November 23, 2011

by Michelle Gibley, CFA, Senior Market Analyst, Schwab Center for Financial Research

Key points

- Investors often find reasons to worry about China, and pessimism is especially strong right now.

- Growth in China is slowing, but we believe the fears about an economic crash are overblown.

- The government is shifting away from fiscal and monetary tightening which could herald a return to outperformance for both Chinese and emerging market stocks.

There's no doubt that growth in China is slowing. In the third quarter, GDP growth dipped to 9.1% from 9.5% in the second quarter.1 Yet, this hardly qualifies as a crash. But you wouldn't know it from the pessimism in the media (one example being the late-October Time magazine cover about the Chinese property bubble).

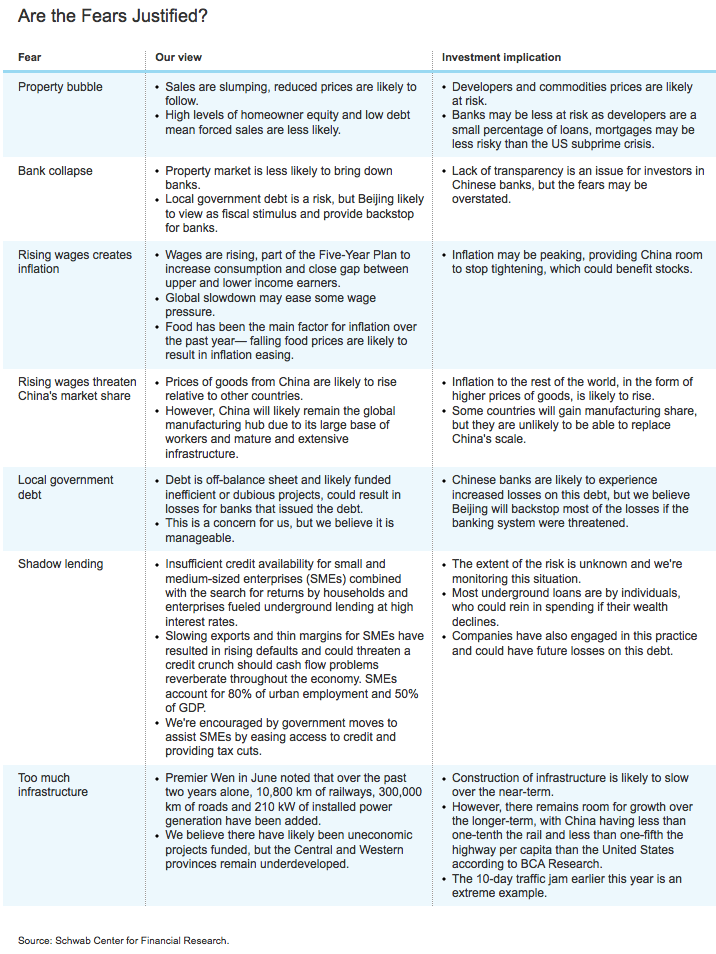

China is an easy target for doubters and investors can always find reasons to worry. While there might be some truth behind the worries of the pessimists, we don't subscribe to the dire predictions about the Chinese economy.

China is entering a slower growth phase than the frenetic pace of the past several decades. But we don't believe it's headed for a near-term hard landing—when growth slows too much.

In fact, the government has begun a subtle shift to expansionary policies—offering tax breaks and easing lending conditions. We believe this could herald a return to outperformance for both Chinese and emerging market stocks.

Here, we'll examine:

- Why are some analysts bearish on China?

- How far will growth slow?

- Might it be time to consider adding exposure to China?

- How can investors add exposure to China?

Why are some analysts bearish on China?

China's importance to the global investment landscape has significantly increased in recent years. Yet, it remains a puzzle to many. The lack of transparency and inconsistent release of government-controlled data fuels the mistrust. In addition, allegations of accounting fraud damage China's reputation.

In this type of environment, sentiment about China can be easily swayed by rumors. We're not discounting all the concerns, but don't subscribe to the dire predictions and believe a middle ground is more likely.

We analyze China by gathering data from many different sources and fall back on our experience of watching the markets and economy over time.

[click chart to enlarge]How far will growth slow?

