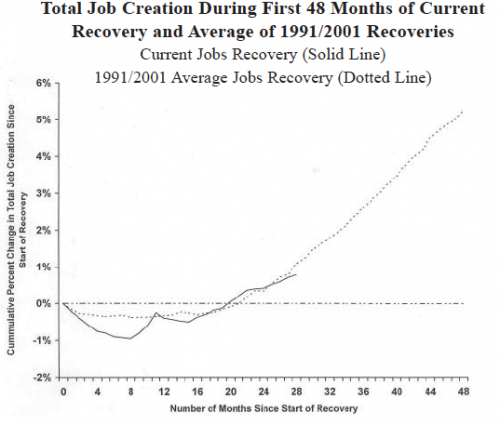

Overall, rather than being a unique “new-normal” cycle, the current recovery is tracking the speed and character of the last two recoveries far closer than widely recognized. Like the last two recoveries, the speed of real GDP growth in this recovery is far less than recoveries prior to 1985, the job market has been stubbornly slow to recover and confidence throughout the economy remains nearly nonexistent. However, “year three” is coming and if the current recovery continues to track the 1991/2001 recoveries, a “Gear Year” may be in store for 2012!

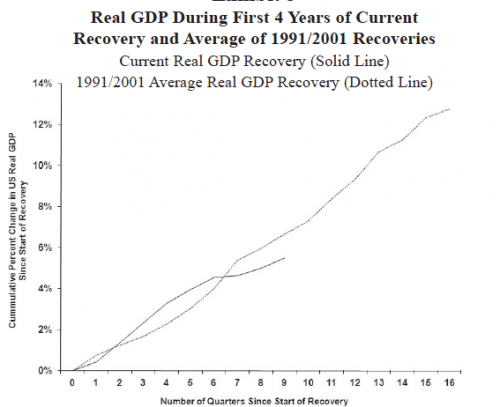

Exhibit 3

Illustrating the “Gear Year”!? The Gear Year is not about surging economic growth. For example, at the end of the third year of the 1991 recovery the annual growth in real GDP only reached 3.5 percent while the third year of the 2001 recovery only produced 2.9 percent annual growth. The Gear Year is about attitudes. It is the year when doubts of economic dysfunction calm and are replaced by a widespread acceptance the economic recovery finally seems to be working and will likely sustain.