Market commentary from investment professionals at the Capital Group organization. Capital International Asset Management (Canada), Inc. is part of The Capital Group Companies, Inc., a global investment management firm based in Los Angeles.

The year of living uncertainly

“Keep calm and carry on.” Those words, printed on a poster by the British government in 1939 in an effort to boost morale among citizens at the beginning of World War II, have gained new currency during the past few years. It’s good advice, but for many investors, it’s not easy to follow, and it’s not hard to understand why.

For more than a decade, investors have been dealing with the most volatile market environment since the 1930s. From the bursting of the Internet bubble to the financial crisis that brought on the Great Recession, investors have faced one challenge after another.

The past year offered little relief. In fact, for a good part of 2011, many argued that it was really 2008 and that the global economy and world’s equity markets were poised at the edge of another precipice. From natural disasters to seemingly insurmountable sovereign debt issues, the world seemed to be a very uncertain place.

Those issues and others have led to increased volatility in the equity markets. Capital Research and Management Company portfolio manager Rob Lovelace is concerned that volatility could drive some investors out of the market or cause them to make emotional decisions that could have long-term consequences for their portfolios.

“In an environment in which investors should have a welldiversified portfolio, some investors are concentrating their portfolios,” Rob says. “They’re going to cash or bonds. That might seem like the right short-term decision, but at some point, their portfolio is going to be really badly positioned. Diversification matters now, perhaps more than ever.”

The reasons for the increased market volatility are subject to debate, but one element may be that powerful computers now allow some investors to make short-term trades at exceptionally high speeds. And, in the past decade, there has been an increase in investment vehicles that have their values tied to indexes or bundles of stocks rather than individual companies, making their transactions more broadly felt than others.

“The volatility is unfortunate because of the negative impact on investor confidence and the faith in the market system,” says portfolio manager Don O’Neal. “We continue to take a long-term view in how we invest, which seems to contrast with what many others are doing. We believe this is a source of competitive advantage for our investors over time.”

The volatile market conditions of the last few years have made some investors want to retreat to the sidelines. But history has shown that by staying the course, investors can achieve solid results in the years following significant downturns, even when those years are rife with geopolitical and economic challenges.

The case for better times ahead

Jim Dunton, Portfolio manager 49 years of investment experience

One of the things that’s been so disturbing to me is the inordinate amount of handwringing about business and the U.S. economy. The reports have been so down in the mouth that it just really scares everybody. But I think business is in much better shape than has been widely reported.

It’s important to understand that we have come back fairly sharply from the very serious problems we experienced in the first quarter of 2011. You’ll recall that the earthquake and tsunami in Japan affected industries around the world, and oil prices jumped during the first part of the year, putting pressure on the consumer.

Since then, things have gotten steadily better. The U.S. gross domestic product has increased every quarter since the third quarter of 2009. While overall U.S. unemployment remains a problem, private employment has been increasing smoothly and steadily for about two years, and I think you’ll continue to see more of that in 2012.

This recovery is a little over two years old, but recoveries over recent decades have lasted at least seven years. So I think there’s good reason to be positive about the U.S. economy.

Volatility can lead to herd mentality and cause investors to rush for the exit

- Turmoil in the markets can inspire powerful emotions and lead to very human, but ultimately destructive, investment decisions. For investors confronted with confusion, uncertainty and financial pain, the natural temptation is to retreat.

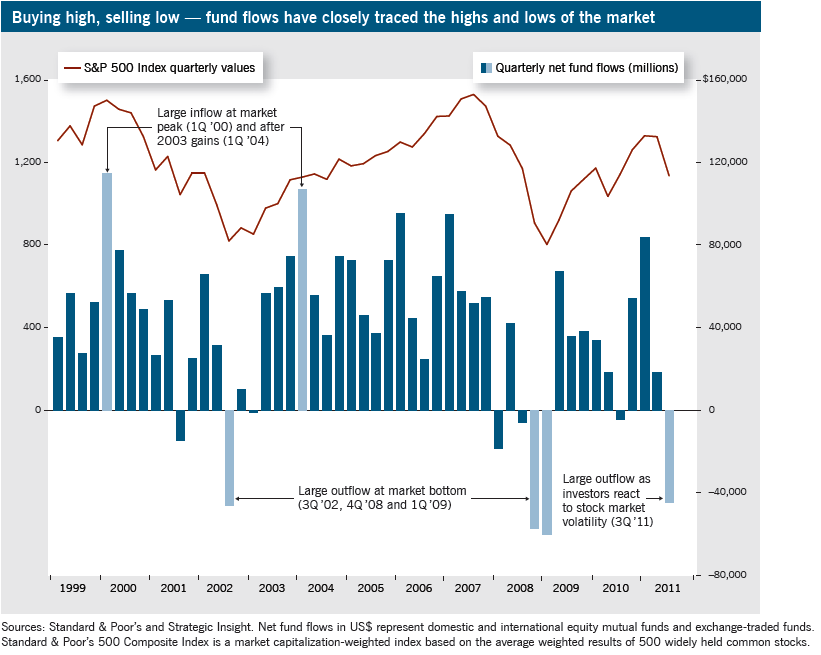

- The chart shows how market cycles can exert a powerful pull on investors. The flows into U.S. and international equity mutual funds and exchangetraded funds during the past decade display a striking correlation with the returns of the market. When financial markets have risen, money has flowed into the market. And when the market has faltered, many investors have left the market.

- A consistent investment plan can help take the emotion out of investing and reduce the temptation to try to time the market. This approach can help steer investors away from their tendencies to lock in losses after market declines.

“This is not a time to panic and not a time to be selling. I look at this period as an opportunity to add to positions I already have or to start new positions in companies I have been waiting to buy when the price was right.”

— Gregg Ireland, portfolio manager, Capital Research and Management Company