China's overall growth rate held up relatively well during the most recent global recession with the country posting GDP growth of 9.2% in 2009. Other countries did not fare as well. In 2009, GDP fell by 3.5% in the United States, 4.3% in the eurozone, and 6.3% in Japan.2

This sharp decline in global economic activity resulted in Chinese exports tumbling by 52% between September 2008 and February 2009.3

Right now, we don't expect to see that type of drop-off in growth in the developed economies. And while infrastructure and property construction in China is likely to decrease, we don't believe it will plunge. So while growth in China is likely to decrease, it is still likely to be robust enough to avoid a hard landing.

We believe a hard landing in China would probably only occur if there's a US and global recession. In addition, Chinese policymakers have many levers to arrest a slowdown. The Chinese government is better positioned than many other countries to provide stimulus due to its relatively healthy financial position. On the asset side, China has over $3 trillion in foreign exchange reserves and ownership in many private and publicly-traded companies.4

Meanwhile, liabilities appear to be low relative to other countries. Government debt as a percentage of GDP in 2010 was 34% versus 94% in the United States.5 Local government debt (estimated at 27% of GDP by China's National Audit Office in June) is not included in debt levels at the national level, similar to global standards.

It's true that the Chinese economy is entering a slower phase of growth. The economy is maturing—transitioning away from exports and construction spending and moving toward consumption. This transition to a consumption-driven economy is likely to occur over a decade or more. Meanwhile, the government is planning on a growth rate of 7% during their Five-Year Plan from 2011-2016.

We believe the shift toward a consumption-driven economy is likely to occur because:

- Wages have room to rise. In 2010, income per capita in China was $4,382 versus $46,860 in the United States.6

- Savings could decline in importance. The government is striving to improve pension and healthcare coverage.

- The services sector is still under-developed and will likely grow as the economy matures.

Might it be time to consider adding exposure to China?

There's a lot negative sentiment about China right now. In fact, the Shanghai Composite Index has dropped more than 25% after bottoming in late October. Negative sentiment can work in a contrarian manner, providing a base from which returns can grow.

Additionally, lost amid the general market turmoil, we've noticed that Chinese bank stocks actually underperformed European banks from June to mid-October this year. We find this interesting, as this was the period when the eurozone debt crisis was breaking out, yet one would think that China is better positioned to quickly backstop their banks in the event it is needed.

Chinese Bank Stocks Fell More than Europe's

Source: FactSet, STOXX, Standard & Poor's. As of November 16, 2011. Chinese banks are index of four top banks in China. All indices indexed to 100=June 1, 2011.

With growth globally slowing, inflation moderating, and pessimism on China high, it is an interesting time to weigh the investment opportunity.

Another factor to consider is that Chinese stocks tend to move in response to policy. We've witnessed an increase in the pace of new expansionary policies (albeit small and targeted in scale) and believe that China's tightening phase is likely complete. A sampling of recent easing announcements includes:

- relief for small businesses

- adding jobs as an explicit priority

- funding for railways

- signs that lending conditions are improving

- a change in tone by government officials (Premier Wen noting the need to "pre-emptively fine-tune policy," a departure from the prior single-minded focus on fighting inflation).

Therefore, we believe Chinese stocks could be entering a better period for relative performance. By extension, emerging market stocks could also begin to outperform because a large portion of the emerging market universe is Asian-based and relies heavily on China's growth.

How can investors add exposure to China?

Clients can find out more about investing in China on the international research pages. Go to Regions & Countries and select China. Here you'll find economic data, research, news, allocation guidelines and investment options, including the ETFs and mutual funds with the largest exposure to China. More ETF options can be found using our Predefined Screen "International Equity — Regional" and changing the Morningstar Category to "China Region."

We remind investors that any allocation to emerging markets, particularly to one country, should be a small portion of an overall diversified portfolio. We recommend emerging markets as a whole constitute 20% of your international equity allocation, equating to a 0-5% position, depending on your risk tolerance.

For investors who have a greater risk tolerance and time to devote to in-depth research, there are many Chinese American depositary receipts (ADRs), which represent a share in a company that trades on US exchanges in US dollars. To search for ADRs, clients can use the Stock Screener. Go to Basic Criteria > select Universe > and then International (ADR).

Important Disclosures

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by calling Schwab at 800-435-4000. Please read the prospectus carefully before investing.Investment returns will fluctuate and are subject to market volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost.International investments involve additional risks, which include differences in financial accounting standards, currency fluctuations, political instability, foreign taxes and regulations, and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.Examples provided are for illustrative (or "informational") purposes only and not intended to be reflective of results you can expect to achieve.Diversification does not eliminate the risk of investment losses.