Harnessing the Power of Momentum

by Michael Nairne, Tacita Capital

Momentum is defined as the tendency for investments that have performed relatively well in the recent past to continue to do so and for relatively poorly performing investments to continue to fare poorly. It is a well-documented anomaly in modern finance. Numerous academic studies have confirmed that, when measured in periods of approximately three to twelve months, past investment winners tend to keep on outperforming while past losers tend to keep underperforming.

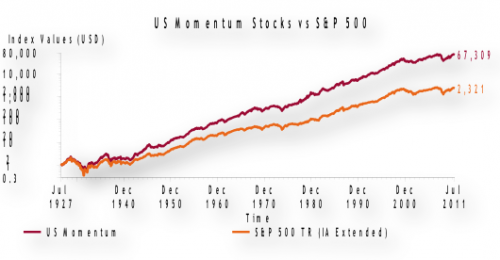

Stocks that evidence positive momentum have returned a significant premium to the overall market. This premium is illustrated in the following graph which illustrates the growth of $1.00 invested in a portfolio of positive momentum stocks[i] (in dark red) compared to the S&P 500 (in light brown) from August 1927 through July 2011.

The $1.00 investment in momentum stocks grew to $67,309, nearly thirty times larger than the $2 321 earned in the S&P 500. For long-term investors, this outperformance has been remarkably enduring. In 99.6% of the ten-year rolling periods since July 1937, momentum stocks have outperformed the S&P 500. The following graph illustrates this outperformance by comparing the rolling 120-month annualized performance of momentum stocks to the S&P 500 since July 1937.

Momentum is not simply a US phenomenon. A recent study[ii] covering equities in 23 countries from November 1989 to September 2010 found evidence of strong momentum returns in North America, Europe and Asia Pacific; only Japan was an exception. Another study tracking the largest 100 stocks in the British market from 1900 to 2009 found that a portfolio comprised of the 20 best performers over the prior 12 months outperformed the worst performers by 10.3% annually[iii]. The same authors found momentum in 18 out of 19 markets, dating back to 1975 in larger European markets and 1926 in the US.

Momentum is not confined to portfolios of individual stocks – it exists in a variety of asset classes. A recent study[iv] has found that momentum exists in government bonds, commodities and currencies as well as country equity indexes. Momentum has also been found in corporate bonds[v] as well as the financial futures market[vi].

Behavioral finance experts suggest that investors’ cognitive biases are the primary explanation for momentum. Some investors are slow to assimilate new information about a security and hence, initially underreact to good or bad news. This delays the immediate adjustment of prices to fair value. A behavioral heuristic known as anchoring and adjustment where individuals rely too heavily on their existing viewpoint and adjust only gradually to new information is one factor behind under-reaction. Confirmation bias, the tendency to focus on facts that support one’s existing position, is another contributor to under-reaction.

As new information is assimilated into the market and prices begin to respond, the bandwagon effect – the tendency to move with the crowd – sets in. Price trends become established creating a momentum effect.

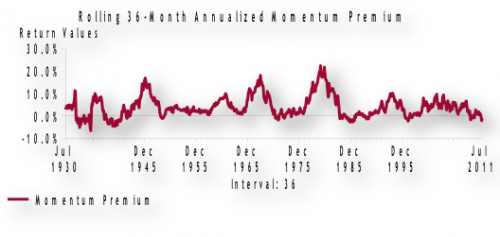

Despite its pervasiveness, momentum-based investment strategies are far from risk free. For example, there are prolonged periods where stocks with positive momentum underperform the market. This is illustrated in the following graph which depicts the rolling 36-month annualized return of the momentum premium (i.e. the return of the portfolio of positive momentum stocks minus stocks of the S&P 500) from August 1930 to July 2011. Despite an overall annualized premium of 3.9%, there have 22 periods where stocks with positive momentum have underperformed the market by greater than 5%, with durations as long as several years.

Momentum is important phenomenon that can be exploited by astute managers in their pursuit of superior results for investors. It offers a wide range of applications ranging from trading to security selection. Managed futures, in particular, is a strategy that takes advantage of momentum across a wide variety of assets. As with other factor-based approaches such as value and small cap strategies, investor patience is a critical element in successfully capitalizing on its potential.

November 30, 2011

Tacita Capital Inc. (“Tacita”) is a private, independent family office and investment counselling firm that specializes in providing integrated wealth advisory and portfolio management services to families of affluence. We understand the challenges of affluence and apply the leading research and best practices of top financial academics and industry practitioners in assisting our clients reach their goals.

Tacita research has been prepared without regard to the individual financial circumstances and objectives of persons who receive it and is not intended to replace individually tailored investment advice. The asset classes/securities/instruments/strategies discussed may not be suitable for all investors and certain investors may not be eligible to purchase or participate in some or all of them. The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. Tacita recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor.

Tacita research is prepared for informational purposes. Neither the information nor any opinion expressed constitutes a solicitation by Tacita for the purchase or sale of any securities or financial products. This research is not intended to provide tax, legal, or accounting advice and readers are advised to seek out qualified professionals that provide advice on these issues for their individual circumstances.

Tacita research is based on public information. Tacita makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to inform any parties when opinions, estimates or information in Tacita research changes.

All investments involve risk including loss of principal. The value of and income from investments may vary because of changes in interest rates or foreign exchange rates, securities prices or market indexes, operational or financial conditions of companies or other factors. There may be time limitations on the exercise of options or other rights in securities transactions. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized. Management fees and expenses are associated with investing.

[i] The US Momentum stock portfolios were constructed by averaging the monthly returns of momentum portfolios 8 -10 selected from the 10 portfolios formed on momentum available from Professor Ken French’s website at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

[ii] Fama, E. F. and K. R. French. “Size, value, and momentum in international stock returns” (June 21, 2011). CRSP Working Paper. Available at SSRN: http://ssrn.com/abstract=1720139

[iii] “Why Newton was wrong”, The Economist, January 6, 2011. http://www.economist.com/node/17848665

[iv] Asness, Clifford S., Moskowitz, Tobias J. and Pedersen, Lasse Heje, “Value and momentum everywhere” (March 6, 2009). AFA 2010 Atlanta Meetings Paper. Available at SSRN: http://ssrn.com/abstract=1363476

[v] Jostova, Gergana, Nikolova, Stanislava (Stas), Philipov, Alexander and Stahel, Christof W.,” Momentum in corporate bond returns”, (September 26, 2010). Available at SSRN: http://ssrn.com/abstract=1651853

[vi] Pirrong, Craig, Momentum in Futures Markets (February 23, 2005). EFA 2005 Moscow Meetings Paper. Available at SSRN: http://ssrn.com/abstract=671841