by Jason Hsu, Research Affiliates

Before the publication of the Fundamental Index® concept in 2005, equity portfolio implementation was largely dependent on one’s view of market efficiency. If markets were deemed mostly efficient, then the equity allocation would consist of index funds. If not, then active managers would fill out the equity slice.

Proponents of the Efficient Markets Hypothesis and proponents of active management disagreed vehemently; paradoxically, many organizations displayed schizophrenia in their investment philosophy by employing both a passive index team and an active management team. Passive proponents would point to performance databases that showed the failure of most active managers to produce index-beating results over the very long term. The active managers would parade examples of substantial mispricings (e.g., bubbles) in sectors, countries, and individual stocks that create opportunities for the disciplined and well-informed.

What does the past 10 years of data have to offer on this debate? As seen in Figure 1, the S&P 500 Index earned an annualized return of 2.8% through September 2011—not very good in absolute terms but good enough to beat 67% of large-cap core managers. The indexers have achieved better results than the large majority of their competitors with far less effort and heartache!

However, in the last decade, we have also observed some undeniable mispricings—technology stocks in early years of the decade and homebuilders and mortgage bankers in mid-2007. Arguably, financial and consumer cyclical stocks of early 2009 were significantly undervalued. The S&P 500 capitalization-weighted index, by systematically overweighting the overpriced and underweighting the underpriced stocks, trailed the S&P Equal Weight Index by 3.8% per annum. Unpleasantly for investors, both active and passive approaches have delivered poor results.

While we believe strongly in markets being inefficient, we underperform the benchmark net of costs. Additionally, we believe that cap-weighting is an inappropriate passive investment vehicle where prices are inefficient as the index overallocates to expensive stocks and underallocates to cheap stocks. There is a third option for clients who wish to allocate to equities—non-price-weighted strategy indexes, which offer investors an alternative and complementary choice. Since the publication of “Fundamental Indexation” in the Financial Analysts Journal,1 many asset managers and indexers have created a dizzying array of “alternative betas” or “strategy indexes” designed to offer investors passive investment vehicles that are grounded in the hypothesis of market inefficiency.

We have studied the similarities and differences among these alternative beta strategies. Our comprehensive research, which was published in the Financial Analysts Journal, compares the performance of several of the well-known alternative betas using a common data set and investment parameters.2 We summarize the main findings of that research in this issue of Fundamentals.

The Methodologies

The non-price-weighted strategies examined can be classified into two categories: heuristic-based-weighting methodologies and optimization-based-weighting methodologies.

The heuristic-based strategies include naïve Equal-Weighting and its extensions that seek to eliminate the undesirable characteristics of a simple equal-weighting strategy (e.g., Equal-Weighting’s sensitivity to the number of stocks in the portfolio). The strategies examined are Diversity-Weighting, which has limited turnover and tracking error relative to the cap-weighted benchmark as it is mathematically an interpolation of equal-weighting and cap-weighting; Risk-Clusters Equal-Weighting, which groups securities by country and risk factors, intuitively provides more robust diversification as it equal weights uncorrelated risk factors rather than individual securities; and the Fundamental Index Strategy, which completely severs the link with market prices, and instead uses variables tied to the economy to select and weight securities.

Optimization-based strategies are generally more complicated; they require complex mathematical and computational routines to arrive at a mean-variance optimal portfolio. While they are theoretically attractive, their models are difficult to apply in practice. Ad hoc assumptions for estimating the expected returns for all stocks and their covariance matrix are often required. The optimization-based strategies we look at are the Minimum-Variance strategy, a popular approach which assumes uniform expected returns for all stocks and targets the left end of the efficient frontier; the Maximum Diversification Index, which incorporates information on expected stock returns and seeks to reduce portfolio volatility; and Risk Efficient Indexation, which assumes risk and return are related to their downside risk and includes carefully designed portfolio constraints.

The Results

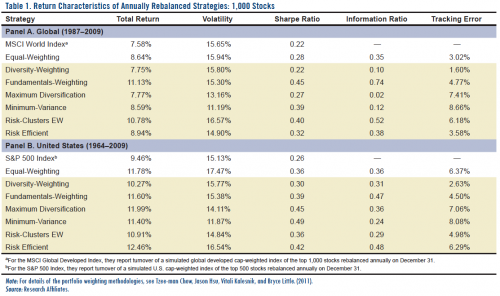

Our research involved simulations of the alternative beta strategies using a consistent database, risk factor construction, and portfolio parameters. Total returns were calculated for each strategy at a monthly frequency from 1964 through 2009 for the U.S. strategies, and from 1987 through 2009 for the global strategies. We compared these strategies to two leading cap-weighted indices—the S&P 500 for U.S. strategies and the MSCI World for global strategies. The choice of date ranges depended entirely on the breadth of historical data. Portfolio parameters were synchronized to achieve a controlled environment for performance comparison.

As Table 1 shows, all of the strategies produced meaningfully higher returns than their cap-weighted benchmarks over the full sample period. In general, the optimized strategies have higher tracking errors and lower volatilities, and the heuristic-weighting strategies tend to have relatively higher volatilities and lower tracking errors. As expected, the minimum-variance portfolios show the lowest volatilities of the strategies considered.

Is There Skill in Eliminating Negative Alpha?

