread won’t hold, the difference between the two yields will remain well below its historical average. This will likely force investors to continue searching for yield-oriented assets, leading dividend oriented equities to continue to outperform the market. However, it’s imperative that investors look for companies that have sustainable dividends instead of those paying distributions they cannot afford.

Potential Investment Ideas:

- BMO Canadian Dividend ETF (ZDV)

- BMO Equal Weight REITs Index ETF (ZRE)

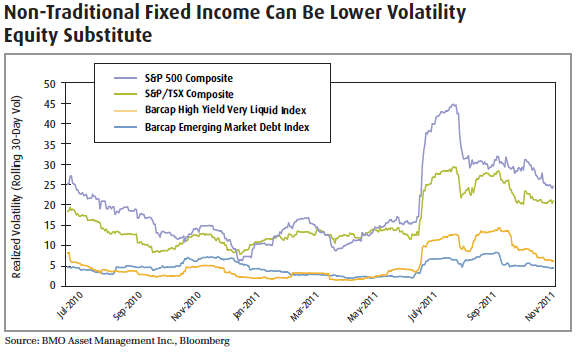

Fixed Income Themes

Similar to last year, we believe an investor’s fixed income allocation should be divided into two categories: Canadian bonds and non-traditional fixed income. The U.S. Federal Reserve’s (the “Fed”) move to artificially compress the yield curve will likely continue to drive investors to riskier areas in the fixed income market such as U.S. high yield bonds and emerging market debt. We believe some investors should have an allocation to these areas, given their diversification benefits to an overall portfolio. These areas, however, should be complemented with Canadian bonds. Though paying lower yields, they are instrumental in the portfolio construction process to partially offset risk in non-traditional bonds and should be utilized to bring down overall portfolio volatility. The higher risk in our fixed income allocation is another reason why we continue to allocate to lower beta areas in our equity allocation, as we believe risk allocation is imperative when constructing portfolios.

- Canadian Bonds: Over the last several months, the BoC has expressed concerns over the European sovereign debt crisis and how it may negatively impact the global and Canadian economy. Currently the consumer price index (CPI), a measure of inflation, sits at 2.9% year/year. Though in the higher range, it still remains within the BoC’s inflation control target and should commodities fall in the short-run, inflation pressures should ease, giving the central bank some leeway on rate reductions if needed. The futures market has already begun to imply a higher probability of lower borrowing rates in six months time. As a result, we believe investors may want to take some duration risk, by overweighting the mid-part of the curve to get a yield pick-up. Although, the long-end of the curve outperformed in the second half of 2011, we would avoid extending duration past the mid-point to limit duration risk. Last year’s rally on the long-end, was largely due to the Fed synthetically flattening the long-end of the curve via “Operation Twist,” and expectations that it would indirectly impact the BoC’s monetary policy. From a credit stand point, investors may want to avoid provincial bonds with the recent credit outlook from Moody’s Investor’s Service.

Potential Investment Ideas:

- BMO Mid-Federal Bond Index ETF (ZFM)

- BMO Mid-Corporate Bond Index ETF (ZCM)

- Non-traditional fixed income: With the Fed pledging to keep interest rates at historic lows and enacting “Operation Twist2” to flatten out the yield curve, investors will continue to look to other areas to source yield. This may create a tailwind for U.S. high-yield bonds and emerging market debt, as both categories saw strong fund flows globally in 2011.

As these areas are correlated to equities at times of risk and deleveraging however, they can also be utilized as an equity substitute and thus viewed as a lower volatility means of equitizing cash. Should Canadian equities turn higher during the year, we will look to reallocate some of our non-traditional fixed income exposure to stocks.

Potential Investment Ideas:

- BMO Emerging Market Bonds Hedged to CAD Index ETF (ZEF)

- BMO High Yield U.S. Corporate Bond Hedged to CAD Index ETF (ZHY)

Commodity Themes

- Commodity volatility will continue to be elevated: Commodity prices will likely remain volatile in the first half of the year as global economic growth lies in the resolution of the European crisis. As the outlook remains uncertain, commodities, which are correlated to economic expansion, will likely be volatile. In addition, there are a growing number of push-pull factors. New European Central Bank (ECB) president Mario Draghi, seems to be more accommodative to easing interest rates compared to his predecessor. In addition, the Peoples Republic Bank of China, looks to be easing as well, both factors are supportive of commodities. On the other hand, however, increasing global macro-risks already mentioned will weigh on some commodity prices.

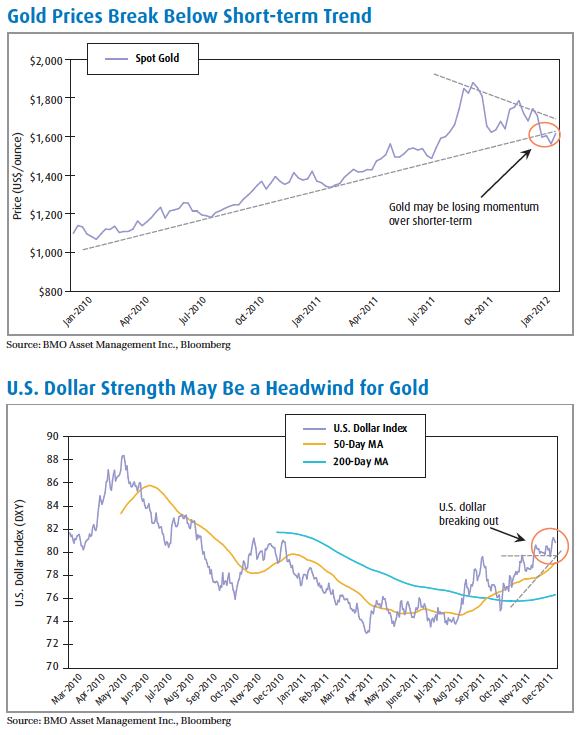

- Precious metals will face headwinds in first quarter: Gold prices enjoyed a strong rally in 2011 hitting an all-time record of US$1900.23/ounce, before fizzling out in December. With the recent move by the Fed to lower borrowing costs for U.S. dollar swaps, demand for greenbacks has soared in the last month. Although the U.S. dollar has been on a secular decline, its short-term trend has been bullish and breaking out. This will likely lead to some headwinds for commodities, particularly gold, which has been used as a hedge against fundamental concerns of a U.S. dollar and treasuries last year. Watching the greenback for the loss of its momentum, will be key indicator to knowing when to get back into gold. Investors should keep in mind however that gold is not a safe haven, but should be viewed as more of an alternative currency that can be extremely volatile. In addition if economic risk factors remain this year, bullion will outperform gold miners and both will underperform the U.S. dollar during a financial crisis, contrary to popular belief. We do remain long-term bullish on gold and will revisit our position after the first quarter. For the several months however, we are taking our bullish stance on gold over the last two years down to neutral for the time being.

- Energy Outperformance: Energy stocks continue to hold steady despite a strengthening U.S. dollar and concerns of a slowing global economy. In addition to global macro-economics, oil prices are also largely affected by geopolitical risk factors. Ongoing concerns of a closing of the Strait of Hormuz may keep the price of crude (especially Brent Crude) elevated.