by Alfred Lee, CFA, DMS, Vice President & Investment Strategist, BMO ETFs & Global Structured Investments

BMO Asset Management Inc.

alfred.lee(@)bmo.com

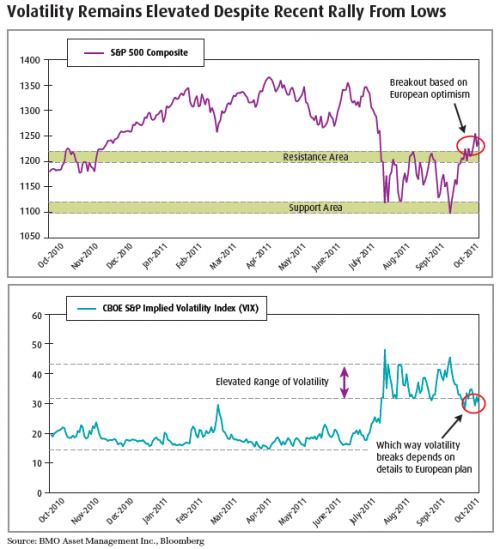

Volatile, temperamental, undecided, distorted... you decide the term to sum up the market’s recent behaviour. Though investor sentiment was quick to bounce between “risk-on” and “risk-off” coming into 2011, the pace at which the market changes its mood has become even more rapid since early August. The catalyst to the great uncertainty has been a myriad of events. The primary culprits have been the downgrade of U.S. Treasuries by credit rating agency, Standard & Poor’s, the European Sovereign debt issues coming to a boil and increased concerns of China’s economy headed for a hard landing. With these three areas struggling, global economic growth could continue to face headwinds, which may also place pressures on global equity markets, despite the recent optimism on the European bailout. Our view is that lower growth and higher volatility will be with us for quite some time as such periods have historically followed extended secular bull-runs.

The CBOE S&P Implied Volatility Index (VIX), which is widely recognized as a “fear index” or a gauge to investor sentiment, has itself been volatile due to this uncertainty. In addition, it has remained significantly elevated since the beginning of August. Though the market swings may be good for traders, it has been difficult for longer-term investors, especially those relying on fundamentals. The story at the company level, although promising, has largely been weighed down by the macro-economic and political headlines and markets have followed technical swings. Volatility has a tendency to be mean-reverting, but as we have mentioned throughout the year, one consistent theme is that we do expect volatility to see sudden shocks on a frequent basis, due to the sensitivity of investors’ sentiment to negative headlines. Investors as a result, should consider strategies that could potentially help reduce volatility in their portfolio and/or increase income to wait out the turbulence.

Consideration #1: Reduce Equity Beta

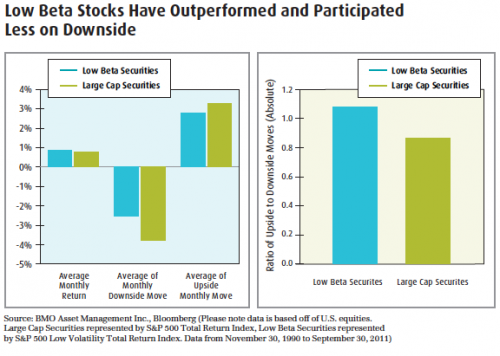

At the onset of the year, one of our major asset allocation strategies was to moderately increase our allocation to non-traditional fixed income such as emerging market sovereign debt and U.S. high yield bonds. Though we don’t suggest a large allocation, it should help investors increase their portfolio yield. As these areas tend to be more sensitive to macro-economic factors than traditional fixed income, our recommendation has been to offset some of this risk by reducing beta in the equity component of your portfolio. Investing in lower beta stocks, or equities that are less sensitive to market movement, could potentially help investors reduce some of the market noise.

Financial academia, has always taught us that higher returns can only be generated through higher risk. More recent studies, however, have shown that lower beta equities have actually outperformed over the long-term. Thus investors may not necessarily have to overexpose themselves to risk in order to maximize their returns. The implementation of lower beta stocks could therefore help investors as a volatility reduction strategy and potentially increase their long-run returns, thus creating a more efficient portfolio strategy. Lower beta stocks could be utilized either as a core strategy or a tactical overlay in this challenging market environment.