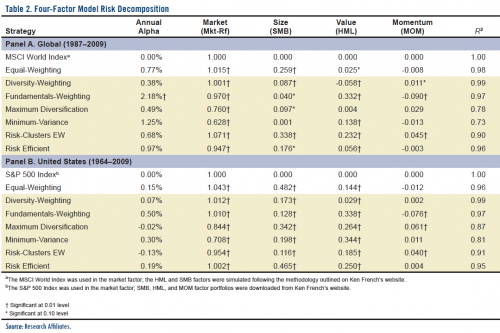

All of the alternative betas surveyed produced excess returns. Indeed, there is no such thing as a bad backtest! But we attempted to dive a bit deeper and, odd as it sounds, assess the “manager skill” in each of the strategies. We used a four-factor analysis for the various strategies.3 As Table 2 shows, all of the strategies display positive and significant exposure to the size and value factors, resulting in their outperformance. Additionally, optimized strategies generally have a lower exposure to the market portfolio. We conclude that none of these strategies are different from naïve equal-weighting in their investment insights.

Despite the lack of statistically significant alpha based on the four factors, we conclude that these alternative betas are valuable to investors because they provide access to the size and value premia. Traditional value and small-cap indices exhibit negative Fama–French alphas, suggesting that they may not be the best ways to access value and small-cap tilts.4 Furthermore, Fama–French factor portfolios are impractical for the vast majority of investors—big and small alike—because they require shorting, experience high turnover at monthly rebalancing, and contain many illiquid stocks. Thus, any portfolio that can capture the vast majority of these premia in a more reliable and cost-effective manner deserves careful consideration.

The Devil’s in the Details

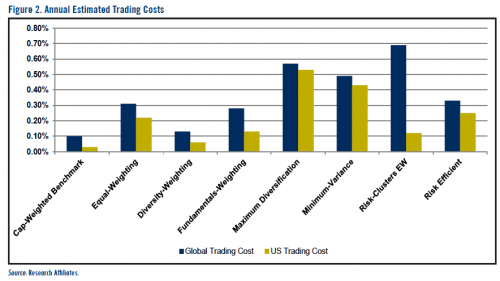

Thus far, we have only discussed “paper portfolios.” If indeed alternative beta’s main attraction is to provide efficient exposure to value and size effects, then we must turn our attention to implementation costs. We find, not surprisingly, that the trading cost estimates are economically higher for the alternative beta strategies than for the cap-weighted indices (see Figure 2). Of the alternatives, Diversity-Weighting and the Fundamental Index strategies generally have lower annual turnover and trading costs. These strategies, with their greater average market-capitalization and lower turnover, also are likely to have higher investment capacities. The Fundamental Index and Diversity-Weighting strategies also generally have lower bid–ask spreads and higher average daily trade volumes. The implication is clear—investors in alternative betas need to carefully weigh the ease and efficiency of implementation before making a determination on what strategy over another. Indeed, we may go so far as to say that it should be the primary driver of the decision-making process.

Conclusion

While the Fundamental Index strategy remains very close to our heart, we are very encouraged by the increasing innovation in the field of alternative betas. Despite often very different approaches, their respective results validate the entire idea of deviating from the binary active–passive world of the past. Some of the most compelling attributes of both are embedded in alternative betas. Like active managers, these methods can produce excess returns and produce different market exposures than mainstream indices, resulting in lower volatility and increased Sharpe ratios. Like traditional indices, most will have lower management costs, many will have similarly skinny implementation costs, and all will have lower governance/monitoring costs than active strategies. Furthermore, some of the most scalable approaches efficiently capture the value and small-cap effects without the long/short requirement, monthly maintenance, and illiquidity of a true Fama–French implementation.

Most investors make their biggest bets on equities, comprising more than 50% of their asset allocation. Accordingly, they have sought to diversify risk within equities by style, size, and geography. We assert that investors should go to greater lengths to diversify their equity portfolio. The past 10 years have brought considerable pain to both sides of the equity active–passive aisle. The third choice of alternative betas—even the simplest such as Equal-Weighting—would have resulted in a far better outcome. Will history repeat? Nobody knows. However, we think the evidence is far too compelling to ignore. We suggest moving alternative betas up your to-do list.

Endnotes

1. See Robert D. Arnott, Jason C. Hsu, and Philip Moore, 2005, “Fundamental Indexation,” Financial Analysts Journal, vol. 61, no. 2 (March/April):83–99.

2. For detailed descriptions of the strategies and research tests, see Tzee-man Chow, Jason Hsu, Vitali Kalesnik, and Bryce Little, 2011, “A Survey of Alternative Equity Index Strategies,” Financial

Analysts Journal, vol. 67, no. 5 (September/October):37–57.

3. Investors traditionally use a three-factor model based on the Fama–French size and value factors, plus a market factor. We added momentum factors based on the methodology described by Mark

Carhart in “On Persistence in Mutual Fund Performance,” Journal of Finance, vol. 52, no. 1 (March 1997):57–82.

4. Jason Hsu, Vitali Kalesnik, and Himanshu Surti (2010) attribute the negative Fama–French alpha for traditional style indices to the cap-weighting construction, where the more expensive value

stocks and small stocks take up larger weights than the cheaper value and small stocks (“An Examination of Traditional Style Indices,” Journal of Index Investing, vol. 2, no. 2 [Fall]:14–23).