3 Economic Scenarios for 2012

by Russ Koesterich, Portfolio Manager, iShares

January 5, 2012

As 2011 draws [drew] to a close, many investors are asking me what I expect the global economy will look like next year.

As 2011 draws [drew] to a close, many investors are asking me what I expect the global economy will look like next year.

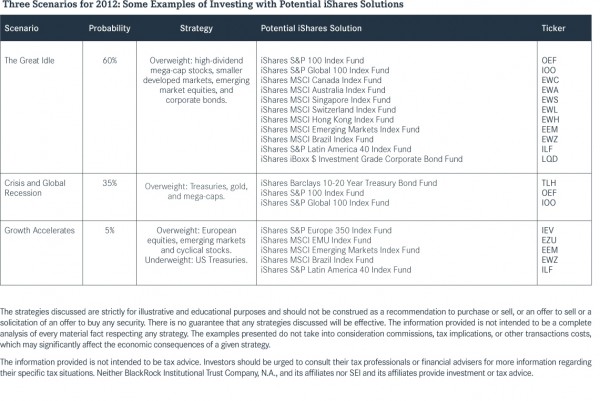

While I don’t have a crystal ball, I do believe that three economic scenarios could play out in 2012. In my recent Markets Perspective piece, I’ve assigned probabilities to them based on how likely I believe they are to occur.

The most likely scenario is that “The Great Idle” continues. This is the term I’m using to describe a global economy that continues to muddle along with slow but positive growth, avoiding an economic crisis.

A severe global recession in 2012 is a second possible scenario. In fact, I’m placing higher odds on another global recession than I did last year.

If this were to occur, it would most likely stem from policy failure and a banking crisis in Europe. It could also be the result of policy mistakes in the United States or some unexpected event like an oil shock.

There’s a tiny chance of a third scenario, which is really an unlikely fairytale ending to this year’s downturn. In this scenario, emerging markets would resume stellar growth and the developed world would revert back its long-term average growth.

In the chart below, you can find the exact probabilities I’m assigning to the three scenarios as well as the investment strategy I favor for each.

In a world where so many different outcomes are possible, investors should consider building a portfolio that represents the two scenarios they believe are most likely. This essentially means having two portfolios, with each one weighted roughly inline with the odds of the scenario.

The portfolio could be adjusted over the course of 2012 as signs of the various scenarios — such as progress on a European fiscal union and European Central Bank bond purchases (see my Market Perspectives for more signs) — play out.

If your investing timeframe is longer than one year, consider lowering exposure to Treasuries and raising exposure to global mega caps.

There’s always the chance that events will happen that will change the global economy in unforeseen ways. For instance 2011’s unexpected events included devastation in Japan, a spike in crude oil prices, and a near perfect streak of policy missteps in Europe and the United States. These unpredictable developments turned what was predicted to be a difficult year into an excruciating one.

But the portfolio ideas below could at least help you prepare for the wide range of scenarios that can be predicted today

Disclosure: Author is long IOO, EWC, EWA, EWS, EWL, EWH, EWZ, LQD and IEV

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Securities focusing on a single country may be subject to higher volatility. Bonds and bond funds will decrease in value as interest rates rise. An investment in the Fund(s) is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Investors should consult with their financial advisor prior to implementing any investment strategy.

Copyright © iShares