Since then investors have been punished for their optimism. As you can see from chart 2, those who bought UK equities in 1998, 1999 and 2000 and held on to them for 10 years have suffered the indignity of negative inflation-adjusted returns.

I believe much of the underperformance of recent years is a bi-product of the excessive optimism of the late 1990s. An entire generation of investors grew up believing equities would always go up in the long run. Since 2000 the investment environment has changed for the worse but the faith in equities has only gradually been undermined, causing fund managers to only slowly adapting to a more challenging environment.

Another factor making life difficult for active managers in more recent times is the rising dominance of the ‘risk on’ versus ‘risk off’ mentality. Not that it represents a new paradigm. Investors have always been either pro risk (risk on) or against risk (risk off). What is new is how those cycles appear to become more and more compressed and how investors increasingly demonstrate herd-like behaviour (i.e. most of us are either risk on or risk off at the same time).

It is not for me to speculate on why that is but the implications are there for everyone to see. As risk on switches to risk off, virtually all share classes sell off simultaneously, rendering simple portfolio techniques such as diversification largely useless. Until active fund managers embrace the new world and adjust their portfolio management techniques accordingly, they will likely continue to struggle.

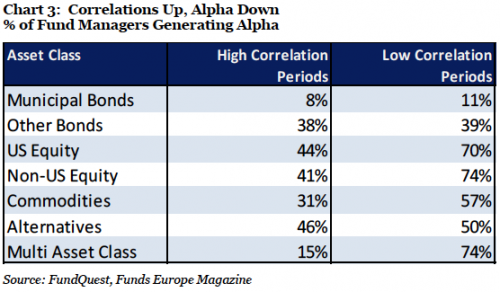

Consulting firm FundQuest has analysed the performance of 32,730 US domiciled non-index mutual funds over a 30 year period (see chart 3). Managers were judged to have generated alpha if they beat their benchmark by more than 50 basis points.

Several conclusions stare the reader in the face:

1. Giving money to active bond managers is (statistically) a losing proposition in any environment. When well over 50% underperform their benchmarks even at the best of times, it is hard to see the justification for using active managers in this asset class.

2. Managers in charge of equity and commodity funds can only justify their existence in more benign market environments. When the going gets tough (risk off), less than half the managers deliver alpha.

3. Alternative managers have nothing to be proud of. With only about half the managers generating alpha regardless of environment, you might wonder whether you should resort to the art of throwing darts.

4. Multi asset class managers struggle badly (only 15% outperform) when correlations rise – not really surprising considering high correlations undermine the very idea of the multi asset class strategy (i.e. diversification across asset classes) but worth bearing in mind if the ‘risk on/risk off’ environment which has so dominated the investment landscape in recent years continues for a prolonged period of time.