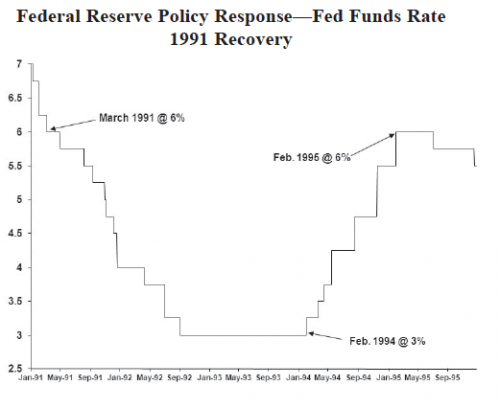

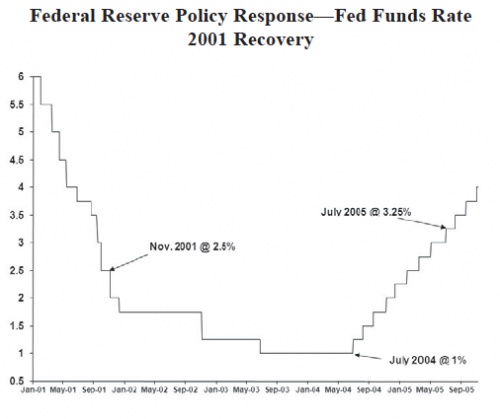

Perhaps the best way to illustrate the Gear Year (year three) of the last two recoveries is to examine Federal Reserve interest rate policy. Exhibit 4 shows the Fed Funds rate during the first four years of both the 1991 and 2001 recoveries.

The 1991 recovery began in March whereupon the Fed lowered the funds rate from 6 percent to 3 percent and left it at 3 percent until February 1994, almost three years later. That is, in the 1991 recovery, the Federal Reserve did not raise interest rates until the recovery was almost three years old. Why? Because during the first three years of the early-1990s recovery, the national mindset (including that of the Federal Reserve Board) was full of angst surrounding the “dysfunctional recovery” and few believed the economy was strong enough to sustain on its own, let alone against tightening moves by the Fed. Suddenly, however, in early 1994 the economy surprisingly “geared.” The rapid change in attitude among bond vigilantes caused the long-term Treasury bond yield to surge by a record-setting amount during the first nine months of 1994 from about 6 percent to almost 8.5 percent and the Fed doubled the funds rate to 6 percent within the next 12 months!

Exhibit 4

Real GDP growth did not suddenly explode. Annual growth in March 1994 (the three year mark of the recovery) only accelerated to 3.5 percent and rose only to a healthy but hardly explosive 4.2 percent by December 1994. It wasn’t economic growth that surged. It was sentiment! Policy officials, investors, businesses, and households finally decided the recovery was working and was sustainable. The impact of this swift change in attitudes was remarkable. The consequent knee-jerk surge in both bond yields and Fed tightening was so dramatic it ended up blowing apart Orange County. That is, the Orange County crisis was a direct result of (and Orange County itself was a victim of) the 1990s recovery “Gear Year”!

The 2001 recovery began in November and the Fed lowered the funds rate from 2.5 percent to 1 percent and left it at this level until month 33 (almost three years) of the recovery. Although the recovery began in 2001, it was not until 2004 that the national mindset finally accepted the recovery was out of harm’s way and would sustain. Similar to the early 1990s, once recovery fears faded, both bond vigilantes and the Fed were quick and aggressive in response. Between March and June of 2004, the 10-year Treasury bond yield surged from about 3.7 percent to 4.8 percent. The Fed finally began to lift the funds rate in July 2004 and would raise it by 2.25 percent in the next 12 months! Like the early-1990s recovery, it wasn’t an explosive surge in real GDP growth which produced the change in national attitudes. Annual real GDP growth was only 2.9 percent by the end of 2004. However, also similar to the 1990s recovery, the aggressive change in attitudes and interest rates in 2004 eventually led to a mid-cycle slowdown (rather than an Orange County like crisis) in 2005.