So here’s the question: we think we understand the value and great potential in silver today, and we know that the buyers who bought in late September most definitely understand it,… but do silver mining companies appreciate how exciting the prospects for silver are? Do the companies that actually mine the metal out of the ground understand the demand fundamentals driving the price of their underlying product? Perhaps even more importantly, do the miners understand the significant influence they could potentially have on that demand equation if they embraced their product as a currency?

According to the CPM Group, the total silver supply in 2011, including mine supply and secondary supply (scrap, recycling, etc.), will total 1.03 billion ounces.9 Of that, mine supply is expected to represent approximately 767 million ounces.10 Multiplied against the current spot price of US$31/oz, we’re talking about a total silver supply of roughly US$32 billion in value today. To put this number in perspective, it’s less than the cost of JP Morgan’s WaMu mortgage write downs in 2008.11

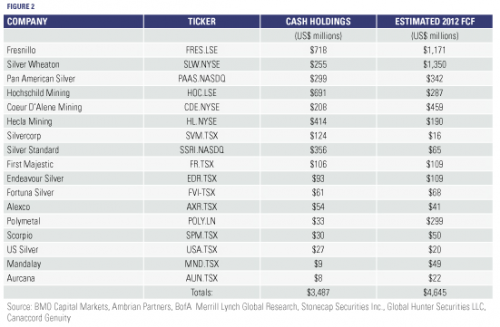

According to the Silver Institute, 777.4 million ounces of silver were used up in industrial applications, photography, jewelry and silverware in 2010.12 If we assume, given a weaker global economy, that this number drops to a flat 700 million ounces in 2011, it implies a surplus of roughly 300 million ounces of silver available for investment demand this year. At today’s silver spot price – we’re talking about roughly US$9 billion in value. This is where the miners can make an impact. If the largest pure play silver producers simply adopted the practice of holding 25% of their 2011 cash reserves in physical silver, they would account for almost 10% of that US$9 billion. If this practice we’re applied to the expected 2012 free cash flow of the same companies, the proportion of investable silver taken out of circulation could potentially be enormous.

Expressed another way, consider that the majority of silver miners today can mine silver for less than US$15 per ounce in operating costs. At US$30 silver, most companies will earn a pre-tax profit of at least US$15 per ounce this year. If we broadly assume an average tax rate of 33%, we’re looking at roughly US$10 of after-tax profit per ounce across the industry. If GFMS’s mining supply forecast proves accurate, it will mean that silver mine production will account for roughly 74% of the total silver supply this year. If silver miners were therefore to reinvest 25% of their 2011 earnings back into physical silver, they could potentially account for 21% of the approximate 300 million ounces (~$9 billion) available for investment in 2011. If they were to reinvest all their earnings back into silver, it would shrink available 2011 investment supply by 82%. This is a purely hypothetical exercise of course, but can you imagine the impact this practice would have on silver prices?

Silver miners need to acknowledge that investors buy their shares because they believe the price of silver is going higher. We certainly do, and we are extremely active in the silver equity space. We would never buy these stocks if we didn’t. Nothing would please us more than to see these companies begin to hold a portion of their cash reserves in the very metal they produce. Silver is just another form of currency today, after all, and a superior one at that.