Potential Investment Idea:

- BMO Low Volatility Canadian Equity ETF (ZLB)

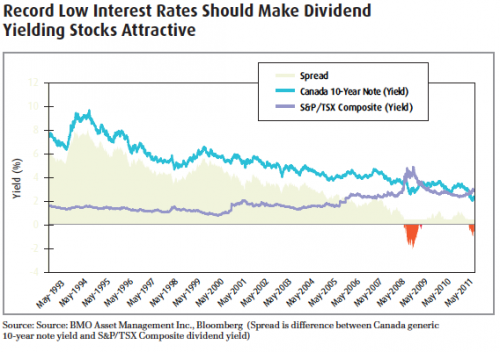

Consideration #2: Increase Dividends

In the 1990’s, or what was dubbed “the new era,” high flying growth stocks that provided capital gains were the theme of choice for most investors. Historically, however, the majority of the returns from a stock have been attributable to the dividend portion of the investment. Since the 2008 financial crisis, market participants have been looking for equities to “normalize” and higher growth stocks to come back to favour. It can be argued however that we have already normalized, with the outperformance of high growth stocks in the decades past being more of an anomaly. In addition, with U.S. Federal Reserve Chairman, Ben Bernanke, pledging to keep rates low until at least 2013, this may lead to a high demand for yield oriented assets and thus outperformance by dividend paying securities.

Regardless of how the final details of the European debt situation is laid out and how the U.S. handles its growing deficit, an increase in austerity measures is likely to be involved. As a result, the macro-economic backdrop will likely continue to trickle down to the company level. Investors may therefore want to consider companies with sustainable dividends and diversification across sectors as slower growth environment will likely impact various industries differently.

Potential Investment Idea:

- BMO Canadian Dividend ETF (ZDV)

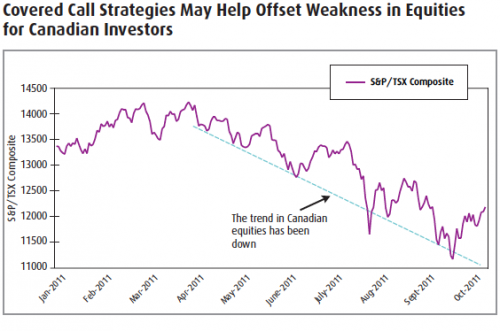

Consideration #3: Covered Call Strategy

One strategy that we have favoured during the year are covered call strategies, which involves going long equities and then selling call options against some of those positions. (For a more detailed explanation of the mechanics behind a covered call strategy, please see the white paper on our website www.bmo.com/etfs.) This is a consideration for investors that may want to both potentially reduce volatility and raise income.

In a bear market, as we currently find ourselves in, a covered call option writing strategy will help investors raise yields in their portfolio strategy while slightly limiting the downside risk by the option premiums. Covered call strategies will however underperform a non-covered strategy in an aggressive bull market. A number of studies have shown that covered call strategies may offer better risk/return profiles than an uncovered strategy. The addition of covered call strategies in your portfolio can thus potentially improve its efficiency. Though investors should always consider their risk-adjusted returns, in today’s market environment, it is even more important to do so.

Potential Investment Idea:

- BMO Covered Call Utilities ETF (ZWU)

- BMO Covered Call Dow Jones Industrial Average Hedged to CAD ETF (ZWA)

- BMO Covered Call Canadian Banks ETF (ZWB)

At the time of writing this report, the market is still anticipating final details out of the European Union Summit in how they will deal with their sovereign debt crisis. Though the markets have rallied on optimism, the deadline has been moved back a number of times already, which may leave us in another situation where leaving key decisions to the eleventh hour may be frowned upon by the market. Regardless of whether a solidified plan is eventually released or not, it may be a short-term solution, and the devil may be in the details as the recent rally has been lifted by unbacked optimism at the time of this report. Regardless, the economic growth in the coming decade may be muted to what we’ve been accustomed to in the last two decades and volatility is likely to remain with us, with a number of unresolved economic concerns. Investors may therefore want to consider reducing volatility and/or raising income as part of their portfolio strategy using the considerations previously discussed as they are portfolio construction ideas for long-term investors.

Copyright © BMO ETFs