Oil or Not,

Here They Come

By Kevin Bambrough

Contributing Author: Paul Dimitriadis

Sprott Asset Management

Oil has been markedly absent in the financial headlines lately. While the recent clamor over EU solvency and weak global growth has temporarily displaced its media attention, oil’s crucial importance to the world economy has not dwindled in the slightest. Oil remains the world’s greatest single energy source today, providing over 1/3 of our energy supply. Although it is well understood that the oil price is critical to the global economy, we sometimes neglect to appreciate how tightly oil supply is correlated to global growth. By historical standards, the world has been coping with constrained oil production and high oil prices for most of the past six years. This tightness in oil supply has been a significant factor limiting global growth, and it would appear that no matter what financial solutions are eventually engineered by our politicians, global growth will remain significantly restricted by the real economy’s ability to produce oil. Limited global supply growth means that the Western world now faces significant competition for oil from emerging markets whose citizenry are willing to work much harder for far less. This will continue to result in a narrowing gap of per capita consumption between emerging and developed economies as the emerging economies continue to gain relative economic strength, wage growth, currency appreciation and purchasing power. We believe strategic investments in oil producers and service companies will offer an effective way to profit from this trend.

Production – Where’s the Growth?

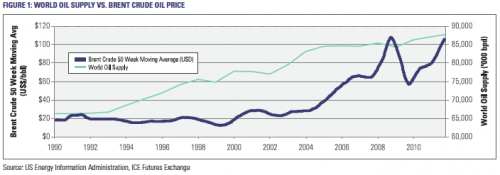

We begin with a review of global oil production. We first wrote about Peak Oil back in 2005; and speculated that we were approaching the pinnacle of global crude oil production.1 As Figure 1 below illustrates, since that time, global oil production has grown very little, appreciating by a mere 2% in total production. This production plateau generated the 2008 oil price spike to nearly $150 per barrel. Subsequently, despite the economic stagnation experienced by developed economies, the price of Brent Crude Oil has averaged over $78 per barrel, four times higher than the ~$18 average that Brent traded at in the 1990s.2

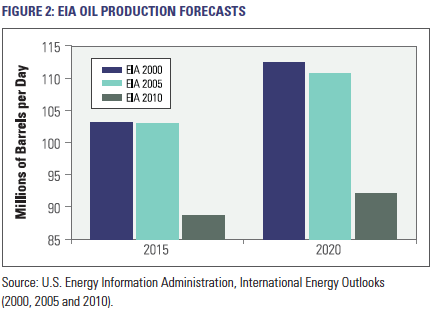

Despite this extremely large and sustained increase in price, oil production has failed to grow meaningfully. Over the past ten years, most experts have consistently overestimated future production growth and have continually revised their forecasts lower as a result. Figure 2 from the U.S. Energy Information Administration (“EIA”) below charts production forecasts made in 2000, 2005 and 2010. Over the last decade the EIA has revised its global oil production estimates lower for 2015 and 2020 by 14% and 18%, respectively. In light of these downward revisions, it still seems extremely optimistic that supply will increase significantly in the coming years.

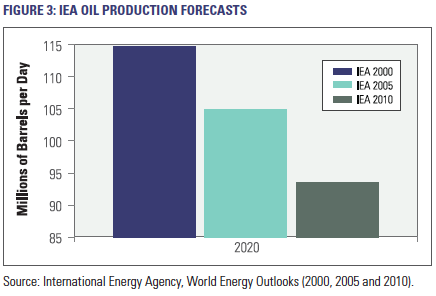

Figure 3 above illustrates that the International Energy Agency (“IEA”) estimates have been just as inaccurate, forcing it to reduce its global oil production estimates year after year.