Currently, Fed policy seems abnormal. Short-term interest rates have effectively been at “zero” since the recovery began! However, if the Fed leaves the target funds rate at zero until next summer (that is, does not raise interest rates for the first three years of this recovery), they will be right on schedule with the pattern of policy easing evident now for the last three economic recoveries. An economic recovery began in 1991, but it wasn’t until 1994 when it finally “geared.” Similarly, a recovery began in 2001 but did not “gear” until 2004. Will the recovery which began in mid-2009 (but one which nearly everyone currently believes remains dysfunctional) finally “gear” sometime in 2012?

The Path to a Gear Year in 2012?

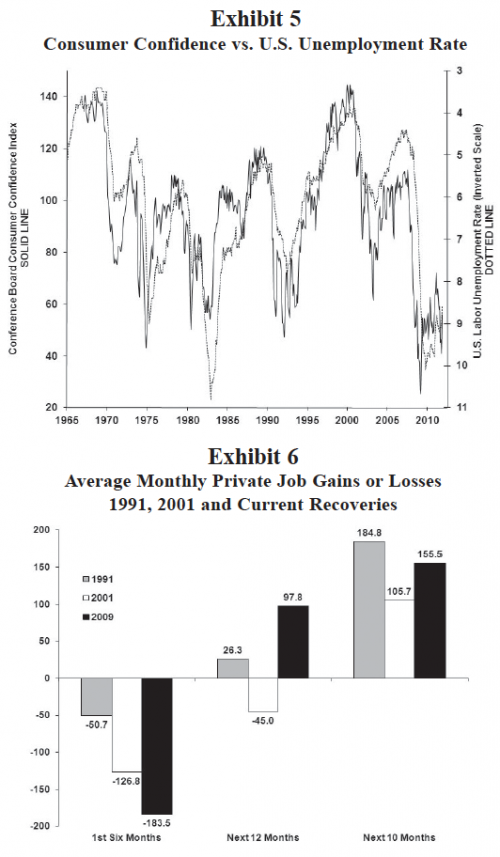

The Gear Year is about a revival in economic confidence which Exhibit 5 illustrates is tied importantly to reducing the unemployment rate. The solid line is the consumer confidence index and the dotted line is the U.S. unemployment rate (shown on an inverted scale). As made clear by this exhibit, the path to rising confidence (i.e., the Gear Year) is an improvement in the unemployment rate. Fortunately, signs are evolving which suggest the unemployment rate is about to embark on a slow but steady decline.

Exhibit 6 shows the contemporary recovery in jobs is continuing along a path quite similar to the last two recoveries. This exhibit compares average monthly private job gains in each of the last three recoveries. During the first six months of the every recovery since 1990, job losses resulted. In the following year (next 12 months), job gains in the current recovery significantly surpassed either of the last two recoveries and so far in the first 11 months of this year, job gains have been better compared to the 2001 recovery but slightly weaker than the 1991 recovery. Overall, while unremarkable, the current job market recovery continues to make steady progress similar to the last two recoveries.

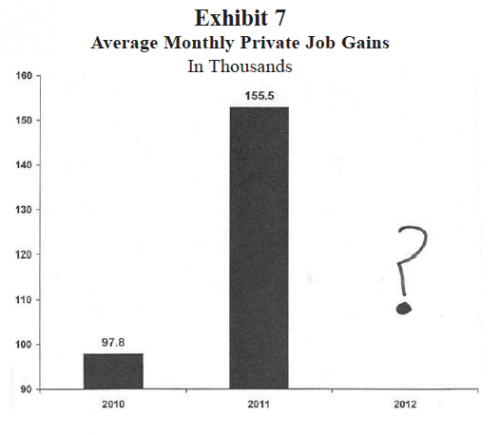

As shown in Exhibit 7, private monthly job creation averaged about 100 thousand in 2010 and through the first 11 months of 2011, it has accelerated to about 155 thousand. At this pace of improvement, we expect average private monthly job gains to surpass 200 thousand in 2012. Monthly job gains of between 150 to 200 thousand should surpass labor force growth and lead to a slow but steady decline in the U.S. unemployment rate. As suggested by Exhibit 5, a steady decline in the unemployment rate during 2012 will likely raise confidence and could produce the third “Gear Year” of the last three economic recoveries.

An “Unintended” Drop in the Unemployment Rate During 2012???

While the unprecedented extension of unemployment insurance payments to 99 weeks has assisted many who lost jobs, it has probably also, at least marginally, prolonged the duration of unemployment and artificially elevated the unemployment rate. In the coming year, this temporary elevation could start to unwind and may cause a more pronounced decline in the unemployment rate than widely anticipated. Exhibit 8 illustrates two seemingly incompatible charts. The duration of unemployment has risen to a level four times longer than it has averaged throughout the post-war era. However, the Conference Board’s “Jobs Hard to Get” Survey shows although finding a job is difficult today, it is no harder than at many times since the late-1960s. Why is the average duration of unemployment four times longer than normal when supposedly jobs are no harder to get today than many times in the past? At least partially, it is probably because we are paying the unemployed four times longer to remain jobless.