Dividends can be a sign of quality companies in developing countries

- Political and financial systems in many developing countries have come of age during the past two decades. Emerging markets generally fared better than traditional developed markets during the recent economic downturn.

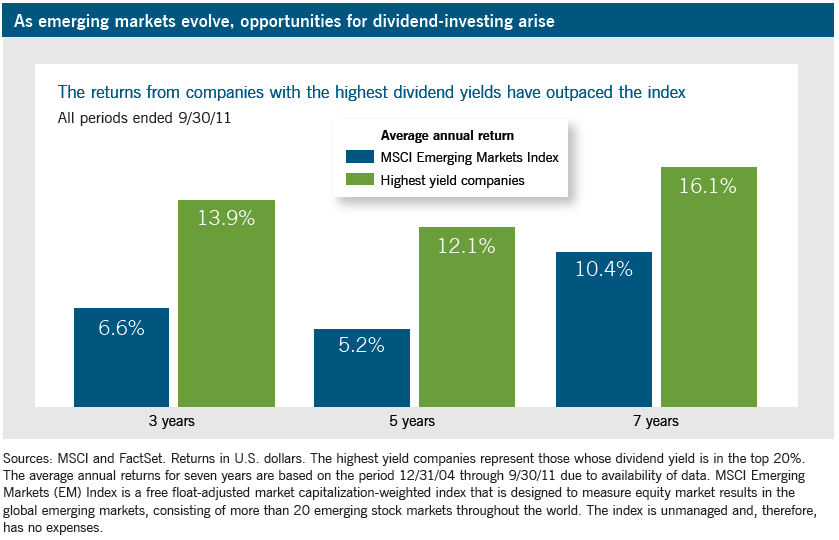

- Companies that serve these rapidly expanding economies can be potentially attractive investments, and in some cases the companies have adopted a policy of rewarding investors by paying dividends. In emerging markets, many companies that pay the highest dividends have also been among those with the highest returns.

- The chart shows that companies with dividend yields that ranked in the top 20% of the index provided superior average annual returns of over various periods ending ended September 30, 2011.

- Investing globally entails some additional risks, and yet many developing countries now have more competent fiscal and monetary policies than in the past. Improved legal, regulatory, and economic climates within many developing countries have brought increased stability and transparency.

“The emerging markets have relatively unlevered balance sheets, access to capital like they’ve never had before, access to technology and a rapidly growing middle class. That’s where the growth potential is going to be.”

— Gordon Crawford, portfolio counselor Capital Research and Management Company Capital Research and Management Company

*****

Important Disclaimer

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Some of the investment professionals featured are not directly involved with managing the Capital International portfolios. The statements expressed herein are informed opinions, speak only to the stated period, and are subject to change at any time based on market or other conditions. This document is for informational purposes only and is not intended to provide any tax, legal or financial advice. Capital International Asset Management (Canada), Inc. or its affiliates assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained about each product or firm, as the case may be, has been supplied without verification by us and may be subject to change. The Capital International portfolios are available through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Capital International Asset Management (Canada), Inc. is part of The Capital Group Companies, Inc., a global investment management firm originated in 1931. Our funds are subadvised by our affiliates, Capital Research and Management Company and Capital Guardian Trust Company (part of Capital Group International, Inc.). These groups, which manage equity assets independently from one another, are two of the world’s largest providers of global/international equity investment services.